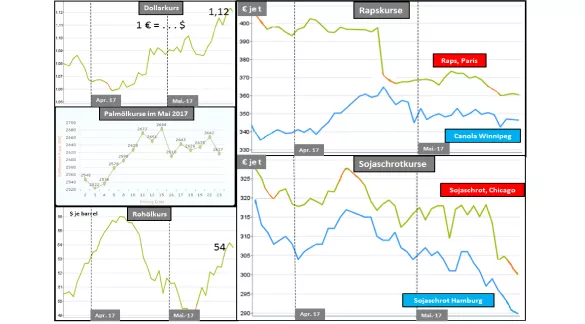

Oilseeds in the interplay between exchange rate fluctuations, rising crude oil prices and different harvest expectations due to weather conditions. The politically induced decline in the Brazilian currency has brought the soy to a great extent to slump and other products in the oilseed sector. The increased purchasing power of the euro has strengthened the price reduction here.Soybean prices in Hamburg have fallen far below the magic limit of 300 € / t and will go down to the order of 285 € / t for the later delivery dates. Rapids have dropped to € 360 / t. Low soybean oil courses and a strong euro cause competing vegetable oils The courses in the rapeseed market. The higher crude oil price Has only been able to prevent rapidity.The end of the month weaker again Course Also make no appreciable contribution to price stabilization. The harvest prospects in the soybean sector remain above average. In Brazil, IGC now expects orders of magnitude of 113 million tonnes. The fallen Brazilian currency Real has a willingness to sell The farmer strongly cranked. The stocks of US soybeans will be more than twice as high as in previous years. The current rainfall in the US cultivation areas limits the last maize sowing at the end of May, leaving more area for soybeans. The upcoming US soya harvest is estimated to be 115.5 million tonnes (IGC), two recorders in the last two years.On the other hand, worldwide rapeseed supply is modest. The overlay levels are as small as in years. In the EU, rape yields are once again lower, with the result that harvesting may be similarly weak as in the previous year. On the other hand, one is optimistic in Canada with a harvest expectation, which is to cross the European. However, worldwide rapeseed harvest yields are only on a narrow average in several years. Palm production has not yet led to the expected growth rates. The production peak is expected in Oct. -17. The courses have now given way again after an upturn in the medium level.Further reduction potential is to be expected, but the prices may not be quite as low as in earlier times.

ZMP Live Expert Opinion

The low-price level in the oilseed sector is in principle due to the above-average supply development due to high overlay stocks and several large harvests in the soybean sector. The rising purchasing power of the euro will strengthen the low price level. The low-price competition leaves little in the way of the prices in the scarce supply sector. The lower than expected increase in production in the palm oil sector is just as limited as the increased price of crude oil.