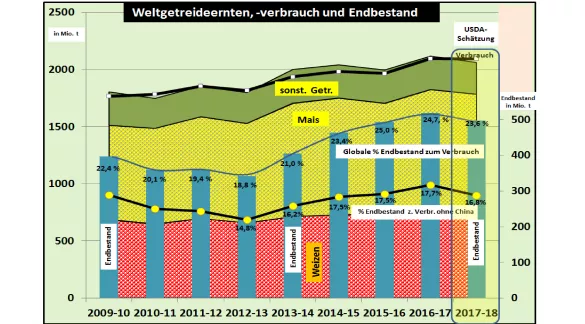

USDA Oct. Estimates World Trade Market 17/18 - Great Harvest - Closer Supply The latest USDA estimate for the world-wide market yielded a production volume of 2,070 million tonnes, which is 51 million tonnes behind last year's record. World grain consumption is estimated at 2,092 million tonnes, 22 million tonnes below current production . The result is a reduction in global inventories on the same scale.At 497 million tonnes in absolute terms, the anticipated final stocks are still at a high level, measured as a percentage of consumption, the supply figure drops to 23.8% compared to the two previous years. 25% . This is still a good average, assuming the long-term value of 22%. In the case of the wheat market, the strong stock build up initially stands at 11.5 million tonnes to 268 million tonnes. However, on closer inspection, this proves to be a possible fallacy of a supply improvement. As in the previous years, the stock build up in the order of 16 million tonnes takes place in China alone . The Chinese wheat stocks amount to approx. 47% of world stocks, but they are not available to the rest of the world market.The final amount -uale% wheat in terms of consumption is 22.5%, well below the values of the voraufgegangenen three years 24%. From a regional point of view, several areas of production are particularly prominent. Russia has a record number of 125 million tonnes, of which 82 million tonnes of wheat alone. In the last 3 years, Russian production growth has increased by approx. a third . Exports have doubled . Russia stands at 32.5 million t in the 1st place at the Weizenexport .Higher export volumes are failing due to logistical bottlenecks, especially in the winter period. With almost 20 million tonnes of inventories, Russia's inventories tripled in comparison to 2015/16 . Although the US total of 423 million tonnes does not match the previous year's record, it is still the multi-year average. The higher estimated corn harvest still entails some risks, as harvesting is delayed. On the other hand, Australia 's drought of 33 million tonnes is far below the previous year' s result 50 milliont far back This is the worst Result for almost a decade. An improvement of the global supply supply is therefore not to be expected this year . Also Argentina will be with a lesser crop 17/18 can not contribute to an increase in the supply in the second half of the year.The USDA estimates the EU harvest at the level of the EU Commission, taking into account the different calculation methods. The exchange rates in Chicago have initially reacted with price fluctuations in a wider range, but have then essentially returned to the previous state. Only dollarnotted wheat tends to be weaker. For the Paris stock exchanges, the price of the euro increased to 1.185 $ / €.

ZMP Live Expert Opinion

At first glance, the global supply situation is quite favorable. However, closer examination reveals structural bottlenecks. The China effect with the high stocks of non-exportable stocks clearly restricts the supply situation, particularly in the case of wheat. Russia, on the other hand, is compensating with its pressing export offer. Limitations in logistics, however, could limit exports during the winter period. The prices on the stock exchanges are still under the influence of declining Russian export prices and a cutback in the case of US maize. However, the supply situation opens up more price margins than downwards. But the rooms are not big either.