Falling crude oil prices put a ceiling on oilseed prices - USDA report without surprises

Crude oil prices are as low as 12 years no longer. Depending on the type of stock exchanges record around $30 per barrel. The decreasing tendency reveals still not bottoming. Palm oil, rapeseed oil and soybean oil are drawn on the basis of their use for bio-diesel from the low competitive prices affected, prove to be still relatively stable at a low level.

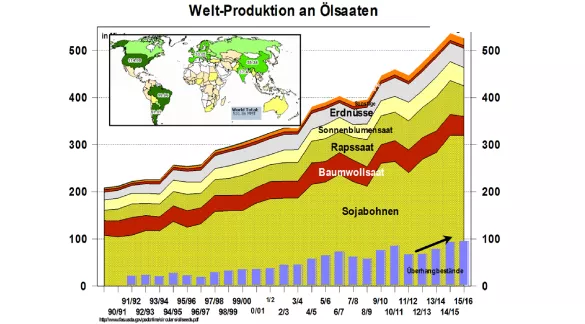

The latest USDA report on oilseeds confirms the high level of supply despite easier withdrawals of single harvest estimates in the years 2015/16. Expect approximately 91 million tonnes of final data or 20% of the processing volume at world level; 5 years ago it was one-third less. The production increases in the amount of 80 million tonnes of exceed the consumption increases to 30 million tonnes in the last 5 years.

The largest oilseed market share keeps the soybean with 319 million tonnes. After a U.S. crop in the autumn 2015 in the record amount of 107 million tons, the USDA estimates the ongoing Brazilian harvest to approximately 100 million tonnes. Brazil itself is optimistic with 102 million tonnes. The export is expected to increase from 50 to 57 million tons. The port capacities are enlarged accordingly.

Argentina's soybean harvest is estimated by the USDA unchanged with 57 million tonnes. Decreased export tax and the peso rate fallen 25% should actually provide for higher export figures. The USDA estimate is however only around 0.5 million tons higher than in the Dec-15 rating.

On the import side is China with 81 million tonnes, or 64% of world trade the dominant size. This year, the increase should only rd. Amount to 2 million tons the previous year. The annual import increases between 4 to 9 million tonnes were in previous years.

The future areas of soy in the United States should be larger. For it speaks especially the soy-corn price ratio, which is above the neutral value for the benefit of the bean. Whether this however is a great harvest, will be in the face of the La Niña weather expected with 90% probability in question. In North America, that means summer dryness with emphasis in the June/July 2016.

The palm oil prices gave back something despite production decline under pressure from crude oil prices in recent years. High inventories have also made their contribution. The negative effects of the El Niño weather on the growth of the plantations will be still for months to feel. The lower oil production will provide a significant destocking, which in turn could stimulate the palm oil prices.

The global canola market continues with approximately 5% in the results of previous years despite the Höherschätzung of the Canadian canola crop. The global acreage should be was not extended. Given the reset surplus stocks in the canola sector, the future supply situation is classified only little change. The question remains to what extent the low crude oil price and the wide range of soybean meal canola prices will continue under pressure.

ZMP Live Expert Opinion

An above-average global supply situation in the oilseed sector in conjunction with a falling rate of crude oil down the price developments after above narrow limits. However, risks with a falling palm oil production and the possible impact of a la 2016 facing Nina weather in the present.