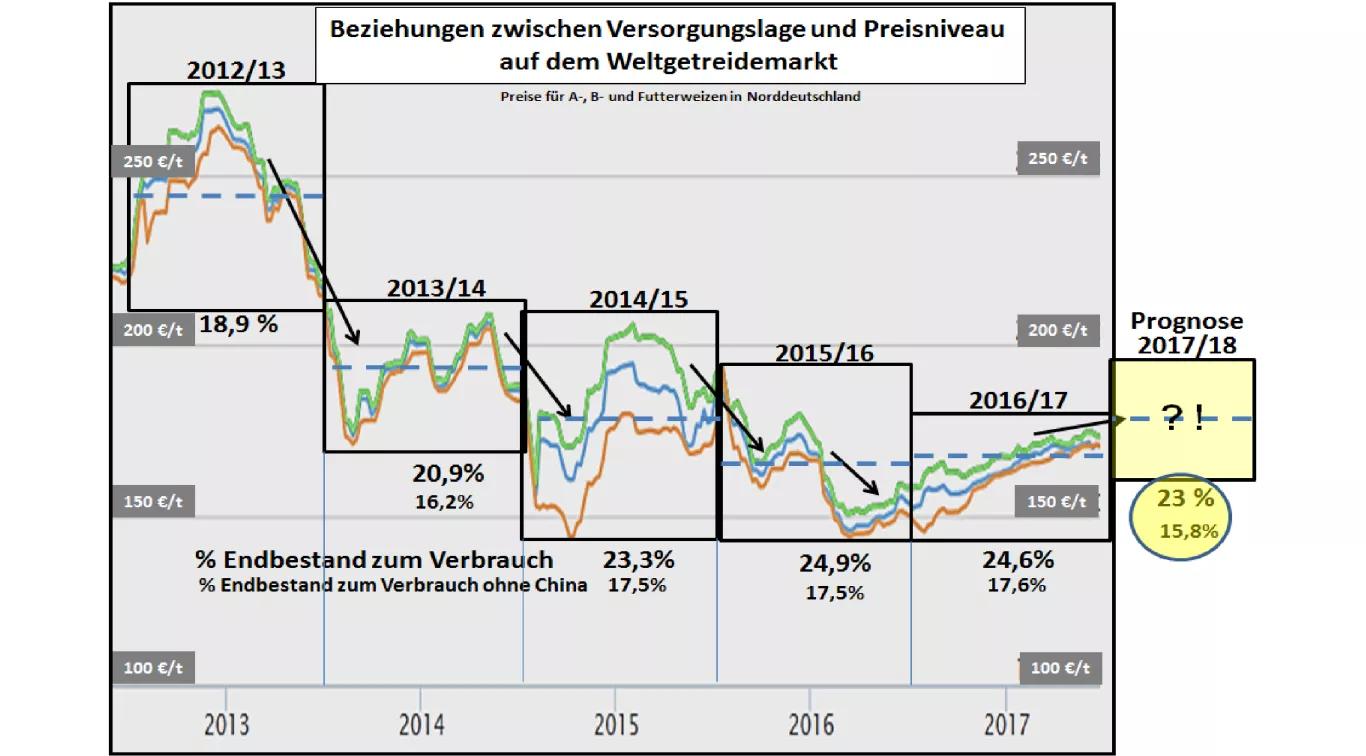

How are the 2017/18 wheat prices? Good weather seasons alternating with heat waves and storms are currently driving the stock exchanges worldwide up and down . In the currently ongoing period of earnings formation , the weather development decisively determines the outcome of the upcoming crops. In the large cultivation regions at world level, any change in the growth conditions is therefore acknowledged with appropriate corrections of the stock exchange quotations. At the Paris stock exchange , the wheat shows a significant decline after only a few days. Behind the exchange-technological reactions of profit-taking assumptions are presumed that the achieved price level may not be sustainable in the market. Actions and reactions.Are often associated with over-estimates. In the search for a reliable orientation for wheat marketing 2017/18, therefore, one will not look in the first line for the day-to-day exchange events, but will use basic pricing mechanisms from the recent past as far as they can be transferred to the coming year. A useful prediction of a future price level can be derived from the relationship between the annual supply situation on the global cereal market and the associated price level. The supply position is usually measured using the "stock to use ratio" indicator.In the 10-year average, a supply of approx. 22% as the mean value. The percentages differing in the individual years lead to higher or lower price levels on average for the year. An extreme case was the year 2012/13 with a supply figure of almost 19% , which had a price level of approx. € 250 / t . The opposite was observed in 2015/16 with a supply figure of just under 25% and an average price of approx. 160 € / t.For the coming year 2017/18 , it is assumed, according to all estimates so far, that the ratio of the end- to-end consumption to approx. 23% should fall off. Although such a supply situation is still above average, it is significantly lower than in the previous two years. A more accurate estimate can be obtained by offsetting the Chinese stocks (about 40% of world stocks) which are not available for the world market . In this case it can be seen that the supply figure for 2017/18 drops by only 2 percentage points compared with the previous year to only an average level.A supporting argument can be inferred from the observation that, as a rule, the wheat prices already fall in the second half of the year when the supply of improved supply is expected in the following year . In 2016/17, which is still ongoing, it is the opposite. The prices remain at least stable, despite a high level of stockpiling, but in the expectation of a future lower supply situation. As a result of the above considerations, wheat prices 2017/18 could reach between 160 and 185 € / t . However, it should not be overlooked that not only weeks but also months which are still unpredictable can go by as far as global harvesting.