USDA estimates an oilseed crop 2015/16 to 10 million tonnes less than in the previous year, yet high power layer

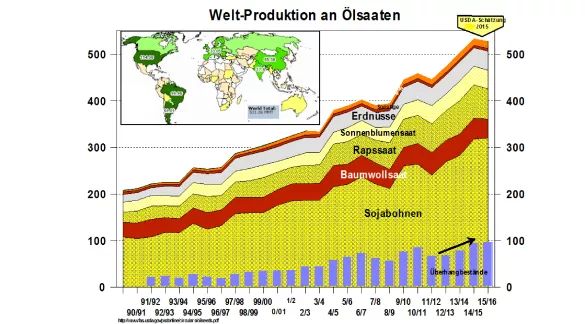

The U.S. Department of agriculture (USDA) estimates the 2015/16 on 527 million tonnes oilseed crop total or 10 million tonnes less than in the previous year. It is the largest so far result. At the end of the marketing year, the already high end stocks to lay again slightly. Thus, an above-average supply location is confirmed.

The soybean with almost 320 million tonnes, which is intended to provide a same result as in the previous year claimed the largest share. The global canola crop is lowered to 64.5 million tonnes after just 72 million tonnes harvested last year. Cottonseed, groundnuts and sunflowers make a contribution to the 40 million tonnes each.

In the market of vegetable oils soya and palm oil are both at the top and argue about 2/3 of world production. Both are considered as market leader, with the slightly larger cheapest oil palm oil offer, while soy has the advantage of protein-rich soy schrotes.

The U.S. soybean crop 2015 estimates the USDA to 107 million tonnes just below the previous line of 108 million tonnes a. However, doubts as to the estimation of the Flächenerträge are loud again. The two South American spring/summer crops by 2015 in Argentina and Brazil remain on course for record together 155 million tonnes. Their ongoing marketing interferes with the advance of the US product.

For the upcoming spring harvest 2016 is for Argentina and Brazil already a lot together 154 million tonnes predicted. However will be at high risk of treasure, because the El Niño weather period in the amount of time. The sowing begins end of September 2015.

RAPS plays with 3rd. 15% market share a customizer role in the oilseed market. The small world rapeseed harvest caused by the two largest producers EU with 21 million tons and Canada with 14 million tonnes. Weather-related yield losses and reductions in areas have contributed to the result of this estimator.

Oilseed prices have impressed by the USDA estimates result little shown. The figures were in line with expectations.

On $430 / fallen t palm oil prices have again stabilized a week and based on the $500 / t brand. In the background, the El acts Niño weather, which announces a season time. This is done just in the time span, in the palm oil production in Malaysia and Indonesia intends to on its annual peak in the Oct. It is already foreseeable that the maximum yields are unavailable.

The rape rates have stabilized again after its price decline at a somewhat higher level. The competing products from Palm oil and soybean meal admit no significantly higher prices despite worldwide shortage of rape.

The current quiet market development in the oilseed sector should not obscure that still considerable risks in the course of the marketing year 2015/16 due to the El Niño weather phenomenon are to survive. Major price fluctuations are therefore cannot be ruled out.

ZMP Live Expert Opinion

The exceptionally well-stocked oilseed sector as a whole covers small bottlenecks in the canola market. The previous crop estimates record results in series. The risks of the impending El Nino weather phase by Oct. 15 to March 16 are due to lack of knowledge but still not included. The remaining market and price uncertainty should not be underestimated given the currently relatively quiet market phase.