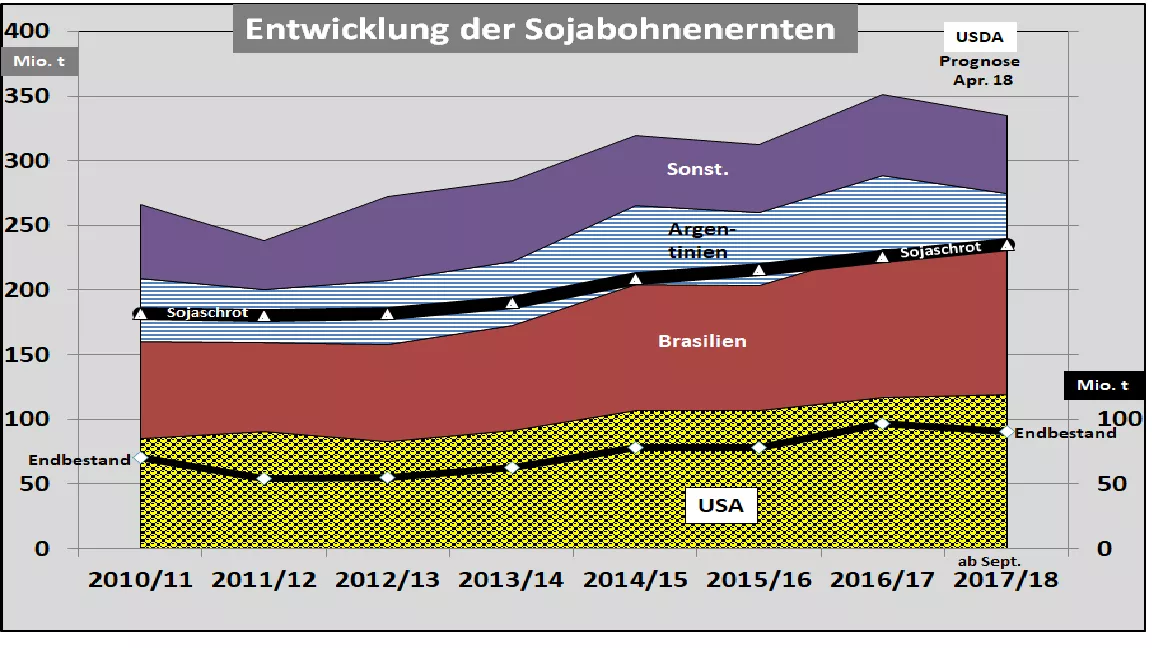

USDA cuts soybean crop forecast in the oilseeds sector The US Department of Agriculture (USDA) updated the global oil supply supply situation in its most recent April issue. Compared to the previous month's estimate, the production volumes were reduced by approx. 6 million tonnes to 335 million tonnes. The decisive impetus comes from Argentina . As a result of the months-long drought, the originally expected soybean harvest of 56 million t is estimated at approx. 40 million t decreased. There are also opinions that rate the result even lower.In contrast, the final-stage soybean harvest in Brazil was estimated at a high of 115 million tonnes, 1 million tonnes higher than in the previous year. Just 2 years ago, the crops were 96 million t. The remaining soya harvests were kept unchanged. With a slight reduction in consumption, soybean prices will be significantly reduced this marketing year . The volumes fall from just under 97 million tonnes to an estimated 90 million tonnes. Although this is still above the long-term average, the supply situation can still be classified as favorable.The potential impact of the trade dispute between China and the US on the introduction of a 25% import tax on soybeans remains uncertain. The USDA has left Chinese soybean imports unchanged at 97 million tons. In the meantime, the order of magnitude of 100 million t per year had been mentioned. In this case, both countries rely on each other. The US has so far shipped more than half of its soybean exports to China. China has so far received almost 40% of its soybean imports from the USA. Dodge opportunities exist only within narrow limits. For the palm oil market , no significant changes were made to the existing supply situation. The production is above the consumption quantities, so that with just under 11 millioninventory levels above average levels. The estimates of the USDA for the worldwide rapeseed market 2017/18 were once again estimated at approx. 74 million tons of rapeseed production increased. The deciding factor in this is the good EU harvest and the increase in Canadian canola production. The crop reduction in India is of little importance. On the stock exchanges , the prices show different developments at an elevated level. The soybeans are again rated higher after a short setback. By contrast, soybean meal and soybean oil develop only moderate movements. While rapeseed prices tend to weaken again in Paris, the Canola courses in Winnipeg have moved significantly upwards.Palm oil tends to weakness after a short flight. The deciding factors are the reduced exports with an above-average stock of inventories.