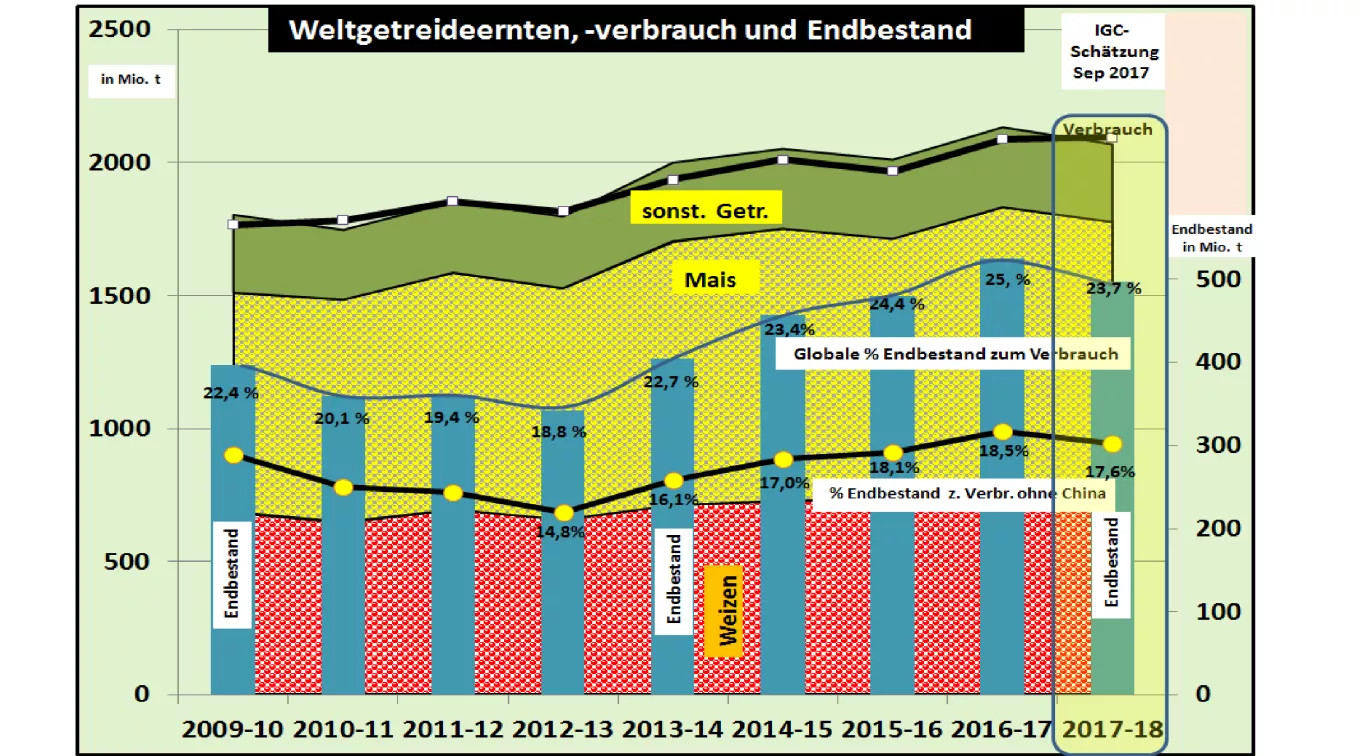

IGC-Sep.-17 estimate of the World grain crops - surprises on US stocks The international grain harvest (IGC) estimates the global grain harvest 2017/18 by +1% higher than in the previous month August 2017. Consumption growth should be +0.33%. The final stocks are expected to rise from 485 to 497 million tonnes, which was calculated in advance. The increased figures suggest a better than previously estimated supply situation 2017/18.Accordingly, the stock markets reacted down to corn with a short-term price hike . If, however, the new figures are compared with the previous year's result , it remains to be seen that the supply situation for the current financial year is significantly lower. Last year's final stocks stood at 525 million tonnes, which is estimated at 497 million tonnes this year. The price-fixing supply rate is only 23.7% of the final stock for consumption instead of 25%.Measured against the long-term average of 22%, a slightly above-average supply situation can be assumed for the time being . If China is left out of the world because of its unimportant participation in the world trade, the supply figures below the level of 2 years ago. In the wheat sector , the new IGC estimate is also more optimistic than in the previous month.The final stocks are rising are above the level of the previous year and at first glance they are significantly improved Close the stock. However, the increase is mainly due to the build-up of stocks in China, which, as is known, is not exported. Excluding China, final stocks fell below the level of 3 years ago. In the world's leading wheat export areas, inventories declined by 8%. The only exception to this is Russia, which expects an increase of 70% in final stocks due to its unusually high harvest and limited export logistics.The global maize harvest is still estimated by the IGC at a consumption level. The harvesting work is only at the beginning. There are still some residual risks to the actual harvest output. The South American spring harvest is only at the beginning of a difficult sowing season. The supply situation 2017/18 still benefits from the high initial stocks year record.Quarterly US stock estimation for Sept 2017

| In million t |

01.Sep.2017 |

Experts' estimates |

Sep.2016 |

| Wheat stock 1 Sep |

61.32 |

59.77 (from 56.47 to 67.64) |

69.26 |

| Corn Stock Sep. 1 |

58.29 |

59.8 (from 58.77 to 62.33) |

44.12 |

| Sojabestand 1. Sep. |

8.20 |

8.16 (from 8.07 to 9.84) |

5.35 |

The quarterly stock of US stocks as of 1 Sept. reported different results. In the case of wheat , stocks were lower than in the previous year due to the weak harvest results. However, measured by the forecasts leading market experts, the volume of wheat found by the USDA was surprisingly high. The weed annotations on the Chicago stock exchange turned down from the previous price surge. The US corn stock on 1 Sept was expected to be higher than in the previous year. The inventories generated by surveys remained slightly below the market participants' expectations. This is not surprising since the aging product is only present to a small extent, in contrast to the wheat, where the entire new crop is subject to higher estimation errors.The Maiskursen on the stock exchanges rose slightly. In the case of soya beans , the stock of alternating goods has been higher than was predicted. In this case as well, the stock exchanges have experienced a short-term setback.