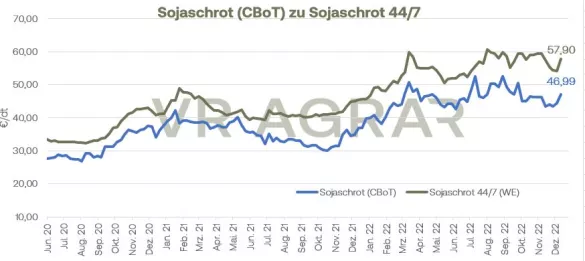

Prices for rapeseed on the Euronext/Matif and on the local spot markets are still under pressure. On a weekly basis, oilseeds went down, although the downward trend of the past few weeks has slowed. At the close of trading yesterday, Thursday, the February contract in Paris closed with a settlement of EUR 558.50 per ton. Only on Tuesday did rapeseed really go north on the stock exchange. Overall, positive vegetable oil markets are supporting local rapeseed here. Palm oil production has recently been lower and global palm oil stocks have also recently fallen significantly, which in turn has supported rapeseed oil, soybean oil and thus also rapeseed and canola. Firmer crude oil prices also provided fundamental support. Overall, however, the good global supply dampened the mood and caused rapeseed prices to fall further. Since the beginning of the month, rapeseed has lost 41 euros per ton. For India it was reported yesterday that the country is heading for a record rapeseed harvest. According to official figures, the area under cultivation has increased by at least 9% to 8.8 million hectares, with some observers even assuming that the area under cultivation will be up to 9.5 million hectares.Indian rapeseed production should therefore be at least 12 million tons. The farmers in Australia are also very satisfied with the results of the ongoing harvest work. The inner-European market appears to be well supplied. On the one hand, this year's harvest, at 19.4 million tons, is well above the results of the previous year. At that time, 17.07 million tons were reached and the five-year average of 17.25 million tons was exceeded by a clear 12.53%. On the other hand, the imports of rapeseed into the EU are currently 3.149 million tons, also well above the result of the previous year. Only a small amount of rapeseed is traded on the German cash markets. The listings also fell here recently as a result of the fall in stock exchange prices. The rapeseed meal prices on the local cash markets have not shown a clear direction of late and have remained largely stable over the past few weeks. The soybeans were also weaker on a weekly basis and are also in the red for pre-market trading on Friday. Overall, however, beans were much more volatile this week.Fundamental support came from good export sales, which were well above the analyst's expectations. At the same time, the repeatedly reduced harvest expectations due to the drought in Argentina also supports the soybean complex. Changed plans by the US government to add soybean oil to fuels caused soybean oil in particular to trend downwards, which also weighed on soybeans. Soybean meal was up again this week. Concerns about economic development, especially in China, are having a negative impact on the soybean complex as a whole. The fact that the US Federal Reserve raised interest rates less than previously on Wednesday, but clearly announced that this was not the end of the rate hikes put the financial markets and soybeans under pressure. In addition, the US dollar regained strength slightly, further clouding concerns about the development of demand in the export business. The increased soybean meal prices on the CBoT are slowly but surely also making themselves felt on the cash markets in this country.

ZMP Live Expert Opinion

Basically, rapeseed continues to show a downward trend. Not only since the beginning of the month has oilseed dropped both on the spot markets and on Euronext/Matif. The significantly better global supply of rapeseed is depressing the mood. In Germany, the lower animal populations, especially the declining herds of sows and pigs, are also noticeable in the case of oil meal. In the case of soybeans, why is it still dependent on Chinese demand? The drought in Argentina is supporting, the outlook for Brazil is depressing.