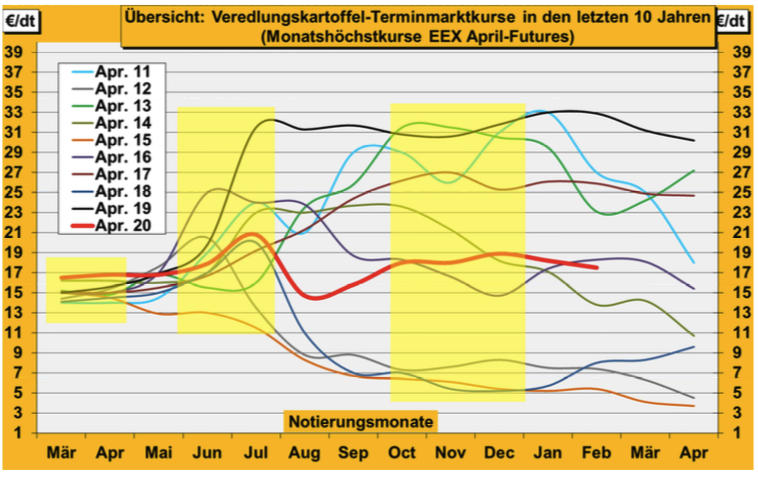

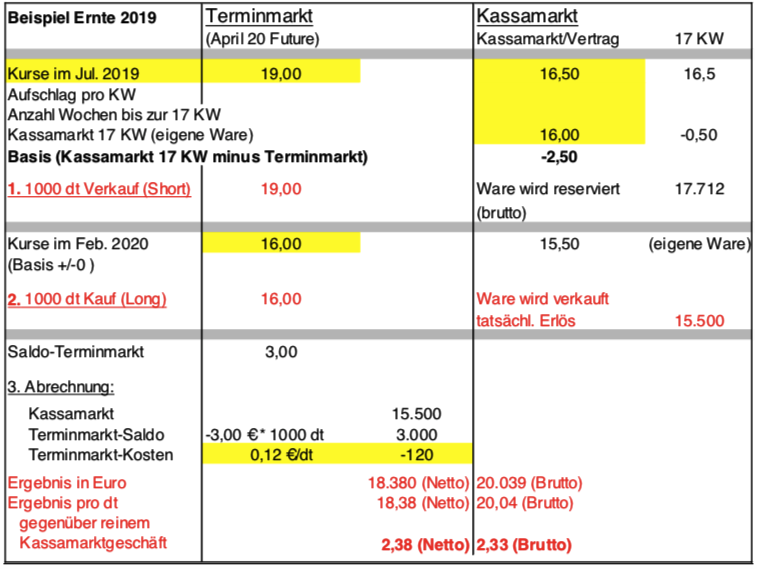

(Text and graphics by Hans Jürgen Hölzmann, agricultural engineer, Meckenheim, February 21, 2020) Every year in February the buyers offer the new contracts for the bearing types for the "french raw material" such as B. Agria, Callenger and Fontane. Depending on the market situation, the conditions for fixed-price contracts change slightly from the previous year, either slightly downwards or slightly upwards as in the last two years due to the scarce supply due to drought and heat. For the varieties mentioned, so-called graduated prices are listed in the fixed price contracts, ie the first listing begins in November and then increases by 5 to 20 cents / dt in each calendar week. Important: The surcharges for a calendar week increase with the progress of the marketing campaign. For the main storage varieties of the upcoming 2020 harvest, retailers will be offering between 13.50 and just under 15.00 euros / dt ex farm at the farm in the 17th calendar week of 2021. In the case of direct delivery to the factory, prices are usually increased by 0.50 to 1.00 euros / dt.The conditions are therefore almost at the level of the previous year, but at the beginning of the marketing period at a somewhat lower level. For this, the later dates are better paid in relation to the last year. The reason for the shift in staggering is primarily the ban on the use of the chlorpropham germ inhibitor. In the past, this effectively ensured the quality of the goods in stock for later appointments.  The potato farmers are now faced with the question of the extent to which they want to secure the proposed cultivation in the so-called fixed price contracts. It is indisputable for many growers that they sell part of the expected harvest before or during planting using a fixed price contract. However, the potato professionals do not “shoot their powder” all at once, but reserve enough goods for a later, often cheaper, marketing date, which, as the illustration shows, occurs regularly in June / July each year.During this period, 9 out of 10 years were in the past much better terms than in the original fixed price contract. These months are particularly suitable for hedging the futures market, since the basis is often the best in this period, between 2 and 4 euros / dt. This is also shown by the practical example from the 2019 harvest with a base of minus 2.50 euros / dt.

The potato farmers are now faced with the question of the extent to which they want to secure the proposed cultivation in the so-called fixed price contracts. It is indisputable for many growers that they sell part of the expected harvest before or during planting using a fixed price contract. However, the potato professionals do not “shoot their powder” all at once, but reserve enough goods for a later, often cheaper, marketing date, which, as the illustration shows, occurs regularly in June / July each year.During this period, 9 out of 10 years were in the past much better terms than in the original fixed price contract. These months are particularly suitable for hedging the futures market, since the basis is often the best in this period, between 2 and 4 euros / dt. This is also shown by the practical example from the 2019 harvest with a base of minus 2.50 euros / dt.  For example, one or the other “futures market-proof” farmer can earn 2 to 4 euros / dt more for the goods marketed during this period - this corresponds to an added value of 1,200 to 2,400 euros / ha. Another marketing date that is favorable in almost every year is the period from October to December of a year, as is also shown by the presentation of the futures market prices of the last 10 years. The courses in the period mentioned can hardly be “topped” in the following months. It is irrelevant whether it is a high price or low price year. It is pioneering that in this period the buyers mainly buy the goods they need for the entire processing campaign.The clever potato grower still holds free goods for the last marketing period in spring. On the one hand, he does not know exactly how much goods are still available in his warehouse at this time, and on the other hand he speculates on better prices, which, depending on the development of the new planting, can often only be achieved in May to June. In any case, the potato professional masters many marketing instruments, which he uses to varying degrees depending on the point in time, the market situation and his own skill and enthusiasm for speculation.

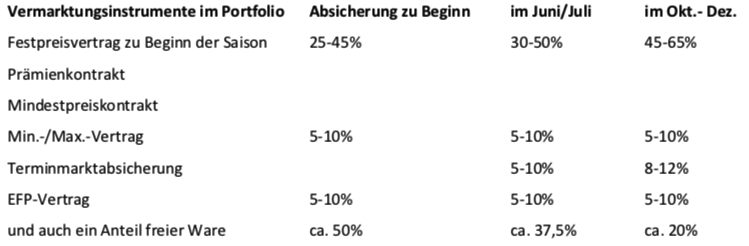

For example, one or the other “futures market-proof” farmer can earn 2 to 4 euros / dt more for the goods marketed during this period - this corresponds to an added value of 1,200 to 2,400 euros / ha. Another marketing date that is favorable in almost every year is the period from October to December of a year, as is also shown by the presentation of the futures market prices of the last 10 years. The courses in the period mentioned can hardly be “topped” in the following months. It is irrelevant whether it is a high price or low price year. It is pioneering that in this period the buyers mainly buy the goods they need for the entire processing campaign.The clever potato grower still holds free goods for the last marketing period in spring. On the one hand, he does not know exactly how much goods are still available in his warehouse at this time, and on the other hand he speculates on better prices, which, depending on the development of the new planting, can often only be achieved in May to June. In any case, the potato professional masters many marketing instruments, which he uses to varying degrees depending on the point in time, the market situation and his own skill and enthusiasm for speculation.  The periods listed in the portfolio should not be used stoically. Of course, with an attractive offer, partial marketing can take place at any time. The main thing is that they act skilfully and achieve a high average price in the marketing campaign. The listed premium and minimum price contracts are usually only offered directly by the factories, but are worth considering in the event of an offer.Each type of contract has its advantages and disadvantages, but a combination in total optimizes the opportunities with limited risks. There is no other way to do this when it comes to securities transactions; a balanced portfolio serves to hedge risk. By the way: How do you get to such contracts / contracts? This is a question of demand and goodwill, both on the one hand and on the other, especially since it is repeatedly emphasized that you want to work in partnership.

The periods listed in the portfolio should not be used stoically. Of course, with an attractive offer, partial marketing can take place at any time. The main thing is that they act skilfully and achieve a high average price in the marketing campaign. The listed premium and minimum price contracts are usually only offered directly by the factories, but are worth considering in the event of an offer.Each type of contract has its advantages and disadvantages, but a combination in total optimizes the opportunities with limited risks. There is no other way to do this when it comes to securities transactions; a balanced portfolio serves to hedge risk. By the way: How do you get to such contracts / contracts? This is a question of demand and goodwill, both on the one hand and on the other, especially since it is repeatedly emphasized that you want to work in partnership.