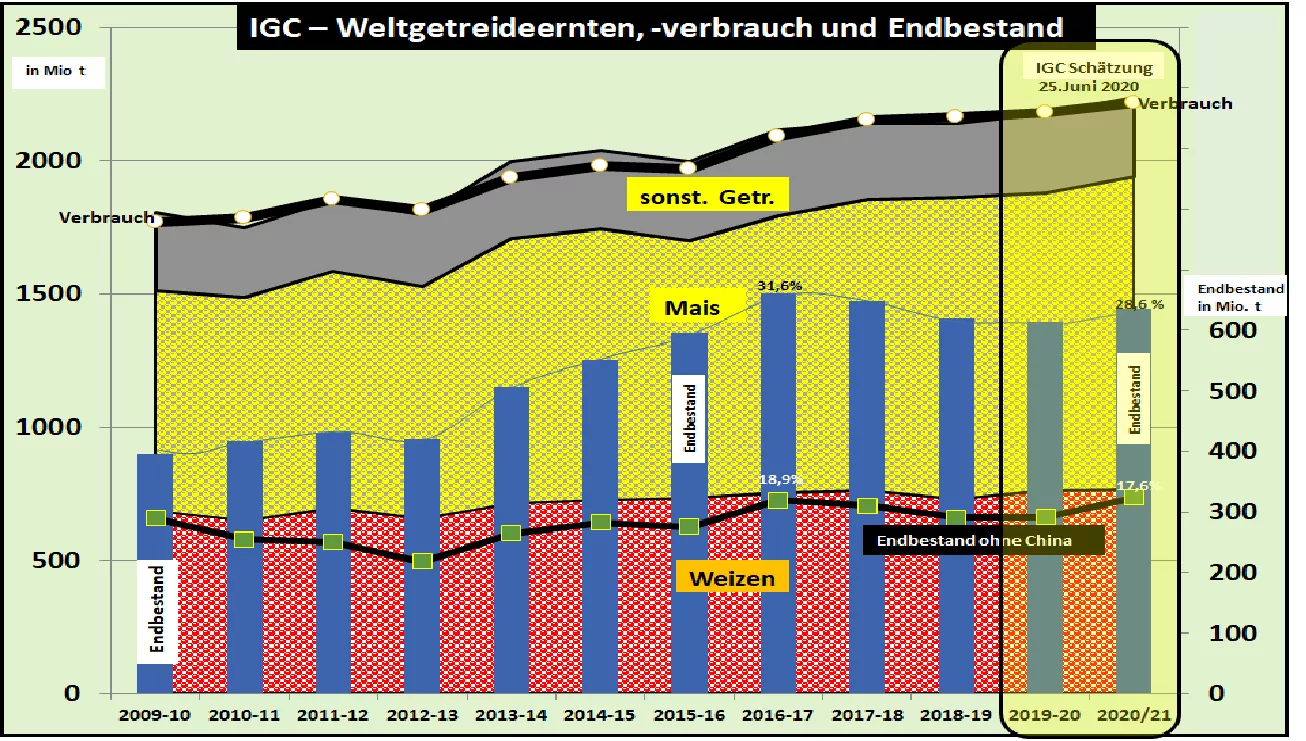

IGC rates global grain supply even higher - stock market prices are inconsistent In its June edition, the International Grains Council (IGC) again estimated that global grain production in 2020/21 was 2.8% higher at 2,237 million tons compared to the previous year. Consumption is only expected to be 1.7% higher at 2,217.6 million t . From this, an inventory build up to 635 million tons . The price-determining supply figure reaches 28.6% final stock for consumption. The range of inventories increases to 105 days ; only in 2017/18 was the result greater at 110 days. If China is left out as a stockholder of almost 50% of the global grain reserves, but only little participation in world trade, a grain supply of only 17.55% final stock for consumption and a range of 66 days compared to 60 days in the previous year are calculated.The IGC estimates the global wheat harvest at 767 million tonnes only slightly higher than in the previous year. Lower production is predicted in the EU, Ukraine and the USA. This contrasts with significantly better results in Australia, India, Argentina and China. Wheat consumption is estimated at 751 million t. In this case too, a build-up of stocks can be calculated, which can be determined based on a high 38.6% final stock for consumption. If you switch off the China effect , only a supply figure of 25% final stock for consumption is reached, but is still a few percentage points above the previous years. The range is 91 days compared to 85 in the previous year. However, when assessing the numbers, one should take into account the national stockpiling as a result of the Covid pandemic. In the case of maize production , the IGC expects a worldwide result of 1,171 million tons . The large US corn harvest with over 393 million t should make a significant contribution to this.Global corn consumption is classified as 3% higher than in the previous year at 1,175 million t . Bioethanol production from corn is expected to normalize again in the course of the coming marketing year. Increases in food and feed use are also anticipated. The comparison of production and consumption results in a reduction in inventories of almost 3 million tonnes to 296 million tonnes of maize. The supply figure is calculated at 25.2% and is significantly lower than the result of 30.5% in 2017/18. The main reason is the decline in Chinese inventories. Without China , an inventory increase to 14% final inventory is expected for consumption. The range is 51 days compared to 45 days in the previous year. Given the continuing drought in large areas of cultivation in Europe, there are still uncertainties in the figures.Corn production in North and South America is still subject to weather risks well into the fall. The experience of the Covid pandemic is also likely to play a role in global trade. On the Chicago stock exchange , corn prices are moving out of the low phase and exceed the € 110 / t line. Although wheat prices are trading below the mark of $ 5 per bushel (about 163 € / t), but the auschlaggebende September futures again shows upward trends. The fluctuating dollar-euro exchange rate ratio, however, contributes to constantly changing conversion prices.