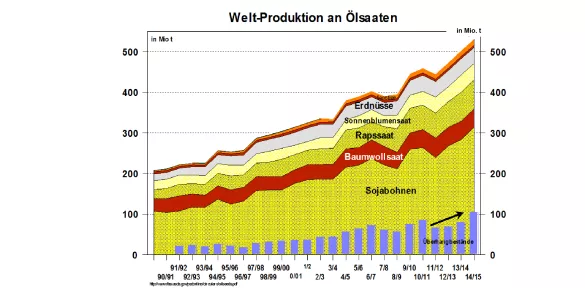

USDA estimate oilseed market 2014/15: plentiful supply of soy

The latest USDA estimate of the world oilseed market is largely unchanged overall results. The harvest volume is prized on rd. 532 million tonnes. Global trade taken back only slightly to 432 million tonnes processing was something set up. The closing stock with 103 million tons remain at record levels and are thus 20% higher than in the previous year. The supply figure is calculated approximately 24%.

With 315 million tonnes or 60%, soy denies the largest share of the oilseed market. The worldwide production of rapeseed is estimated unchanged at 71 million tonnes. Cottonseed is reduced 40 million tonnes with 45 million t in third place ahead of the sunflowers with something.

In the case of the soy market 3 large farming areas the market. The United States has already in the autumn of 2014, with 108 million tonnes (previous year 91.5 million tonnes brought a bumper crop. So far, primarily served the U.S. crop to populate the drastically reduced storage warehouses and only behavior has contributed to the price decline. Running currently on full blast Brazilian harvest is still prized on 94.5 million, although Meanwhile raised concerns over regional droughts. Soon current soy crop in Argentina had almost perfect weather conditions and had high expectations for harvest. Heavy rainfall advise caution in recent times. The USDA keeps to the original estimate of 56 million tonnes (previous year 54 Mio.t) the soybean processing is expected to increase by 6% , and thus the highest level at the world level. Remember, China is engaged with almost one-third, the United States with 20% and Argentina with just over 15%.

The China captured only 74 million tonnes slightly increasing imports amounting to 114 million tons. Chinese imports should rise by 4 million tons this year. Last year, the import increase was approximately 10 million tonnes.

The EU introduces nearly 13 million soya beans. There are also 19 million soybean meal. The import volumes in the EU remain largely stable.

With nearly 90 million tonnes of closing stock is a high level of stock, an increase of + 24 million tonnes the previous year. Thus, global supply is far above average well positioned.

In the market segment of vegetable oils , palm oil production with rd 35% of production plays a significant role. The increase in this financial year to 3 million tons to 62.5 million tonnes falls just barely average. El Nino have led to less than average harvest results with drought and regional floods.

The prices for oilseeds are under pressure. In Chicago the soy complex has substantially ruffle feathers. Malaysia reported falling palm oil prices. In Paris, the rape courses are not quite as strong as in recent months. However, there is support by the weak euro exchange rate, which makes for expensive import prices in the EU.

ZMP Live Expert Opinion

The USDA confirmed the plentiful supply situation 2014/15 in the oilseed sector with their most recent market estimates. Moderate consumption growth, the brought US bumper crop in the autumn of 2014 and the high expectations for the ongoing South American soybean crops cause a considerable increase in inventories. Thus, the prices on the stock exchanges, now and in the foreseeable increasingly under pressure. Uncertainties deliver the changes in exchange rates, which again destroys the price decline of the dollar-quoted rates in particular for the European importer.