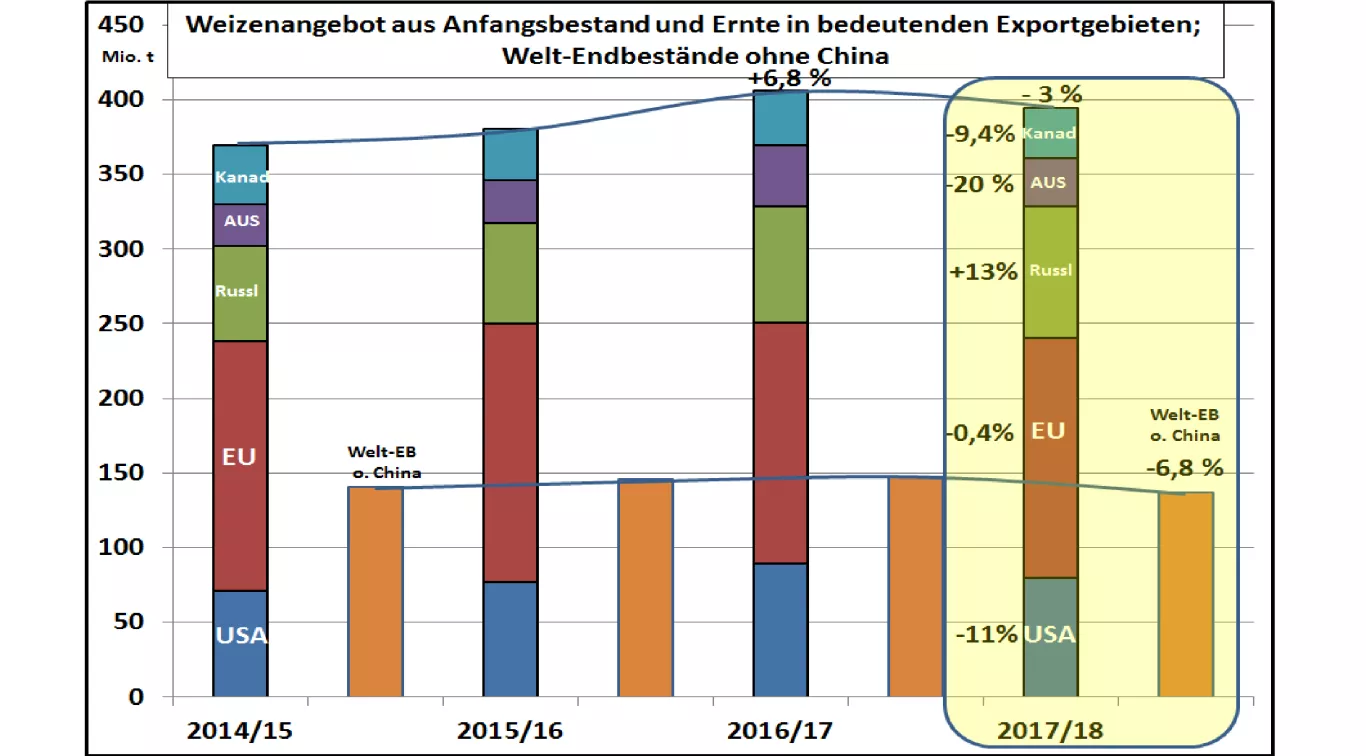

2017/18 rising wheat supply? - Price-relevant final stocks without China fall! The recent USDA estimate of a higher world wheat harvest with particular focus on the exporting countries of the Black Sea region, primarily Russia, initially triggered a shock on the stock exchanges . Prices are subject to persistent pressure. In the current market situation the assessment of a high wheat price is quite understandable. Above-average high levels of stocks in the USA and Russia , combined with rising estimates of the extent of the crop, are leading to a currently growing supply development .In Russia, an increase of the initial stock and of the reputa- tion is to be estimated at + 13% . As the world's leading export country, key trends are set in the direction of price formation. The offer from the competing EU remains largely unchanged despite the increased harvest. The more than 20% decline in US wheat harvest is halved by the high level of overlays from the previous year. Canada's reduced wheat supply is still limited by -9%. The focus is on the scarce supply of high-yield wheat. According to the previous year's record, Australia needs to calculate a 20% drop in the wheat supply volume from Nov. / Dec.-2017 despite an above-average overlap. However, this is still not very acute for the time being.The impression of a world-wide wheat supply is exaggerated by the Chinese conditions. The slightly increased harvest result of this year increases inventories by a further 15 million tonnes to 127.5 million tonnes in the order of almost a whole crop . According to experience, there is almost nothing in export. China's wheat imports, with an unchanged 3 million tonnes per year, are also of secondary importance for market influence . In view of China's insignificant participation in world wheat trading, it is appropriate to exclude China's high stocks for the assessment of the supply situation. The supply figure excluding China falls below the long-term average of 23% for the rest of the world with 22% of the final stock.Against this background, the supply-demand ratio in the further course of the financial year is to be viewed in a different light from what is now the case. Other factors such as the remaining harvest results in the other cereal sector, exchange rates, transport costs, crude oil prices and changes in trade policy play a role in assessing price developments . The trend is, however, more likely to be from ascending and falling wheat courses in the further course of the year.