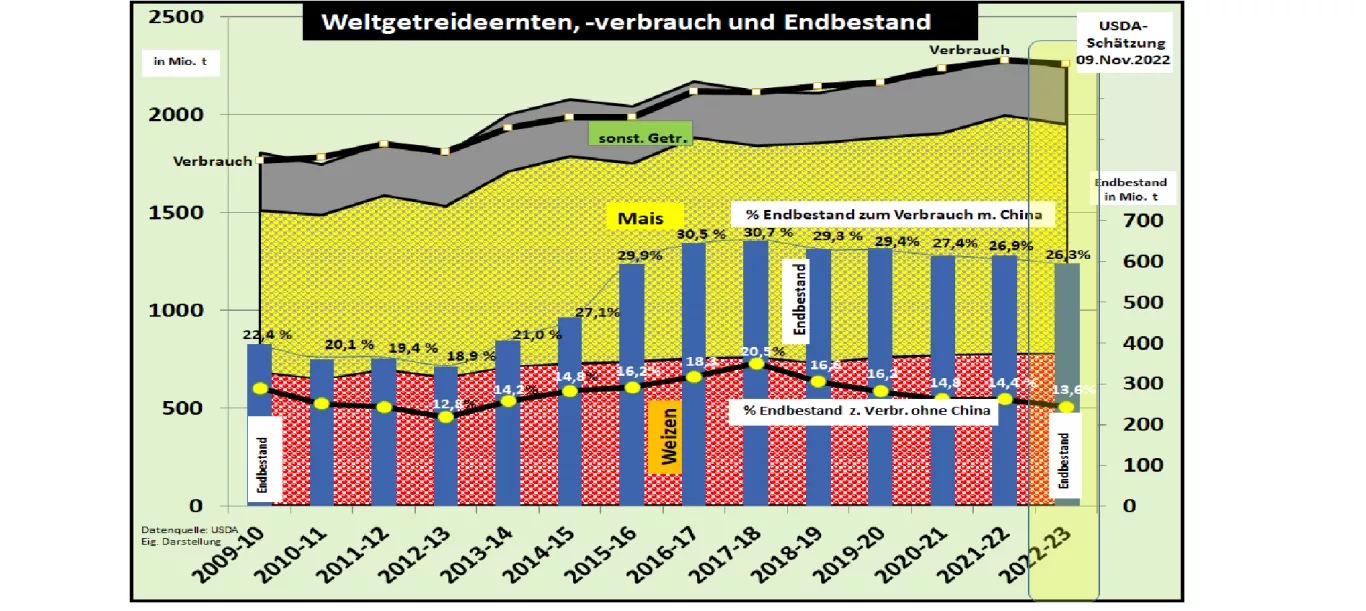

Nov. 2022: USDA corrects global grain harvest 2022/23 slightly upwards compared to the previous month Monthly comparison results The US Department of Agriculture (USDA) only slightly corrected the world grain harvest 2022/23 compared to the previous month in its latest Nov 2022 edition. The changes affected Argentina's drought-stricken wheat and corn crops , with a reduction of 2.5 million tonnes or -3%. In contrast, the Australian harvest is estimated to be 2.5 million t or around 5% higher due to favorable rainfall (“La Niña”). The EU grain harvest was cut again by around 1 million tonnes as a result of the extremely weak maize harvest. On the consumption side , an increase of around 2 million t or less than 1% compared to the Oct. 22 estimate is expected worldwide. The ending stocks of wheat increase only marginally compared to the previous month, while a slight decrease is observed for the rest of the grain.Results in comparison to the previous year The global production is estimated at 2,242 million t (previous year 2,280 million t). Global consumption is also classified as lower at 2,259 million t (previous year 2,280 million t). In global world trade , the quantities were estimated lower at 433 million t (previous year 465 million t). In the case of Ukraine exports , an uncertain export quantity of around 29 million t (previous year 51.7 million t) is predicted; For Russia , the USDA estimates export volumes of 51.6 million tons of grain (previous year: 40.5 million tons ). EU exports are estimated at 44.3 million t (previous year 45.7 million t) .On the import side , the critical supply situation in the North African and Middle Eastern countries is confirmed with slightly reduced import volumes. China is expected to reduce its grain imports by around 15% to 44.6 million tons. The ending stocks were calculated at around 594 million t (previous year 614 million t). The supply figure falls to 26.3% end-of-life for consumption (previous year 26.9%), excluding China to a critical 13.6%. The global supply situation has fallen back to the level it was 10 years ago. The global corn supply is significantly tighter than in the case of the wheat market. Against the background of the war in Ukraine, security of supply is becoming even more stringent. Fear of supply has become a price-determining factor.Stock market prices reacted cautiously to the USDA report. The changes in listing are within a narrow range. Significant downward corrections have already been made since the previous week. The perspective is increasingly directed to the question of the continuation of the agreement with Russia to guarantee the previously secured shipping route for Ukrainian goods through the Black Sea in a newly negotiated form. The current contract expires at the end of next week.