USDA-Oct. 15 rating: global oilseed supply remains well above average

The latest estimate of the U.S. Department of agriculture on the situation on the market of oilseed confirmed the previous development of a better than average powered oilseed market by 2015/16. The production is considered again later to 531 million tonnes in the previous forecasts. Lags but behind the record year 2014/15mit 536 million tonnes.

Consumption page comes with their increases do not at the same level after, so that the closing stock rise to a record level of t 96 million or 21.4% of the processing. The last 5 years average of 18.9%.

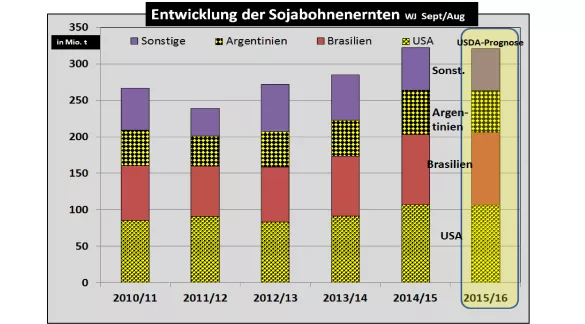

Soy with 320 million tonnes or about 60% of the oilseedsis the largest share. The increases for the previous year still moderately fail once in the further past growth rates of 10 to 15 million tonnes were observed. The consumption is however in slightly more uniform increases by approximately 10 million tons per year. The Sojaendbestände now reach maximum level of 85 million tonnes or 31% of the consumption for a 5-year average of about 26%.

The second-largest oilseed rape is estimated a harvest of 68 million tonnes . The result is poor compared with the two previous years with an average of 72 million tonnes. The weak harvests in the two main growing areas in EU-28 with 22 million tons and Canada with 14 million tonnes, representing more than 50% of world rape harvest is caused.

Other oilseeds are moving in relation to their capacity. Market and price-related changes are not visible for 2015/16.

The market for vegetable oils is extended by Palm oil with a share of about 33% of the entire volume of oil. Soybean oil is in second place with a production share of 28% and rape followed with a share of 15%.

Palm oil is the soybean oil due to its high market share and low prices as the market leader . This year the event is noticeable El Niño in the main production areas of Indonesia and Malaysia with low rainfall. Palm oil prices have a months-long Valley drive from about 650 to under $450 je a steep rise in a single month to over $550 experienced je. Despite a price oppressive course of crude oil, one assumes that Palm oil production under El Niño conditions will respond to a whole year with a lesser growth at least 6 months. High palm oil services are accessible only with 2,000 mm precipitation and average temperatures from 26 to 30 degrees.

The soybean market is becoming increasingly important. To provide a decisive contribution in addition to the two good U.S. crops past and current year the South American growing expansion. The low-cost and flexible mounting of this legume (nitrogen) prompted to upgrade to more and more farmers from the relatively expensive corn production on the soya bean. This is true, but only as long as, as the price ratios between the two competition fruits do not recoup the cost differences.

Especially for Brazil is still an exchange rate effect . The weak Brazilian currency by 4 real to 1 US dollar has led that soy prices in Brazil nearly doubled. Brazil expects a record crop of over 100 million tons in the coming spring 2016. 2 years ago, only 84 million tonnes were achieved.

In Argentina, this year's bumper crop of 61 million tonnes to repeat in the spring of 2016. Here, too, the Exchange from corn to soybean areas plays a role. This adverse weather contributed among others benefiting during maize seed.

In all cases of forecast is expected always to average income. Just under the El Niño weather conditions are however, significant reservations to the earnings prospects to make.

Last not least, on U.S. soy crops from the USDA compared to the previous month's estimate were taken back again. The result should remain with 105.8 million tonnes just behind the previous year. The high US inventories be reduced slightly in anticipation of still good demand.

On the consumption page , it remains more to the previous year at moderate increases in import of Chinese by only 2 million tons. In the previous periods, annual increases of 4 to 10 million tonnes had been observed. Nevertheless, China remains the world's largest importer with a share of the market by rd. 65%.

The EU will be a part of their failed rape schrotes by increased imports of soy balance. The sizes stay humble part of below 2%.

Prices on the stock exchanges have continued for the time being their firm to slightly increasing development . For the further development of the course, logistical problems and the political changes in South America will have role as always speed an attention.

ZMP Live Expert Opinion

The latest USDA estimate confirms an above-average supply development in the oilseed sector. High soy crops are expected in North and South America. The El Nino weather will keep palm oil prices on high rate and saunter with canola prices. On the other hand, a shift of competition conditions could occur given the high increase in the soybean sector. For the time being the stock quotes on fixed level of appealing to slightly move.