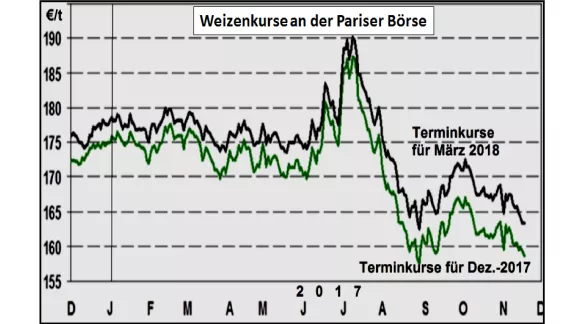

Wheat courses without power and momentum - US corn in a period of weakness The wheat prices on the stock exchanges in Chicago and Paris show only feeble movements . By contrast, US corn is losing ground, while prices in Paris tend to stabilize. Overall, the mood is rather bearish. There are several reasons for this.The largely unchanged USDA estimate of a worldwide high wheat supply provides the basic tone for the price development . As the world's largest wheat exporter, Russia continues to dominate the wheat market with its export offensive. Interim price increases for Russian wheat are already a thing of the past. Support comes from the weak ruble exchange rate, which is significantly influenced by falling crude oil prices.Uncertainty about the application of the ergot limit for deliveries to Egypt leads to restrained ones offered in the tenders. Should it stay at the zero tolerance limit, Russian exports will be in trouble. Nevertheless With the prospect of success, the Black Sea country will remain active worldwide for alternatives to its export volumes.This is also necessary, because the Russian bumper harvest not only leads to high export figures, but also to far above average stock levels. At the latest after the coming hibernation, the overlying stocks will be available for export again. The big Russia exports have pushed back EU exports significantly. The latest figures speak of a decrease of more than 20% compared to the previous year.The overhanging EU wheat quantities stay inland and press on the courses. In Paris, the € 160 / t mark can no longer be maintained. It is perceived only marginally that wheat sowing has been reduced under unfavorable weather conditions both in the USA and in the north of the EU . Only the late forward rates 2018 indicate increased price increases that the conditions for high harvests could be reduced. But that is still far away.In the case of the corn market , the high production and export share of the US dominates the market and price events. Lower than expected weekly exports below the 1 million t mark give rise to fears that final stocks will grow more significantly than previously reported in the USDA calculations. The competition for US corn exports comes from Brazil . The high harvest last year is not yet fully marketed and the Brazilian weak currency REAL favors the South Americans.The expectations of a lower Brazilian corn crop in spring 2018 currently seems to have little impact on prices. In particular, the second crop after soy should be significantly smaller. But that's still a long way off. There are reasonable expectations for price improvements , but apparently at present still with a low implementation rate.

ZMP Live Expert Opinion

The basic tenor of a barely stable to slightly declining Kurstendenz is currently predominant. The capping of the price development is attributed primarily to the high exports of Russia. But also a number of other factors are involved. Arguments for price increases are only a long way off.