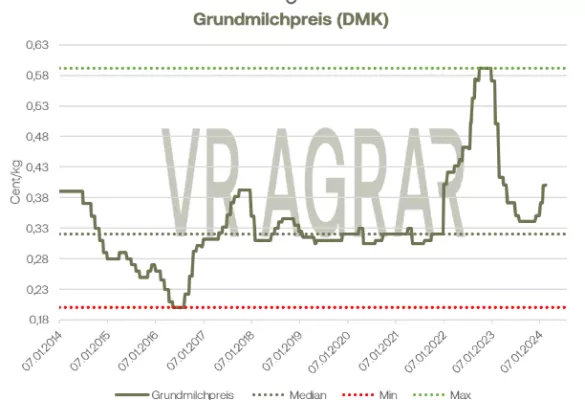

The amount of milk produced weekly continues to grow. Compared to the previous week, around 1.2 percent more raw materials were delivered in the 6th calendar week. Compared to the previous year, however, around 1.5 percent less raw milk was collected by dairies in the first six weeks of the year. Meanwhile, prices for cream have risen in the last week. Because of better prices and increased demand for butter, industrial cream was in better demand. The protein side, however, has calmed down slightly and prices here have tended to be weaker. At 37.0 cents/kg, spot market milk is 1.1 cents/kg lower than the federal average. The prices for block butter increased again this week. Industrial customers in particular have increased their demand registrations following the price declines, and the price surcharges were enforced somewhat more generously for short-term deliveries than for later dates. The butter and cheese exchange increased its price significantly, particularly at the upper end of the trading range. Significantly more contracts for butter were recently traded on the EEX than in previous weeks. As on the cash market, prices showed firmer tendencies. Molded butter is traded at a calm pace, but there are slight signs of recovery regionally. Overall, however, requests are still above the previous year's level. A noticeable increase in demand is expected for the upcoming Easter holiday. The price remained unchanged yesterday. The manufacturers continue to be very satisfied with the orders for sliced cheese . Outgoing goods continue to be at a fairly high level. The food retail trade's orders were very extensive, but within the agreed contracts. Dairies expect demand to increase at Easter, so a lot of milk will be channeled into cheese production. Industry and large consumers show normal demand. In exports, however, things are calming down. Customers from Asia currently cover most of their needs in the USA. Southern European holiday regions, on the other hand, are slowly becoming more active in preparing for the wave of travel at Easter. Ripening stocks remain low and additional requests are hardly being addressed in order to be able to deliver at Easter. The price quotations remain unchanged. Business around skimmed milk powder is busier. Producers are again receiving more and more inquiries, which are also being sealed with signed business deals. Short-term appointments are primarily completed, but there is also increased interest in longer-term deliveries. In Kempten, the price was able to increase, while prices on the EEX were under pressure on a weekly basis. At the Global Dairy Trade Tender in New Zealand, skimmed milk powder increased by 1.3 percent, meaning that goods from Europe are trending at the same level as in New Zealand. Because of the dangerous route across the Red Sea, transport costs from Europe are very high, which means that local providers often continue to lack competitiveness. Feed qualities are also in greater demand and can be traded at higher prices. When it comes to whole milk powder, however, the calm trend continues. International prices received no further stimulus at the auction in New Zealand on Tuesday and fell in price. After subdued demand at the end of January, demand for whey powder is now clearly more dynamic again in mid-February. However, this does not affect prices this week. Business transactions are registered both in the domestic market and in export.

ZMP Live Expert Opinion

The recovery in the milk market continues. In the meantime, demand for skimmed milk powder, which has recently been weak, is again in greater demand. Despite high cheese production, the cage population remains low. The upcoming Easter festival is likely to provide further impetus for the milk market.