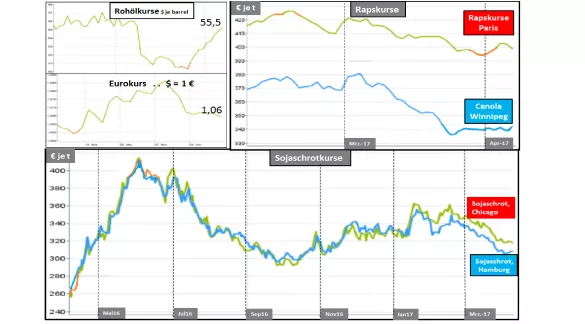

Despite higher crude oil and palm oil prices make a note of Oilseeds weaker rising crude oil prices - not least by the US missile attacks on Syria reinforced - have been again rising palm oil prices but were not enough, over the midfield. Also a come back weaker euro exchange rate could not stop the decline of rapeseed and soybean meal prices. Currently dominates he soy sector the oilseed market. Ample inventories from the U.S. last year's bumper crop are supplemented by a further offer high from Brazil, whose harvesting is aiming to end. Estimates from 107 to 113 million tons compared to the previous year with 96 million tons. Which was just Argentine soy crop launched in for almost 10 days interrupted by rain, should continue but under dry harvest conditions next week. It is expected an average harvest by 55 to 56 million tonnes. Flooding caused significant damage in the river and lowland areas in advance. Pressure on the soybean and oilseed prices also comes from the upcoming U.S. soybean area, which should be expanded according to plans of the U.S. farmer 7%. Thus, a repeat of the record harvest could enter in average earnings assumptions this autumn. But until then passes nor much time and it must be overcome quite a few risks. The angle of view is in the palm oil sector to the seasonal increase in production until the Oct. set into it. Although currently a certain rate consolidation has occurred, it will not be permanent. Market experts expect that the palm oil prices would fall by around 20% by the 2017 of the autumn. Soon the market for vegetable oil better than average will be supplied. It is especially the value-weighted oil rape be particularly affected. A persistently scarce supply balance of the canola sector however faces the. In the competition the two market leaders are set but eventually the tone palm oil and soya in the oilseed business.

ZMP Live Expert Opinion

High overhang stocks and an increasing offer of soy from South America, and in the future erwartbares from the United States provide low rates in the oilseed sector. However, higher crude oil and palm oil prices to align for the time being little. But it's still spreads a to pricing.