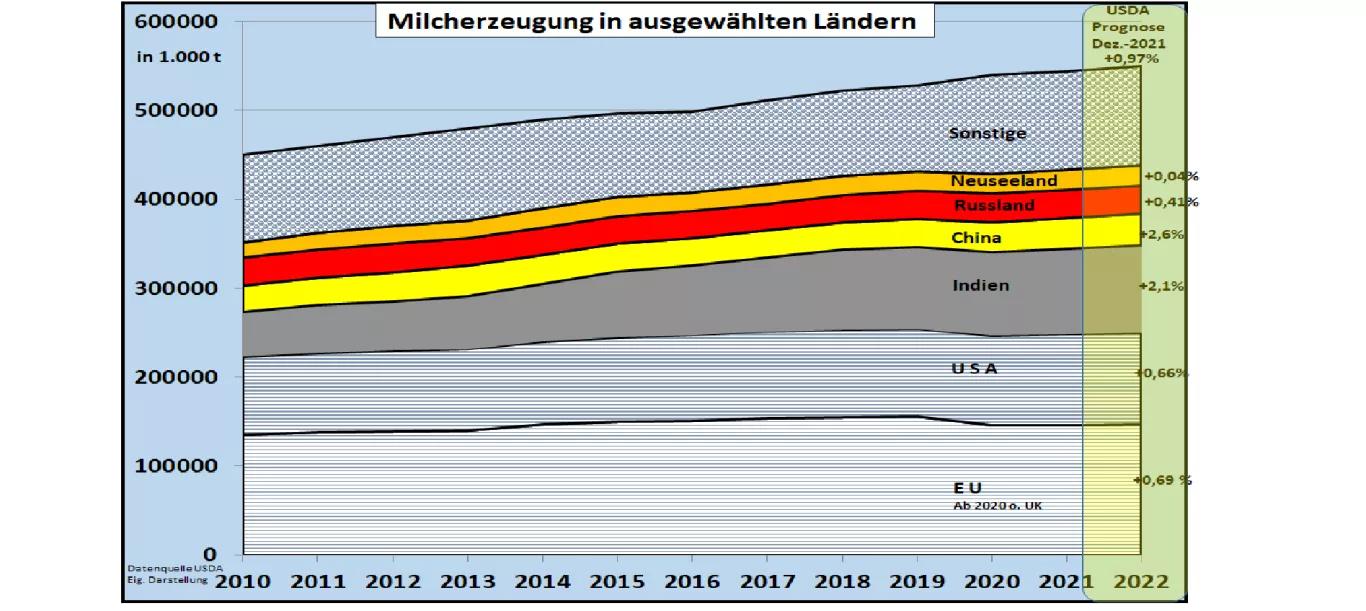

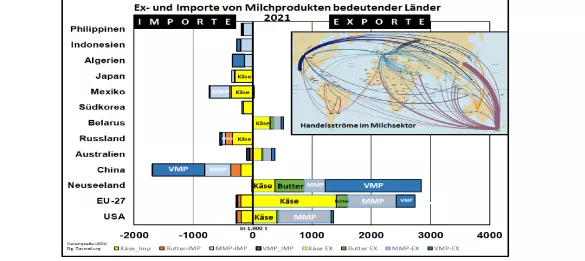

USDA: Expects milk market supply to be scarcer in 2022 In its six-monthly forecast, the US Department of Agriculture (USDA) estimates that the milk market will be less supplied worldwide in 2022. Production in major countries around the world is expected to increase by less than 1% on average. This contrasts with global increases in consumption of between 1.6% and 3.5% for individual dairy products. In the world's largest production area, the EU-27 , cow's milk production of 146.7 million t (+ 0.7% compared to the previous year) is predicted. Continuously declining cow numbers are offset by higher performance per cow. The fresh milk consumption , which has been constant for 3 years, should also remain unchanged in the coming year at just under 24 million t. EU cheese production and domestic consumption are each expected to increase by around 0.5%; the export and import business with cheese in third country trade is estimated only slightly higher.EU butter production is estimated to be 0.5% higher to 2.15 million t. In contrast, last year's increase in butter consumption should not repeat itself, but rather remain just below the previous year's level. Butter exports , which fell by around 21% in 2021, are expected to pick up again. EU butter imports from third countries are estimated to be 18% lower. The Union's production of skimmed milk powder (SMP) is estimated at a slightly increasing 1.56 million tonnes. Domestic consumption in the EU of 0.75 million tonnes continues to decline. The SMP exports , which fell in previous years, are expected to rise again to 0.82 million t; Algeria is one of the big buyers. The USDA estimates the production of whole milk powder (VMP) in the EU to be 6.3% lower than in the previous year to 0.59 million t. The result is a slight drop in domestic consumption and an 11% drop in exports to 0.28 million t.The EU milk powder sector will remain highly dependent on sales on the world market in 2022 with levels of self-sufficiency between 187% and 207%. Even ahead of the EU, New Zealand (NZ) ranks first in terms of exports in world trade. Milk production of 22 million t is at the limit of capacity and will change only insignificantly in 2022. Around 95% of milk is exported in the form of processed dairy products. Whole milk powder is expected to be lower in 2022 with 1.6 million tons of production and export. Skimmed milk powder is estimated at a slightly increased 0.355 million t, but the quantities remain well below previous years. This also applies to the production and export of butter . The increasing production of cheese that has been observed so far - almost exclusively for export purposes - is not expected to continue in 2022. Overall, the export supply from New Zealand will be noticeably smaller and thus contribute to a tighter supply situation on the world market.The USA ranks third in the world in terms of production and export. Milk production is expected to increase only insignificantly at 103 million t. US fresh milk consumption has been falling in small units for years. In contrast, the production and consumption of cheese is steadily increasing with moderate growth. The increasing export of cheese, at 0.41 million t, is greater than imports of 0.19 million t. An increasing butter consumption of around 1 million t should also be covered in 2022 by growing domestic production and smaller import quantities. Whole milk powder plays a subordinate role in the USA. On the other hand, around 75% of the growing quantities of skimmed milk powder amounting to 1.23 million t must be exported. India 's cow milk production is growing by 2 to 5% every year. Around 60 million cows produce an estimated 98 million tons of milk; 85 million t of this is consumed as fresh milk.Butter production and consumption are congruent with the exception of small export quantities; this also applies to skimmed milk powder . When it comes to the milk market, India can largely be classified as self-sufficient. With a slightly increased 35.5 million t, China’s milk production will not be sufficient to cover its own supply in 2022 either. The Middle Kingdom is the world's largest importer of all kinds of dairy products. In the case of whole milk powder , China imports 64% of world trade; in the case of skimmed milk powder , the proportion is 30%. The rising butter imports have meanwhile grown to a market share of 28%. The global import share of cheese rises to 8.5%. Overall, Chinese import volumes are expected to grow by 5.5% in 2022. The main supplier is New Zealand, but it cannot meet the growing demand from China. The forward prices for milk and dairy products on the Chicago Stock Exchange are set for 1.Half of 2022 was 6% to 8% higher than last year.