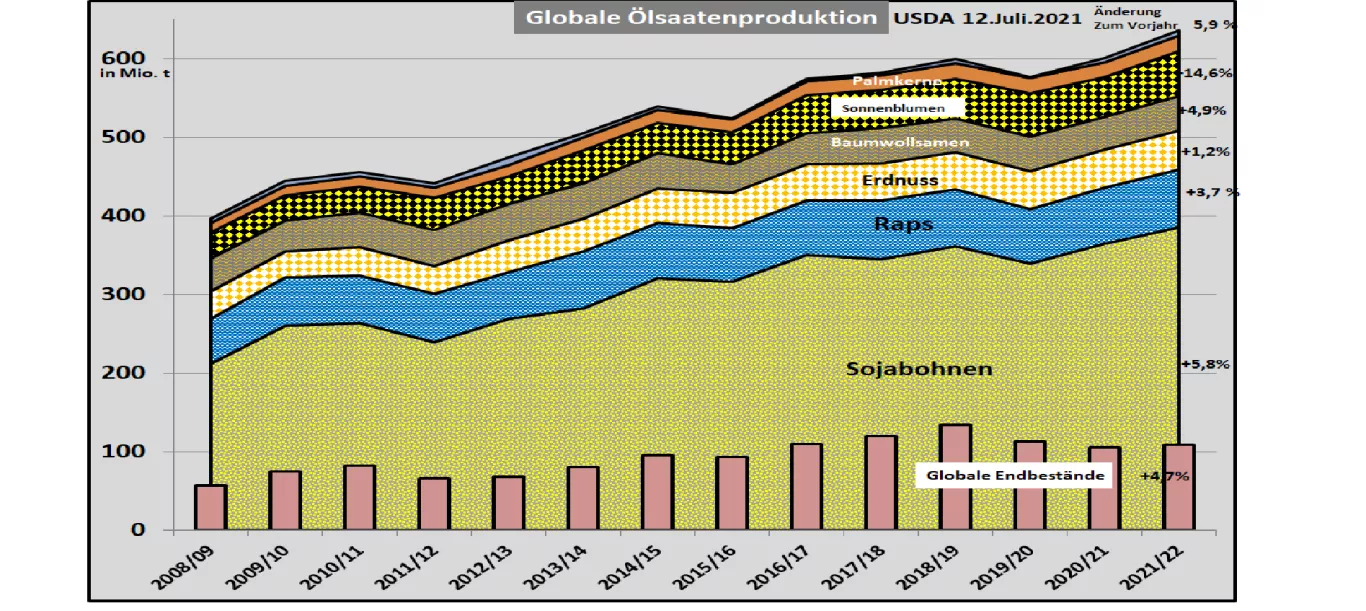

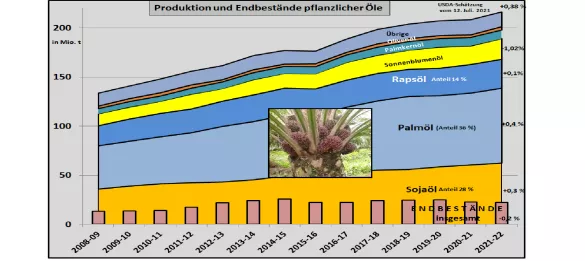

USDA estimates higher oilseed production in 2021/22 and even higher consumption In its July estimate, the US Department of Agriculture (USDA) has increased the oilseed harvest in 2021/22 by 5.4% to around 635 million t (previous year 600.5 million t) ) forecast. Consumption is expected to increase to a similar extent. The final stock is estimated at an increasing 108.6 million t. In mathematical terms, the stocks last for 74 days (previous year 72 days). The decisive increase is due to the higher harvests in the soy sector. As in the previous month, the USDA expects a worldwide increase from 364 to 385 mln t. The additional quantities are mainly due to the Brazilian soybean harvest of 144 million t and the upcoming US harvest of 120 million t in the fall. Argentina only achieved a just under average result with 52 mln t. Increases in consumption are lower than in previous years.In particular, China % stands out, whose import growth has recently been curbed. The Chinese import volume is now only estimated at 102 million t. When it comes to soy exports , Brazil remains in first place with an expected volume of 93 million t. The USA expects exports to decrease by 5 million t to 56.5 million t in 2021/22. The USDA estimates global rapeseed production unchanged from the previous month at around 74 million t , which is 2.6 million t more than in the previous year . While a 0.8 million t higher harvest of 17.0 million t is expected in the EU, an increase of only 1.2 million t to 20.2 million t is expected in Canada due to the drought. The scarce supply situation remains worldwide. In the EU, however, a small increase is expected. The USDA estimates an import requirement of 6.45 million t for the EU.For the other oilseeds, the increasing production of sunflower seeds is of regional importance. Production focuses on Russia and Ukraine. In the meantime, the consumption of sunflower oil in the human diet is number one. Support comes from the relative price worthiness of the higher quality oil. Palm oil: For 2021/22, the USDA is assuming that the estimated 76.4 million t will be able to pick up on the development of previous years. In 2019/20 production collapsed due to corona-related difficulties. The main increase comes from Malaysia with +1.2 million t to 19.7 million t and Indonesia with +1 million t to 44.5 million t. With 3.1 million t (previous year 2.4 million t) Thailand is also contributing to the increase in supply quantities. However, the increases in consumption mean that closing stocks decline slightly, but still remain at a high level. On the Chicago stock exchange , the prices in the soy complex moved inconsistently.The soybeans stabilize at a slightly higher level. Soybean oil gives way again after an increase phase. Soy meal shows signs of increasing again after a short period of weakness. The palm oil prices are asserting themselves again at a higher level after their price low. The rapeseed prices have risen, but cannot maintain the line of € 380 / t on the Paris stock exchange. The increased euro exchange rate makes the imports necessary for supply cheaper.