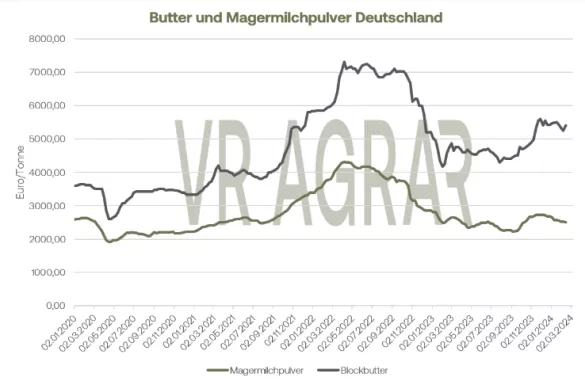

Milk deliveries in Germany continue to increase. In the 5th calendar week, the milk quantity increased by 1.2 percent compared to the previous week, but in the first five weeks a total of around 1.7 percent less milk was served than in the previous year. The concentrates develop inconsistently. Rahm was in slightly greater demand again due to new business deals on the butter market and was able to increase slightly in price. Skimmed milk and skimmed milk concentrate were available in abundance and prices were trending south with weaker demand. The ife Institute recorded a federal average of 38.10 cents/kg (-0.2 cents) on the spot market . Demand on the market for molded butter has increased and returned to normal after the slight decline in volume at the end of January. The quotations remain unchanged. In the coming weeks, the number of outgoing goods is likely to increase, food retailers and large consumers such as industry are slowly but surely stocking up for Easter. The demand for block butter is much more lively. The recently lowered price was able to increase slightly again yesterday, and overall the lower price level has once again provided impulses to buy. Demand from third countries is also slightly higher again, as butter has regained a good deal of competitiveness due to the recent increases in the Global Dairy Trade Tender. The prices for butter on the EEX have also recently increased over the various maturities. Significantly more contracts were traded last week than in previous weeks. The market for semi-hard cheese is in stable condition. Due to the high demand, the stocks in the maturing warehouses are still young and at a low level. Existing customers are adequately served, but additional needs cannot always be met. There is very good demand in the food retail sector, which is supported by promotions. Industry is also ordering large quantities of goods, while large consumers are still acting somewhat hesitantly. An increased wave of travel is expected for Easter and with it better demand for the recently rather inconsistent development of cheese exports to southern European holiday regions.

The price for food-grade skimmed milk powder on the South German Butter and Cheese Exchange was reduced by 20 euros at the top end yesterday. Overall, there is currently little movement on the market; inquiries are mostly focused on short-term delivery dates, which also result in business deals. Overall, however, less powder is traded than usual at this time of year. The export business is quiet, also because China is celebrating the New Year this week and many buyers are therefore not in the market. The supply is currently not oppressive; manufacturers are primarily directing the higher milk volumes of the last few weeks into cheese production. Price quotations on the EEX increased slightly last week. The prices for whole milk powder continue to trend south, buyers do not show any significant demand, only animal feed qualities are traded slightly more again at firmer prices. The recent good demand for whey powder calmed down in mid-February, short-term needs of customers have been covered for the time being and they are waiting for later delivery dates. As a result of higher cheese production, whey powder is unlikely to become scarce in the near future, according to many market participants.

ZMP Live Expert Opinion

The January low on the milk market appears to have been overcome. Demand for butter, cheese and block butter is becoming more lively again. The EEX has also recently indicated increased price expectations. For January, payment prices from dairies tend to be slightly firmer or unchanged.