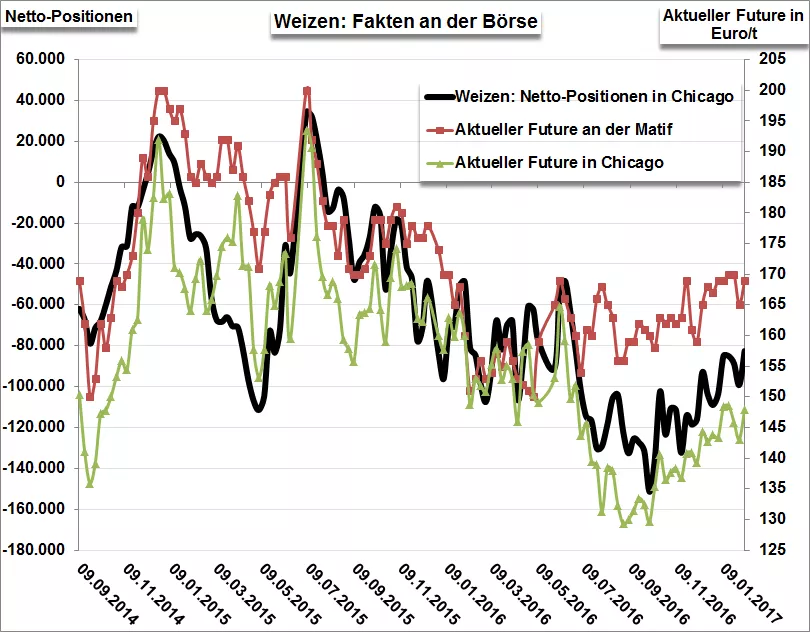

When the wheat speculator in Chicago, the net short positions to 16,630 contracts on 82.547 NET short positions have declined in the reporting week to the 07.02.2017. The courses in Chicago could recover accordingly.

The most recent USDA figures from the February 2017 estimate the grain stocks to 7 million tons (wheat minus 4 million tonnes, coarse grain minus 3 million tonnes) less compared to the previous month. This decline goes back almost exclusively on a reduced wheat production estimate in India and increase in corn consumption in China. Rather, it will be so exciting for the upcoming harvest, the year 2017/18, these modified figures of the business year 2016/17 are likely to affect little the world trade; The futures market rates for prompt marketing and the new harvest rates are at about the same levels around 170 euro / t. The messages on the seed status for the wheat and the scope of the sown areas allow 2017/18 still no reliable estimates for the year. Nothing so far indicates weak harvest expectations, in particular because in addition to a clear area, some energy in the form of good sales from the last harvest and favorable loans for working capital in the production is plugged into Russia. Still, Billed at the end, the winter has lost most of its horrors, yield drought and heat in the early summer and summer have now the largest influence on. Crop losses as last 2010 brought prices clearly in motion at the crop of over 50 million tons due to the dryness in Russia or the heat 2012 in the Midwestern of United States. A 1-2% lower cereal production compared with the original assumptions can clearly swirling messed up the price structure. The local farmers hope dies last, after 2010 and 2012 can there be once again more crop failures in major regions of the world and change the negative price trend in the last four years. Rhenish producer prices remained in the last few weeks with approx. 155 euro / t ex. Relatively stable crop freely •sensors and over 170 euros per tonne for fall deliveries from the farm. The prompt basis and the basis for the autumn deliveries of bread wheat there are 6 or 7 Euro / t significantly above the average (plus/minus zero) the last years and still benefit from the weak 16er harvest in parts of Western Europe and the low tide of the last few months.

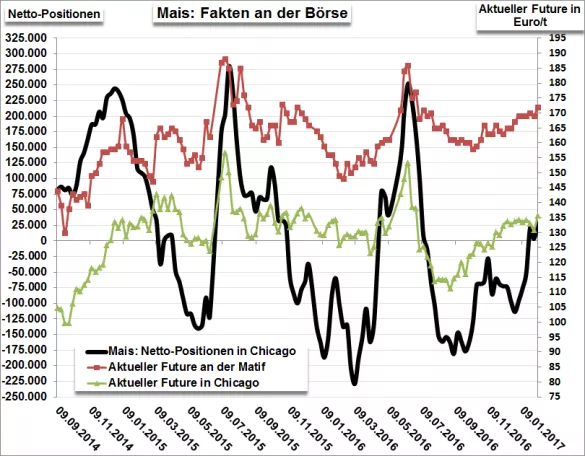

Corn speculators in Chicago to took the net long positions to 25.372 contracts on 28.833 net long positions in the reporting week to the 07.02.2017. The increase in buyer positions resulted in better prices in Chicago.