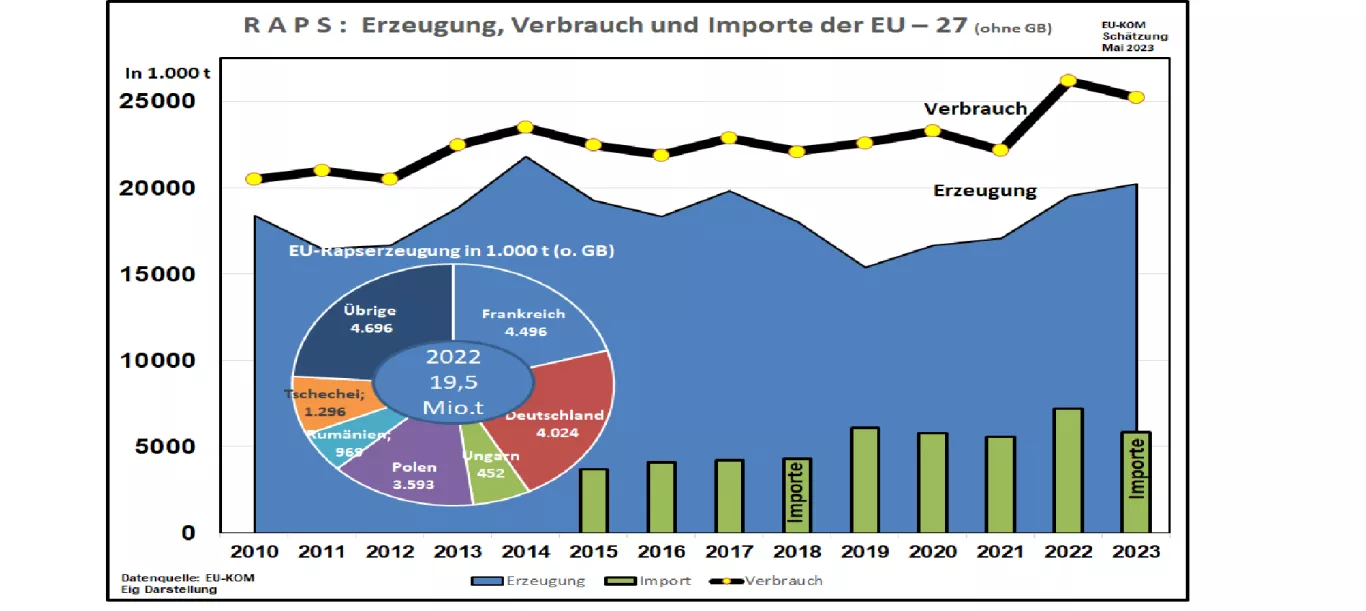

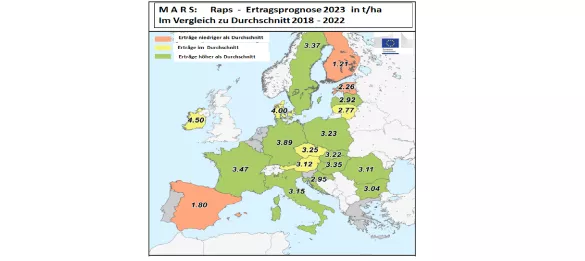

EU COM estimates higher rapeseed harvest in 2023, but consumption lower, rapeseed prices unstable The EU Commission (EU COM) forecasts an increasing rapeseed harvest of 20.22 million t in 2023 (previous year 19.5 million t). The decisive factors are an increasing area under cultivation and a slightly higher yield per hectare. On the consumption side , however, a reduction to just 25.2 million t (previous year 26.2 million t) is expected. The background is the assessment that biofuel production should be significantly smaller due to the rise in raw material prices combined with moderate diesel prices. On the other hand, the recent fall in the price of rapeseed to around €400/t could again be sufficiently attractive for biodiesel production. Accordingly, EU rapeseed imports are expected to fall from last year's 7.2 to 5.8 million tonnes. Deliveries come mainly from Canada, Australia and the Ukraine. According to the latest USDA estimates, the Canadian harvest is around 20.3 million t (previous year 19 million t), Canadian exports are increasing again to 8.9 million t. at.On the other hand, after last year's record harvest of over 8 million t, only 5.5 million t are expected in Australia this year due to the El Niño weather conditions. Australian farmers have already responded with significantly lower acreage. In the Ukraine , the war-related impairment of rapeseed production is expected to contribute to this year's result of between 3.5 and 3.6 million tons. Deliveries by ship could cause difficulties as a result of the uncertain transport agreement with Russia. In case of doubt, however, more expensive transport by land or inland waterway would also be conceivable. After soaring last year to €1,000/t, rapeseed prices have returned to around €400/t. The significantly improved supply situation in the EU and at global level has pushed the price-driving supply fears far into the background. However, weather developments as a result of El Niño should not be lost from view. In addition to Australian rapeseed production, the much more important palm oil production in Malaysia and Indonesia is particularly affected. Soybean production in the USA is also threatened by drought in some areas.