Wheat price rally: the Russian influence is overrated?

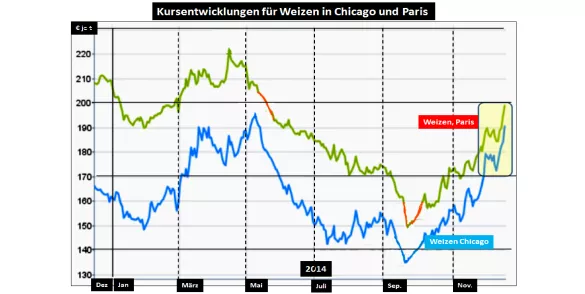

Wheat prices on the Paris stock exchange exceed the mark of €200 per t. The target size of 650 cents per bu is targeted in Chicago. It gave both levels most recently in May before the new big harvest 2014/15. In September, the courses in Paris, to a low of €150 per t slip and Chicago n could be kept in the 500 cents per bu hardly.

What has changed today?

First is the height of this year's crop of 2014/15 better estimates multiple quite firmly in the saddle. The supply situation for cereals is located in the upper mid-range for wheat in good average and for feed grain significantly above average.

In the case of wheat are cutting back to previous years to make, because the unusually high proportion of feed wheat qualities reduces the availability of wheat of the demanded quality in this year. It slips further down the supply assessment and ends up with multi-annual averages.

When in this situation, further limits of the availability of wheat in the global trading business should occur or occur in the future, the logical consequence of price reactions to are up.

These limits are now seen in connection with the Russian efforts to throttle the exports. On the Russian side feared a strong selloff with the result of low inventories. But urgently needed, because the announcements for the upcoming harvest % denominated in a 15 to 20-fall back. One cause is the difficult autumn sowing with weak stocks and highest prone to high rates of Dewinterizing. The second cause is in inflation due to expensive resources for fertilizer, pesticides and fuel. Loans are only with interest rates above the 20% mark, if the banks for loans give money.

Potential affects also the selling restraint of Russian farmer , that the grain used as security against the inflationierenden rubles with approximately 18% see. They sell only so much as they need for ongoing funding.

The sharp fall in the price of the ruble favours the export compared to the competitors. Grain exports are highly attractive for grain traders. Therefore the Russian export restrictions - as well as they are be - justified and handled quite comprehensible.

Has according to current Russia so far almost 20 million t of cereals total estimated 30 million t running. If the remaining exports of half of the are cut, approximately 5 million tonnes with focus are wheat to the disposition. This is an order of magnitude, which is indeed relevant to price, but is bearable given the overall supply situation of the cereals market. This is true especially in the light of high end stocks, the leading exporting countries of the world. The supply situation will indeed close, but non-critical, but focuses more on multi-year averages in the wheat sector.

A long-term funds in the wheat supply is a 26% closing stock measured in consumption. This value is reached, taking into account the aforementioned corrections. On an average supply situation is an average price, which measured on the Paris stock exchange quotes at rd. €200 per is t. In the case of the Chicago listing is the seven-year average of just under 650 cents per bushel . Both brands were tackled in recent years, and now almost achieved.

Should this assessment of the prevailing market conditions for the season, endure, the end of the wheat price rally may be foreseeable. May be some exaggerations may be returned. Surprises are not excluded as always.

ZMP Live Expert Opinion

The simmering Uberschätzung of the supply situation in the wheat sector as a result of not taking into account of the unusual high percentage of feed wheat qualities in 2014/15 is visible through the recent release of Russia's restrictive export policy. To what extent exports are choked, still remains and forms the basis for more speculation.

However, are expected to be adequate "reserves" in the leading exporting countries available to provide sufficient compensation. In addition, new market orientation not at zero cost takes place.

Adaptation of wheat prices on multi-annual average level corresponds to a revised assessment of the worldwide average supply situation in a long-term comparison.