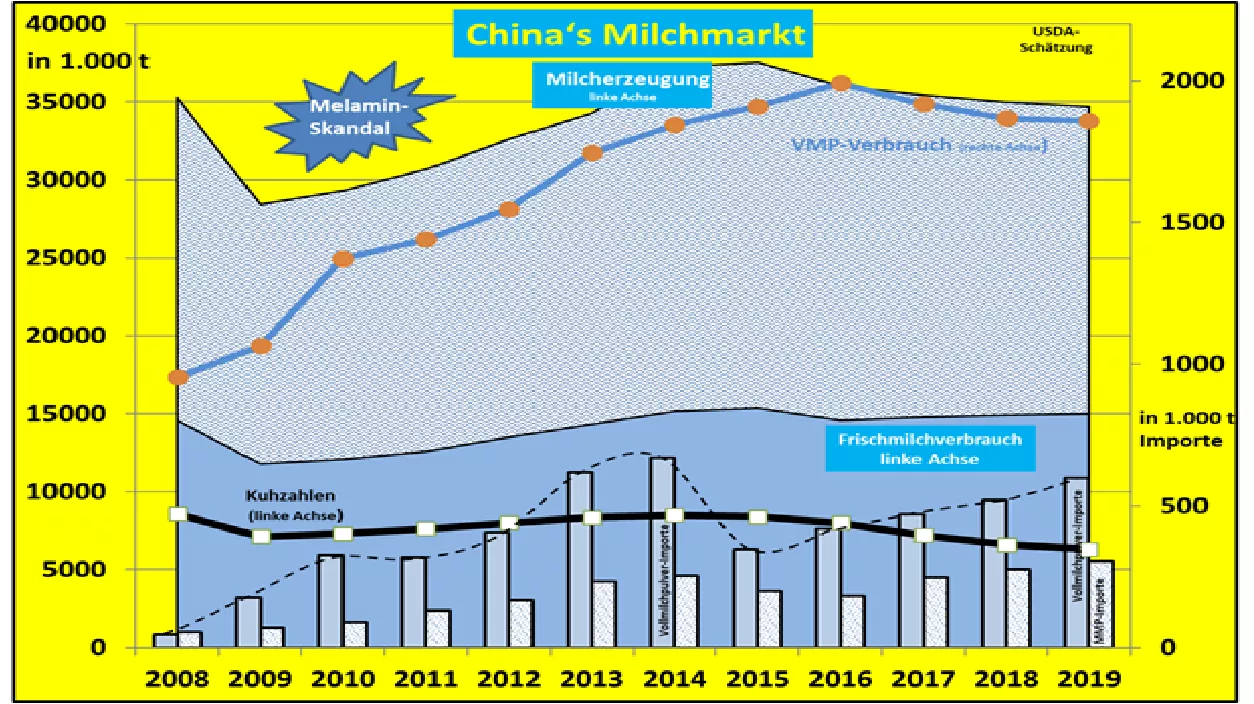

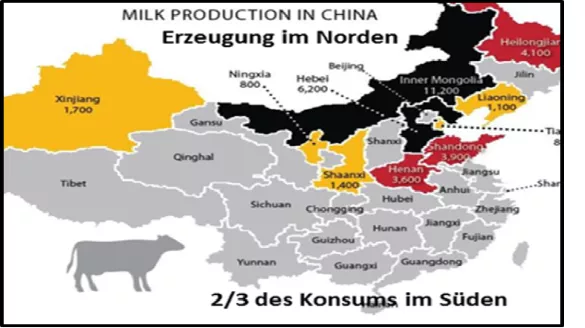

China's dairy industry remains dependent on imports - rising imports in 2019 China's consumption of milk and dairy products is steadily rising. A growing population in growing cities is demanding higher- income food . Dairy products in all variations are included. However, the domestic dairy industry is not able to handle this increase in consumption . The recent surveys showed decreasing cow numbers despite rising output to 5,500 kg per cow falling milk production. For the year 2019, 2% lower milk volumes than in 2017 are forecast.The decline in production has its main causes in the abandonment of milk production in the small flocks with a focus on the south of the country. Increasing environmental regulations, rising feed costs and, for Chinese conditions, too low a milk price of 44 ct / kg are reasons for not increasing milk production appreciably, even for larger crops. Stocking in the main production area of the northern provinces is not enough to offset the reduction in cow numbers in other areas. The more attractive beef market is also helping to increase cow slaughter . It is preferable to use less powerful dual-use cattle in order to benefit from both markets.In the south of the country , milk production is not competitive with rice crops with several harvests a year. Even up to the highest mountain areas, rice is produced in the terrace area due to the scarcity of soil. There is hardly any room for cows. The focus of milk consumption is two thirds in the central and southern provinces . Since there is a lack of a continuous cold chain, local fresh produce can hardly be transported cost-effectively over long distances of several 1,000 km by land. Of the 35 million tons of milk in China, approx. 15 million t consumed as fresh milk .The remaining 20 million tonnes are mainly processed into whole milk powder and marketed in this way. But self-generation is not enough even in this market segment. For 2019, imports of 600,000 tonnes of whole milk powder (VMP ) and 305,000 tonnes of skimmed milk powder (MMP ) are estimated. The rates of increase are between 8 and 15% . The main supplier for VMP is 90% New Zealand. In the case of MMPs, the EU achieves second place with 28% import share to New Zealand with almost 50% Whole milk powder is mainly liquefied for consumption purposes again as sweetened milk drink , but consumption no longer has the momentum of earlier years. Increasingly, the Chinese consumer is asking for ready-to-drink liquid goods. Here, UHT milk and other long-life milk drinks are becoming increasingly important. Yogurt is one of the welfare products. 850,000 tons of milk drinks are to be imported in 2019, approx. 13% more than last year. About 55% of them come from the EU . According to the Chinese documentation, 68% of yogurt imports come from Germany . Baby instant food is also one of the most popular import products. Overall, one trusts the imported goods more security than the native ones. Several food scandals have given Chinese goods a bad image.