USDA estimate oilseeds: more soybeans, still less rape

The latest USDA estimate of the oilseed market showed only F9 changes the overall result. It remains at around 532 million tonnes as compared with the previous month. Compared to the previous year's record year, this year's harvest to 4 million tons should fall less. However, the so far highest level of supply is achieved with estimated 102 million tonnes of final data.

With approximately 319 million tonnes of soya bean denies the majority of oilseeds. This year's harvest is classified again around 1 million tonnes higher than last year. However, the canola crop compared to the previous month estimate again to 67 million tonnes is downgraded. Last year, he provided rape still 71.7 million tonnes at world level. The other oilseeds remain largely unchanged.

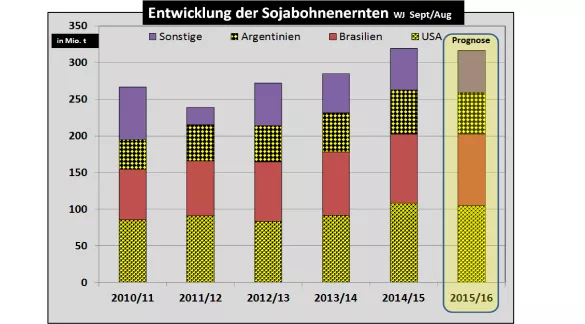

The high soy harvest is the result of the 3 most important growing areas. In South America expects you in Brazil a further increase by the year's 94.5 million tonnes to 97 million t. Argentina in early summer by 2015 a bumper crop of 60 Mio.t brought. For the coming year 2015/16 is expected only to 57 million tonnes. After the peak harvest in the autumn of 2014, with 108 million metric tons, the USDA expects results of 106 million tonnes of US soybeans in its most recent estimate in the autumn 2015.

The U.S. soybean production is however under no budget star. You will need to assume that due to the abundant rainfall around 1 million hectares scheduled soybean areas no longer can be ordered. Also doubt that whether the subordinate Flächenerträge can actually be achieved. Pessimistic estimate now about 96 million tonnes.

The USDA report has shortened the initial data for U.S. soybeans to unexpected 2 million tons. The high livestock of pigs and poultry consumption development was named as a major cause. This reduction penetrate fully on the global balance of power.

On the consumption side , it is still assumed that 77 million tonnes of China claimed the bulk of the trading volume of over 110 million tons for. However, China's import behavior no longer quite so aggressive fails as in previous years.

The weak global oilseed rape crop is caused by the two main growing areas Canada and EU with a production share of more than 50%. The EU rapeseed crop comes to 21.4 million tonnes compared to 24.3 million tons in the previous year. A declining acreage and considerably reduced Flächenerträge last but not least precipitation deficits caused by. In Canada, canola rape as a result of drought has seen very unfavorable start conditions. An insufficient soil moisture continues to be the handicap in the Canadian capital region.

Soybean prices have been supported in their growth phase again. Also the rare courses in Paris have taken. Fallen crude oil and palm oil prices was, which itself but have stabilised again something recently.

For the European market , it's still significantly on the development of the euro exchange rate. Further negotiations in the conflict of Greece will be significantly involved in. The importance of the euro exchange rate is it to read, that each 0.1 change can be expected bucks to Euro price changes in canola and soybean meal from €35 per t. Because in both cases must be imported, a strengthening of the euro exchange rate is cheaper imports. To what extent implemented in the 1-to-1 ratio, is dependent on the forward contracts that have been closed.

For the further development of oilseed prices are still considerable uncertainties which due to weather conditions, partly politically are.

ZMP Live Expert Opinion

The price development of oilseeds have gone through a turnaround. Quite a few signals show at least on stable to slightly rising prices. Soy and palm oil as the market leader set the pace for the rape and other Ölsaaaten prices. The El Nino weather phenomenon may contribute to further impairments of the still outstanding crops. For the euro area is still currency risk in strong dependency on the further negotiation results in the Greece conflict. It is a time uncertain course developments.