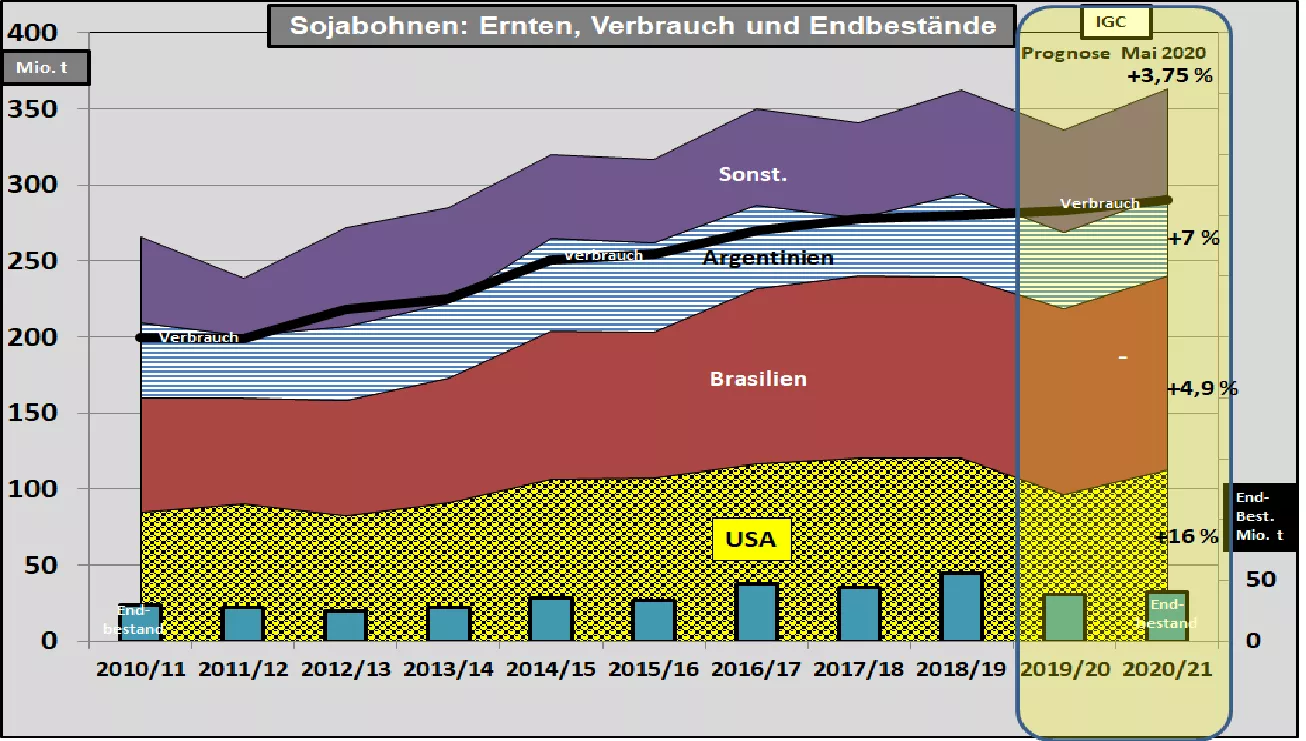

IGC corrects the 2020/21 soybean downwards - good supply situation - low prices The International Grains Council (IGC) estimates the soybean harvest of the 2020/21 marketing year to be only 3.7% higher than in the weak previous year. This means that the production level is back in the multi-year trend. The main causes are the two largest growing areas, Brazil and the USA . In particular, a multi-year harvest is expected again in the USA. The global production result is estimated at 366 million tons ; consumption is expected to increase to 365 million tons. So there is little left to increase the stocks. The overhang amounts are sufficient for 40 days. The US soybean crop was characterized by a rainy sowing period last year, which led to reduced acreage and delayed order dates. The harvest result was correspondingly poor at 97 million t .However, the high excess stocks as a result of China's reluctance to buy have contributed to an adequate supply situation. There has recently been an increase in demand. The background is the lack of dried corn stillage (DDGS) as a result of the sharp decline in ethanol production. The slump in prices for (bio) fuels makes bioethanol production uneconomical. A US soybean harvest of approx. 112.5 Mt expected, slightly below the assumptions in the previous month. One assumes an enlarged acreage and average yields. Sowing has made rapid progress this year. North Dakota is an exception. Now one hopes for favorable weather developments for a good area yield. The completed Brazilian soybean harvest in 2020 is only estimated at 122 million tons . Rainfalls, docker strikes and most recently the Covid pandemic have led to noticeable impairments.A result of 128 million t is forecast for the harvest in 2021 . The final stage of the Argentine soybean harvest is only estimated at an average of 50 million tons . Dry periods have hurt yields. Increased export taxes and obstacles to road transport as a result of the coronavirus pandemic lead to bottlenecks in the outflow of goods. A large oil mill has shut down due to a lack of workers. Argentine soybean meal exports are severely restricted. An average harvest of 53.5 million t is predicted for the harvest in the coming year 2021/22 . On the demand side , China again stands out with growing imports of 96 million tons. or 60% of world trade. The first line to be considered are Brazil with a total export of 78 million t and the USA with 55 million t .EU imports drop to 14 million t . Soybean meal prices were characterized by strong price fluctuations. Intermittent supply bottlenecks and supply fears due to the restrictions caused by the virus pandemic are the causes. However, there can be no question of a fundamental supply crisis. The recent price movements are at a lower level with a slightly decreasing tendency.