USDA estimate of the oilseed market pushing higher soy meal courses.

The oilseed market, stock exchange participants as an opportunity to drive anyway on soaring soybean prices again took the Most recent USDA estimate . The previous thrust factor has its key causes in the Argentine crop failures as a result of prolonged heavy rain damage have resulted in flooding, sprouted and others.

The soy courses through the rising palm oil prices, which tend upwards by the El Niño drought were another drive. Production and inventories have been revised significantly downwards in the April payroll.

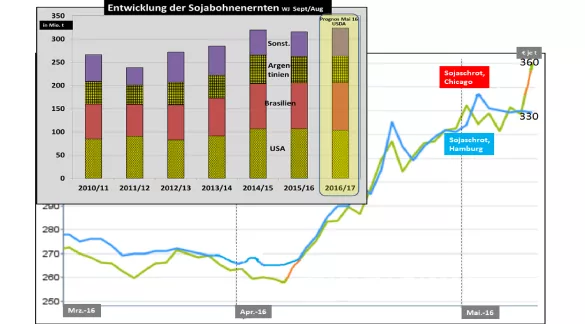

The current oilseed estimate of the USDA is to a low total harvest than last year. While the soybean harvest should be higher than something than in the previous year, but it was assumed in the past few months far higher expectations of harvest. Both in the case of Argentina as Brazil, the USDA has made significant concessions. The 15% falling inventories in the oilseeds are crucial for the rate increases.

The global rape harvesting 2016/17 will be again worse than in the previous year. Significantly reduced harvests are expected in the EU, Canada and Ukraine. A small improvement is expected only in Australia.

The palm oil crops to have rising results next year. For the time being but will be another negative aftermath of the El Nino drought.

The planting of soybeans in the United States is in full swing, while maize sowing is approaching the end. Still, the U.S. farmers have the opportunity to switch to the more profitable due to the recent price increases soybean. To what extent this happens, will show in the next few weeks. A higher soy area could bring to stop the current rises in the soybean. However, there remains still the uncertainty of weather-dependent Flächenerträge.

For EU oilseed imports of soya and rape , the recent decline in the euro exchange rate more expensive purchases. However this effect due to previous contracts was not reflected yet in full in the listings. The rape rate shows first upward trends in Paris.

Like sustainable the recent upward will be in the next few months, remains to be seen. It is conceivable that with higher harvest prospects of U.S. soy market calm reentering.

ZMP Live Expert Opinion

The assessment established months ago an exceptionally good supply situation in the oilseed sector is provided by recent developments in question... Significant crop damage in Argentina, abbreviated crops results in Brazil, removal of palm oil stocks and repeatedly shortened crop expectations when the rape to reduce the offer. On the uses side, is the demand while not urgent, but remains in the moderate slope. The result is a considerable reduction in the inventories. That is taken on the exchanges to the occasion, much to drive up the rates. The biggest Enpass is the Sojaschrotsekor, because Argentina is the world's largest provider in trouble. High rates can initiate but the counter development in terms of increasing U.S. soybean area.