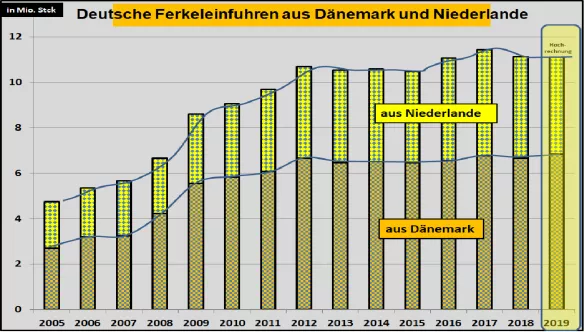

High pork prices - and what about the pig prices? For several months, pork prices have been paid, which are rare in comparison to previous years. The decisive cause is the fallen battle figures in Germany and - with the exception of Spain - some other production areas in the EU. In the background, rising exports to China are also boosting the high price level. But how do the high pig prices affect the piglet quotations ? Basically, there is a demonstrable correlation between piglet and pork price quotations. On average over the last 6 years, the 25 kg NW piglet quotations were approx. 29% of the proceeds for an average pig. In addition, there are usually a number of surcharges that are not always included in the quotations in full. In the tendency, the percentage of piglets in fattening pig yield is well over 30%.Despite the close relationships between piglet and pig prices , some typical peculiarity characteristics emerge over time. First of all, the season- typical course is to be highlighted with a spring high and an autumn low . The spring high is due to the above-average Umrauscherquoten in the sows in the warm summer time, which contributes to a short supply of piglets in the spring months. At the same time, there is the part of fattening an intense demand because the animals are ready for slaughter in the barbecue season, and promise low prices. In the autumn months , the market situation is reversed, with the sales month of January in particular offering a pronounced price weakness. In individual years, the pig price highs and lows are increased or attenuated by superimposed factors.Basically, the rule is that at low pig prices, the piglet prices fall particularly low and pig prices are piglets prices disproportionately high . Therefore, the proportion of piglets (without surcharges) varies in pig yields in a range of just under 20% and extends beyond 35%. The respective extremes usually last only a few weeks. In recent years, an average rising trend of the piglet share in pig proceeds has emerged. The decisive reason is the finding that Germany has an increasing pig shortage in the order of magnitude of approx. 20%. Sows in this country were decimated in the lower stock size classes, while in the upper stock sizes no full compensation took place. The background is the uncertainty about the future livestock regulations , which are created several times in the piglet production area. Germany imports approx. 12 millionPiglets, mostly from Holland and Denmark . However, the high growth rates of imports prior to 2012 are a thing of the past. With small annual fluctuations , deliveries have stagnated since then , because the two countries also encounter environmental protection limits. In the case of Denmark, pig farming is reduced in favor of pig production. The additional Danish piglet population migrates in1. Line to Poland. Conclusion: The high pig prices have led to a significantly higher piglet price level .