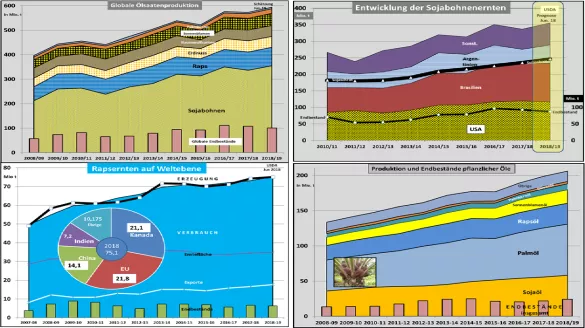

USDA confirms higher global oilseeds compared to the previous year - prices under pressure The US Department of Agriculture once again confirms an increase of approx. 20 million tonnes or 3.4% higher global oilseed crop in 2018/19. The major part of the increase is attributable to soybean, for which approx. 18 million tons of growth are forecast. For the other oilseeds, the changes remain small. Global consumption is not expected to increase quite so strongly, so that the final stocks at approx. 100 million t grow. This is expected to result in a well-average supply situation for the upcoming marketing year.For oilseeds , a global production increase of 14 million tonnes is predicted. This is offset by an increase in consumption of 12 million tonnes. Well-stocked inventories are also foreseeable in this division. The increase in final stocks of vegetable oils and fats is expected to increase even further, to 24 million . t fail. That would be an above-average supply situation, as was the case last time in 2014/15. The growing quantities come from the two market leaders palm oil in the first line and soybean oil by far behind.The big soybean crops come primarily from Brazil and the USA . Following the bumper harvest in Brazil in spring 2018, at 119 million tonnes , the USDA expects an order of 118 million tonnes by spring 2019. The enormous increase becomes clear if one uses the previous results 3 to 5 years ago with only 96 million t . The US harvest in autumn 2017 was 119.5 million t . According to the current state of sowing areas, an estimated 116.5 million tonnes are to be harvested in autumn 2018 . Both results are around rd. 10 million t over the values of 3 to 4 years ago.The catastrophic Argentine soybean harvest with 37 million t in the early summer of this year should not be repeated. The USDA estimates an average of 56 million tonnes for the first half of the year. Of particular importance is the import behavior of China , which is usually approx. two-thirds of world trade in soybeans The USDA continues to expect a Chinese import volume of 103 million tonnes, despite tense trade disputes between China and the US ; this is 6 million t more than in the previous year. As a rule, approx. 40% from the USA. Whether and to what extent these amounts are achieved with a 25% Chinese fine on US imports remains questionable.For palm oil , the USDA estimates an output of 72.5 million tonnes or about. 4% more than last year. Of this total, 61 million tonnes came from Indonesia and Malaysia. However, according to USDA figures, consumption is only 68 million tonnes. The result is a considerable increase in the final stocks to 12.6 million tonnes or + 17%. Notwithstanding the weather- related restrictions on rapeseed production in the EU, Australia and Ukrain e, the USDA assumes a world harvest of 75 million tonnes. This estimate is likely to have been too high according to current earnings expectations. One example is the EU rapeseed harvest, which the USDA estimates at 21.8 million tonnes, while COCERAL predicted a result just over a dozen days ago.The Australian Department of Agriculture has reported in its recent assessment of significant dryness losses of rapeseed crop. Despite all the reservations of an oilseed estimate at an early date, the trend of a more than average supply situation for the coming year turns out. Accordingly, stock market prices have fallen .

ZMP Live Expert Opinion

Despite discernible and unpredictable restrictions on the USDA oilseed market forecast, there is a trend towards a more than average supply situation in the 2018/19 marketing year. This expectation puts pressure on oilseeds prices, particularly in the vegetable oils and fats sector.