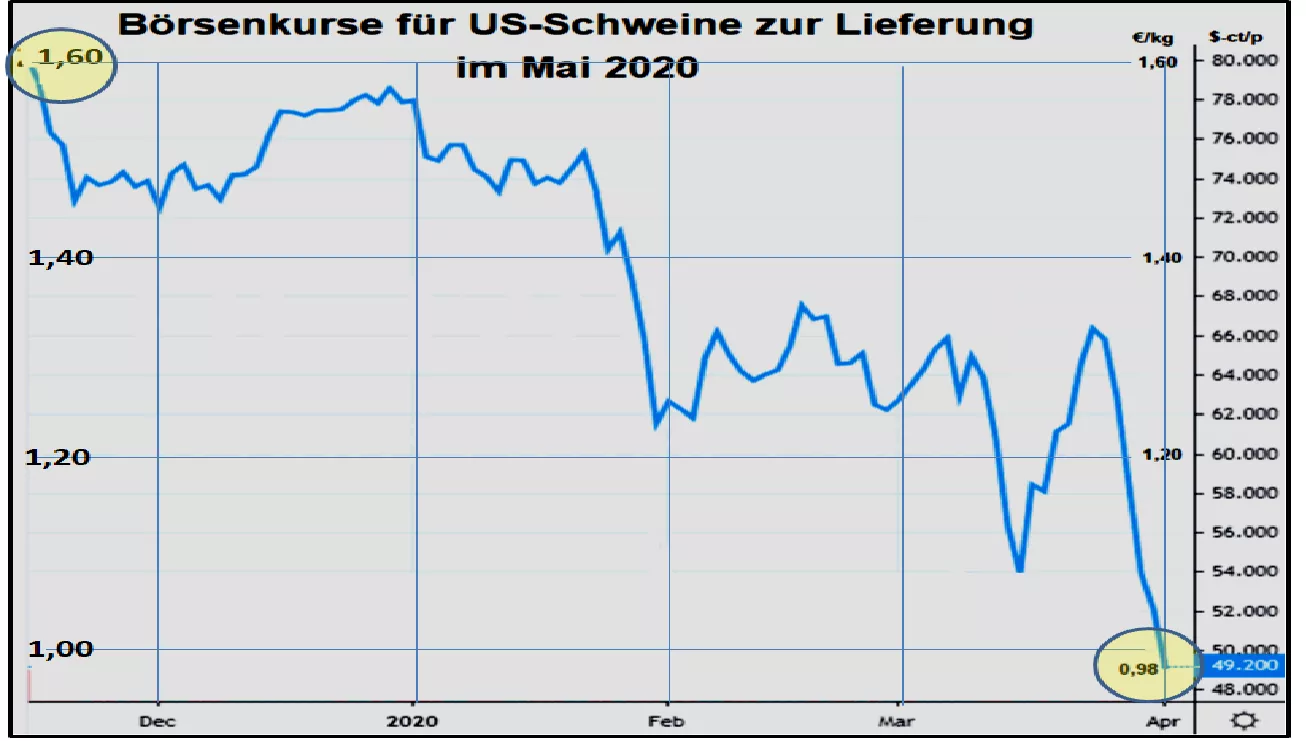

Expectations for US pig prices for summer 2020 plummeted from € 1.65 to € 1.06 / kg. In November 2019 , the US had high price expectations for 2020 with a focus on the summer barbecue season . The term courses for the months of May to August ranged between € 1.55 and € 1.75 / kg . The reason was the combination of seasonally high domestic consumption in the grill phase with slaughter weights and slaughter quantities n usually falling due to temperature, as well as high exports to China. Already in the months of December 2019 and January 2020 the expectations for the delivery dates May to July 2020 were reduced to a price level of the equivalent of 1.50 to 1.65 € / kg . It became increasingly clear that the increasing slaughter quantities overwhelmed domestic consumption and that the China business was not so easy to implement.With the onset of the coronavirus pandemic , there was a sudden sharp drop in price from 1.35 to 1.06 € / kg in mid-March 2020 , but was immediately replaced by the observation of hamster purchases, which brought the prices back down to 1.35 € / kg . kg catapulted up. The recent drop in price was triggered by the publication of the cattle count results as of March 1, 2020. Contrary to all expectations of market experts, the pig population was 4% higher than in the same month last year. Pigs ready for slaughter in the next few months were even 6.5% higher . Slaughter weights that usually fall in summer can only achieve a small partial compensation. In connection with the possible US logistics problems resulting from the coronavirus pandemic, it suddenly became clear that pig prices in the US will come under severe pressure in the coming months.For the further course in the late summer / autumn period , the number of slaughters should increase less strongly (2 to 3%) due to the cattle count results, but as a rule the slaughter weights then increase again and the barbecue season with its increased consumption ends. A fundamental recovery in pig prices to the previous level is therefore no longer expected. The Chinese business cannot bring about a fundamental reversal of market conditions either. The sows herds found in the course of the cattle count remained at +0.4% below expectations between +0.5 and 2%. From the pregnancy data it can be derived that the farrowing will even decrease in the late summer / autumn months. The result is that the number of fattening pigs will be lower in the first months of 2021 than in the current year.The deal was worth it for companies that have fully or partially secured themselves on the stock exchange with the help of hedge transactions . The losses in the spot business are offset by market profits. This shows the meaning of stock exchange hedging: with high profitable price levels, (partial) hedging is always advisable in order to counteract unpredictable price drops. This smoothes profits above average. No more and no less!