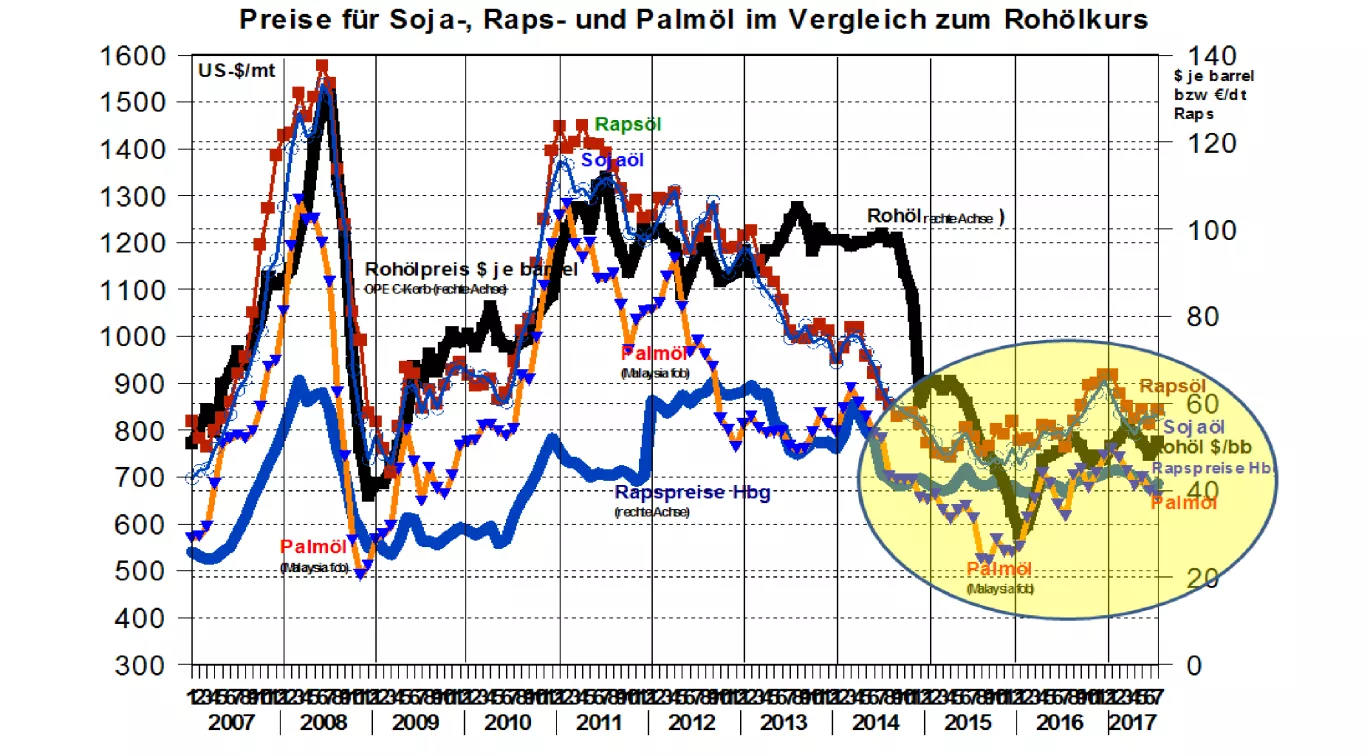

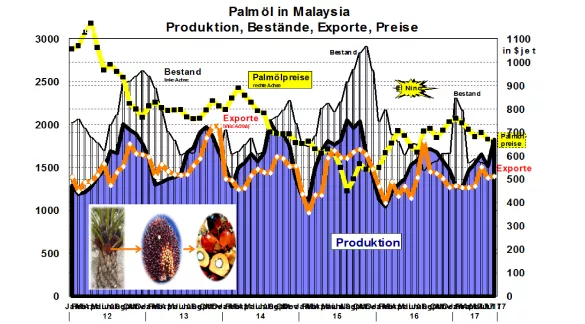

How are the oil seed prices developing? - Soy and palm oil are market leaders! The oilseed courses have been in the lower narrow range of the multi-year price scale for two years . Doing so The supply balance of the individual products vary greatly. The soy market is very well supplied. Rape is scarce not only in the EU, but also worldwide. Yet The rapeseed prices remain within the oil seed pricing range, but clearly at the upper end.After the El Niño drought in 2016, the production of palm trees is far below the average. According to their depth, the palm oil quotations have been moving in a mid-range since 2015. Two high soybean harvests in succession have soared the soybean oil courses from their high altitude flights of past years to the current level of rapeseed oil prices. Overall, the oilseed courses are close together in a lower range . The main reasons are the above-average supply situation and the high degree of interchangeability of the vegetable oils .Deviations mainly result from different transport costs from the individual countries of origin, trade policy measures and changes in exchange rates. The supply situation of a single oil seed therefore provides limited information on the possible course of the course. The integration into the entire oilseed complex is, on the other hand, more productive for the assessment of the market and price development. In view of the production of biodiesel from vegetable oils, the crude price plays a fundamental role.At present, the above-average high soybean supply from South and North America , the moderate crude oil price by the $ 50 per barrel and a seasonal increase in palm oil production in Malaysia and Indonesia determine the price development in the oilseed business. In the latter case an increase to the months Oct./Nov.-2017 is expected after the previous months disappointingly weak. The still below-average rapeseed harvest in Canada and the EU will not allow the rap prices to break out of the framework of the two market leaders soya and palm oil. The competition among the vegetable oils ensures a quick compensation. According to the current market assessment, low oil seed prices are expected for the remaining months of this year .This is also helped by the growing pressure on Ernie. High levels of surplus stocks will also have an effect on the next year. The price margins upwards are narrowly limited. Uncertainties may be caused by US trade policy measures, the euro / dollar exchange rate and, if applicable, changes in crude oil prices as a result of OPEC decisions.