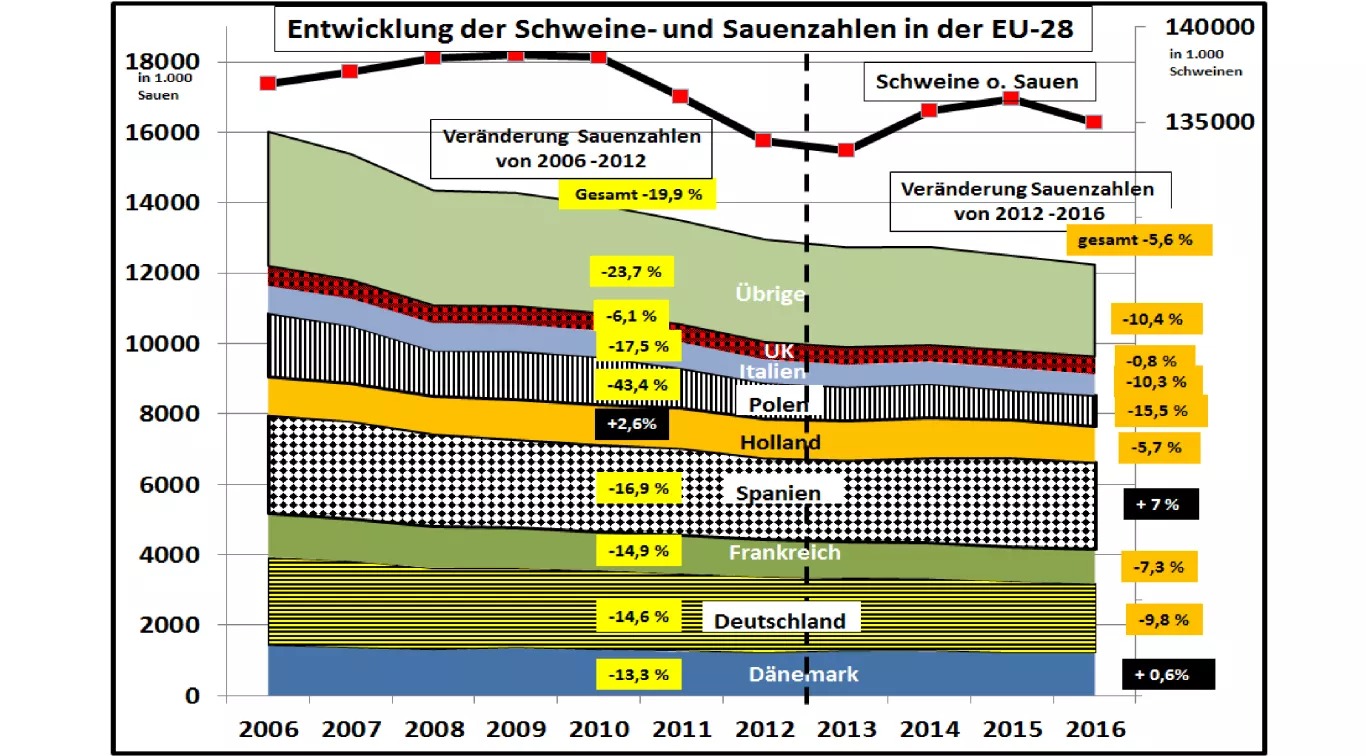

EU swine stocks falling for 10 years - Who are the winners / losers? Between 2006 and 2016, the number of sows in the EU fell by -23.5% . Swine stocks Without sows, however, decreased by only -1.5%. And the production of pork is even slightly increased. Still no contradiction. With less sows, more piglets are produced .The fattening pigs are brought to higher mass weights with lower losses and better fattening . At present, the EU average slaughter weight is increasing 90 kg, but has a span width of 67 kg in Portugal to 121 kg in Italy. Germany is in the upper midfield with 95 kg. However, Spain with the largest pig numbers in the EU is only 85 kg per pig at the slaughterhouse. After 2012 , the rate of change per year has declined significantly . Certain instances of stabilization are apparent. The pig farms as a whole have been caught at a moderate level. The degradation of sows has decreased.Even if the number of EU pigs continues to decline, there is still room for maneuver to maintain pig production overall. But the developments in the individual Member States are very different . The biggest declines in pig farming so far are In the new EU Member States. At the same time, Poland has a total inventory reduction of 43%52% for sows since the 2004 accession year. The main reason is the Economically unfavorable small business structures. It is only recently that there appears to be a stabilization which is supported by the rising incidence of piglet imports from Denmark. In France and Italy too, pig numbers have declined by a double-digit figure for 10 years. Sows have decreased by 21 to 25% in both countries. Although higher numbers of piglets per sow and year represent a part of the remonting potential in their own country, both regions are not suited to import piglets from surplus countries due to their margins.In Germany, on the other hand, the number of sows has decreased by 23% and the piglet productivity has been increased. In addition, 20% of the piglet requirement or 12 million young animals from the neighboring countries of Holland and Denmark are imported into the nearby Northwest German processing area. In this way, the "German" stock of pigs has just been maintained. On the other hand, the number of pigs in Spain has increased by approx. 12% increase. With 29 million pigs, Spain is clearly ahead of Germany with 27 million animals. The strong increase in recent years has been driven by the 7% increase in the number of pigs. Spain is one of the EU countries with the lowest production costs, although the feed costs are above average on account of the Spanish cereal crop.Advantages of housing construction and environmental costs are the same. Holland and Denmark have been structuring their pig farming for years to the less polluting piglet production. The surplus piglets are sold primarily in Germany and Poland. Pig farming in these countries has changed only very little in recent times. The problems to be solved are the future animal species , which are classified differently in different EU Member States And regulated .