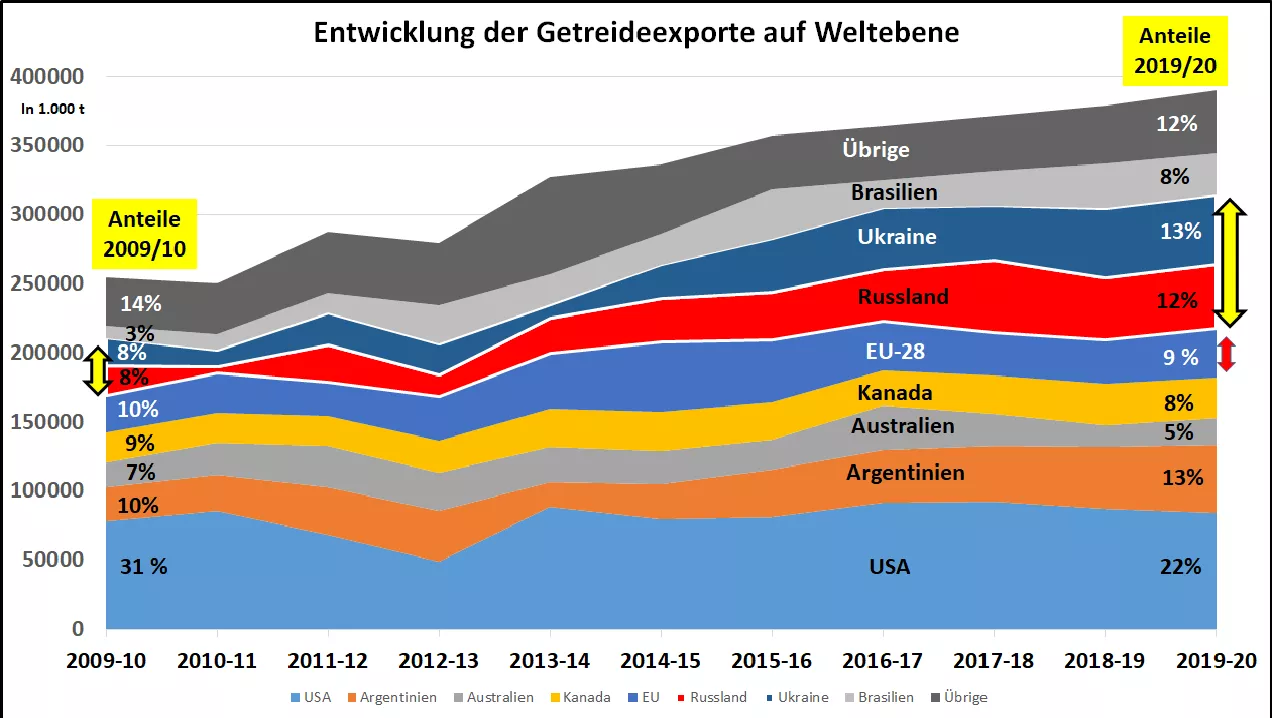

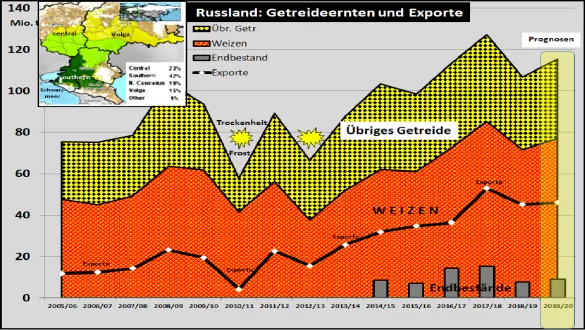

International grain exports: Russia and Ukraine in first place - US and EU lose - Black Sea countries with high price influence. The heavyweights in global cereal exports have changed significantly in recent years. This also shifts the regional significance for price formation. The USA , which was still leading 10 years ago, had a market share of more than 30% at that time, today the percentage is only 22% , of which approx. two thirds of corn deliveries. Canada, Australia and the EU , with a focus on wheat exports, have been unable to fully maintain their export shares. By contrast, the two Black Sea countries Russia and Ukraine, together with a share of 25% , have pushed themselves to the forefront. While Russian supplies are predominantly wheat, Ukraine has shifted more to corn exports. Brazil's grain export increases from 3% to 8% consist almost entirely of corn.The EU-28 is hit hardest by rising wheat deliveries from the two Black Sea countries. Both exporting regions are aimed at the sales markets on the North African Mediterranean coast and the Middle East . Russia and Ukraine, in addition to the transport cost advantages, can often win the market with lower prices . The EU offers were always out of favor, because the offers were too high. The US has also lost considerable market share here . For the year 2019/20 , high harvests are again predicted in the EU, Russia and Ukraine . It is foreseeable that sufficient quantities of cereals will again be available for export . The crops in the affected import areas should be good average. Therefore, it must be assumed that export prices are under pressure again. This development already takes place in the run-up to the new harvest. However, the profit-determining grain filling phase is still to come. The weather plays a decisive role here.After the recent weather, there is still an insufficient reservoir of soil water . The moisture required by the plants must therefore be covered mainly by rainfall. A drying phase that lasts longer in the future could lead to lower yields , which directly affect export potential . A lower harvest in the EU can largely be compensated by the increased overlay stocks. By contrast, Russia and the Ukraine halved their high overhang stocks through continued exports. In the next few weeks and months there will be the so-called weather markets , ie depending on the weather, the grain prices will move up and down. Particular attention is paid to the weather in Europe as far as the Urals.