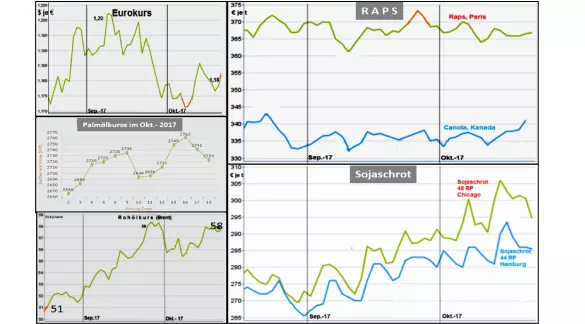

Oilseed courses with limited bandwidth - weak weaknesses after a slight recovery The oilseed courses are relatively calm in manageably limited bandwidths . However, there are tensions, among other things, due to trade policy issues such as the import tariff on biodiesel imports.The solid basic mood comes not least from a crude oil price , which moves with small fluctuations between 55 and 60 $ per barrel. In particular oil-concreted oilseeds are influenced. The euro is also moving at a modest range between $ 1.16 to $ 1.20 per €. Palm oil prices in Malaysia remain in a medium range.The price developments are offset by the currently somewhat disappointing harvest in the high season , by rising stocks and the changing export numbers . The earlier expectation of clearly falling prices to the peak of the harvests in October has not arrived. For this purpose the results remain behind the usual quantities. However, the hope of a prolonged high-season campaign dampens the course development.Rapids do not come out of their monthly lateral movement . The price level of 370 € t can not be held. In this case, opposing influencing factors play against each other. The persistently high crude oil price does not develop a sufficient pulling force to bring the rapeseed upwards. The EU rapeseed harvest is nevertheless so large that the import demand does not rise above the level of previous years. The biggest uncertainty remains the import tariff on biodiesel from Argentina. The sojakurs lost momentum after an upturn in September. The latest developments in mid-October show corrections downwards. The background is the current US harvest , which is to be much better than expected so far, according to recent estimates.China's soybean demand remains high and rising at 93 million tonnes . The main driving factor lies in the construction of a modern pig husbandry, which, in contrast to the former backyard farming, is increasingly gaining importance through the use of protein feed by means of soya bread. The sowing difficulties in Brazil (so far too dry) and Argentina (so far too wet) are increasingly declining. The prospects for a good average harvest in the spring months 2018 are increasing. However, there are still significant uncertainties about the actual outcome.The developments in the well-serviced Soyab area with the coming crop conclusion dominate for the time the course of the oil seed business.

ZMP Live Expert Opinion

Oilseed courses are relatively low on medium (rape, palm oil) and low (soy). A globally above-average supply situation with good prospects for further continuation characterize the market and price events. Uncertainties arise from trade policy.