The supply of raw materials continued to rise in January and is continuing its upward trend after the setback of the week. In the third calendar week, dairies had around 0.6 percent more milk available for processing than in the previous week. However, less milk was served in the first three weeks than in the first three weeks of the previous year. The gap is currently around 1.6%. Activities in industrial cream are restrained and prices are trending sideways. Skimmed milk concentrate is sufficiently available and is showing weaker trends due to subdued demand. Spot market milk, on the other hand, was traded significantly more firmly and increased by 1.4 cents to 39.0 cents/kg compared to the previous week. Demand for packaged butter has recently calmed down. Goods output is somewhat less extensive, but demand is expected to increase again in February. The prices yesterday remained unchanged from the previous week. Consumer prices are also stable at 1.69 euros/250 grams and 10 cents higher than in the same week last year. The block butter business is running impulsively. Prices tend to be weaker. Negotiations usually focus on later deliveries, but rarely lead to conclusions due to different price expectations. Demand in the export business, however, is somewhat more dynamic. Buyers from the Middle East in particular are once again increasingly engaging in discussions with local manufacturers. There are weaker price trends on the EEX over the week. Nevertheless, the prices from August are above the current cash market level, while the terms from February to June are below or in the current price corridor of the cash market. The calm on the market for skimmed milk powder doesn't seem to end at the end of January either. There is a little more demand and business coming from domestically, but these business transactions are not yet providing any impetus. There is little demand for later delivery dates. European goods have recently become more competitive in exports. The logistical problems caused by the uncertain situation in the Suez Canal and the Red Sea are hindering export activities. Inventories remain manageable, which is why the dairies are not signaling any sales pressure. The prices are moving in a wide trading range with a downward trend. Slightly more contracts were traded on the EEX again at lower prices. The price trend for animal feed products is also declining; demand from the industry has been subdued recently, but manufacturers' willingness to sell has increased. Little has changed in the market for whole milk powder . Only what is ordered is produced. New business is transacted at slightly lower prices in the European internal market. The price was reduced yesterday by an average of 40 euros to 3,650 to 3,750 euros/t. The demand for whey powder appeared to be somewhat calmer again at the end of January. The extensive quantities from the beginning of January are no longer evident. However, later delivery dates are in greater demand, with buyers apparently wanting to stock up on contracts early and secure their needs. The price in Kempten fell by 30 euros at the lower end to 900 - 1,030 euros/t. The prices for cheese remain unchanged from the previous week. There has been little change in the fundamental market situation. Demands from food retailers remain at an above-average level for January, while industry and large consumers show no additional requirements outside of the quantities already contractually secured. Interest from third countries has increased. However, the higher freight costs due to the location on the Red Sea put many people off. Buyers from Asia in particular are increasingly looking to other destinations for their needs.

ZMP Live Expert Opinion

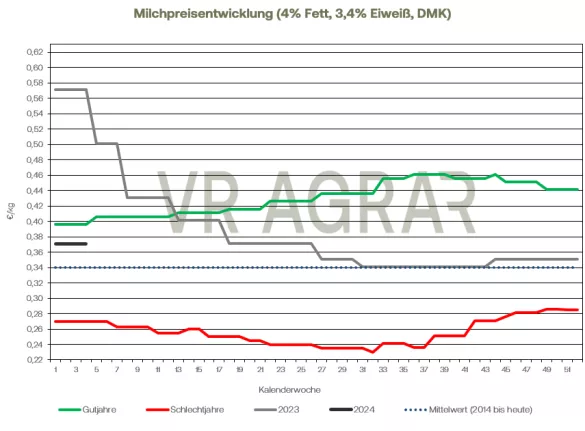

The milk market was not showing a clear direction at the end of January. Block butter and skimmed milk powder are under price pressure due to calm demand. At the same time, inventories are manageable and demand for cheese remains at a very high level. Packaged butter, like white line products, is in high demand among consumers. Overall, however, there are signs of stable development from the producer's perspective.