War in the Ukraine: Grain/rapeseed supplies remain scarce for a long time . The supply routes from the Black Sea, which were blocked due to the war, reduce the global availability of grain. However, as the world's largest wheat exporter , Russia has already completed most of its exports in the current marketing year. The Ukraine mainly exports maize , but most of it (approx. 12 million tons) is still in storage and is now necessary for its own supply. But the effects of the war in Ukraine are more far-reaching than just for the coming weeks and remaining months of the current fiscal year. The following factors need to be considered in the longer term:

- Global grain stocks will be significantly smaller at the turn of the financial year and will make a smaller contribution to securing supplies in 2022/23.

- Preparations for sowing maize in Ukraine are not getting under way. Fertilization and plant protection measures could sometimes be omitted or significantly reduced. Farm labor is being diverted to defense, as is diesel.

- The south-western main cultivation areas of Russia are also at risk of reducing the intensity of grain cultivation due to high fertilizer costs and the uncertainty of the Black Sea outlet. Russian grain prices have already fallen.

- The war in Ukraine is exacerbating the yield and harvest losses that are to be expected around the world due to scarce and expensive fertilizers.

- Energy and transport costs remain at a high level and restrict the scope for trade worldwide.

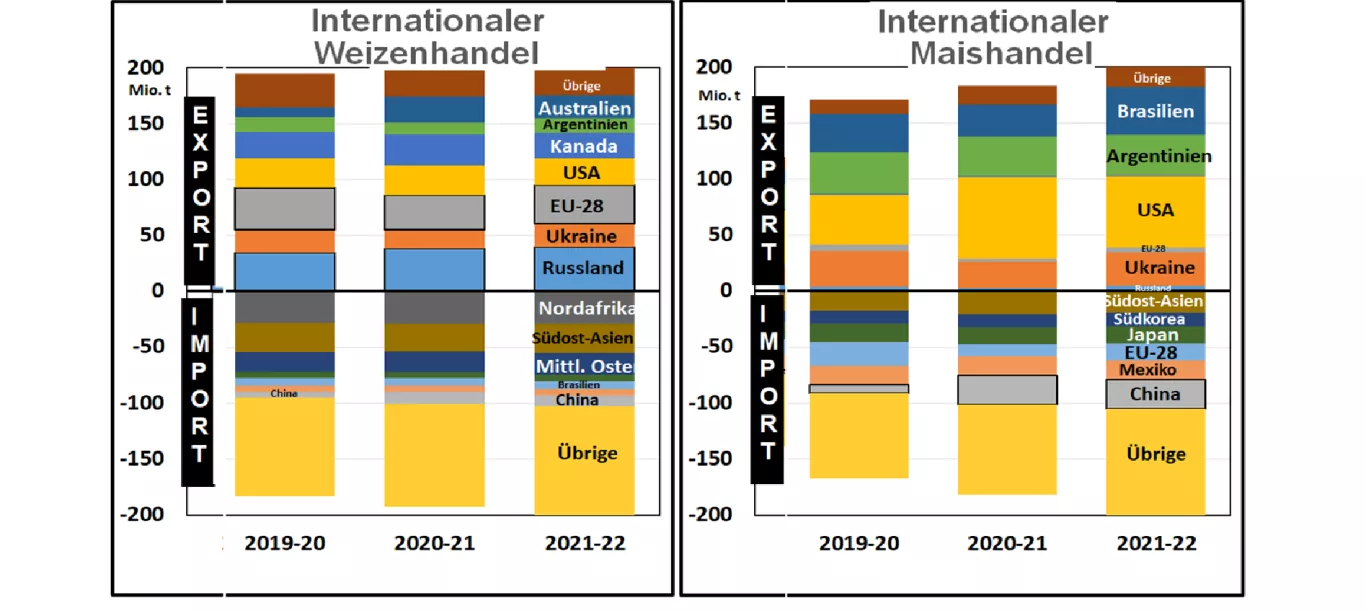

Russia exports around 40 million tons of wheat and 9 million tons of other grains per year. The share in the world grain trade is 11% . In the case of wheat trading , the Russian share is approx.20% Ukraine exports 20 million tons of wheat and 35 million tons of other cereals: the share in world trade is around 12.5%. In the case of corn trading , the Ukrainian share is around 16.5% after the USA (30%), Brazil (21%) and Argentina (19%). The world trade in grain is at an all-time high. A significant impairment of the export supply of grain from the two Black Sea countries, which cannot be ruled out, will open up a sensitive supply gap at world level. The most affected grain importing countries are in North Africa from Algeria through Egypt to the Middle East. But the EU-27 also purchases considerable quantities:

- Depending on the individual year, around 7.5 million tonnes of EU grain imports come from the two

Black Sea countries; of which around 5 to 6 million tons are Ukrainian maize.

- Depending on the year, 15 to 20% of EU wheat imports come from Russia and another 20 to 35% from Ukraine.

- Ukraine supplies 35 to 55% of EU maize imports and around 10 to 15% of barley imports.

- 80% of non-GMO protein feed imports (including rapeseed/sunflower meal) come from the Ukraine.

Oilseed market When it comes to trading in oilseeds , around 50% of EU rapeseed imports (or 2.5 million t) come from the Ukraine . EU rapeseed meal imports reach 280,000 t or more than 70% of import purchases from Russia and Ukraine. Sunflower meal , amounting to almost 1 million t , also comes to 70% from the two Black Sea countries. In addition, there is more than 1 million tons of sunflower oil (or 85% of EU imports) from the Ukraine .Other product quantities from oilseeds are less important. For the rest of the current 2021/22 financial year, the possible trade restrictions will have less of an impact because most of the goods deliveries have already been completed. However, it cannot be ruled out that the military conflicts could last longer. The importing countries will therefore have to take precautions in order to be adequately supplied with goods. fertilizer and pesticide market Russia accounts for around 13% of world trade in intermediate fertilizer products and 16% of trade in finished fertilizers . Russia accounts for 40% of global ammonium nitrate exports. A significant part of it goes to Europe. In addition, Russia is also an important supplier of phosphates , accounting for 17% of global trade volumes.phosphorus fertilizer . Two of the largest potash producers come from Russia and Belarus , accounting for 20% of the global trade volume. All in all, the conflict will fuel a new upward spiral in fertilizer prices. A worsening of the crisis would also have an impact on logistics flows . In any case, there will probably be longer delivery times , detours in transport and sharply rising costs for sea freight and insurance . In extreme cases, agricultural traders can invoke force majeure despite delivery contracts if they cannot deliver the contractually guaranteed goods. The Ukraine crisis could have serious consequences for fertilizer prices .Affected are ammonium nitrate, phosphorus and potash. Export disruptions and European sanctions will significantly impact supply. In 2019 , Russia imported (e) $766 million in crop protection products from Germany ($172 million), France ($104 million), China ($119 million); Belarus ($71M) and Israel ($53M): As of Nov 2021 , imports have increased by around 40%. At the same time, the few exports have fallen behind. The bottlenecks and high costs for fertilizers and pesticides will lead to below- average yields per hectare, so that the harvest result in 2022 will be significantly smaller. Grain and oilseed prices will remain at an above-average level compared to previous years. The futures prices on the stock exchanges underscore this assessment