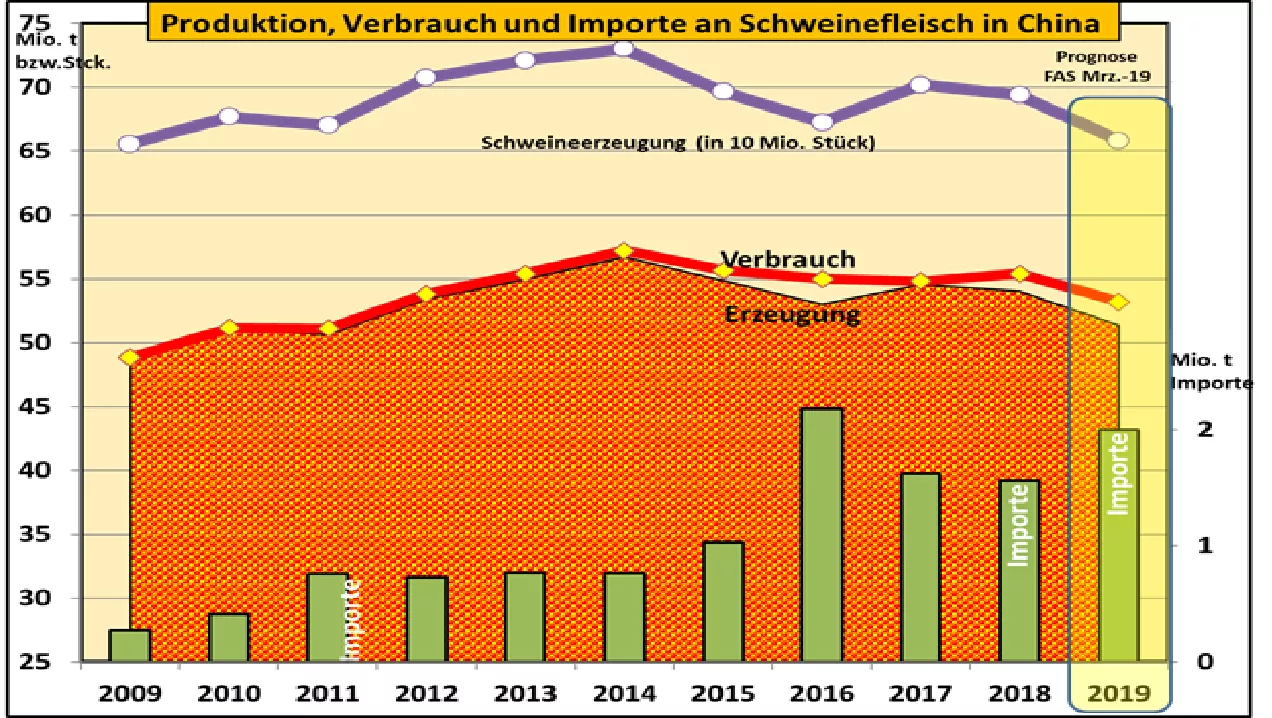

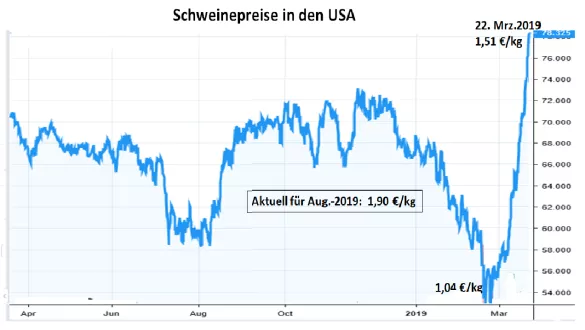

There is no meat in China - who can deliver? It is becoming increasingly obvious: African swine fever (ASP) is tearing serious gaps in pork supply in China. According to recent estimates, the production of approx. 54 million t in 2018 to 51.35 million t in the current year. Chinese pork consumption was 56 million tonnes in the previous year and is expected to fall to just 53.18 million tonnes according to the most recent forecasts. The import requirement is estimated at over 2 million t. In 2018, it was about. 1.5 million t. In addition to pork, beef in the order of magnitude of 1.6 million tonnes is to be imported. Who delivers? In recent years, the EU has provided with constant regularity approx. 56% of Chinese import requirements. In the past 3 years Germany had an export share of China trade of approx. 15.5%. In 2019, however, German production is expected to decline by 2 to 3%.Increased sales volumes in the direction of China will necessitate other sales opportunities. In Spain , production is expected to grow by between 0.25 and 0.3 million t in 2019. With a self-sufficiency level of around 165%, approx. 1.6 million t available for export. So far, Spain had a share in the China imports of approx. 13% with an upward trend. The Spanish market share is expected to be stronger in 2019 and to surpass Germany. Holland, Denmark and France are also involved in China exports with smaller margins. Increased EU pork exports to China will result in a narrower supply situation, with clear implications for price developments, which are already evident from rising prices. Even before the US-China trade conflict, the Americans were with approx. 20% import share from the lot. After the introduction of Chinese punitive duties of 64%, the US share is now only 7.5%.Nevertheless, the Americans have high hopes for an amicable settlement of the commercial dispute. The pork supply in the US is expected to increase by 0.6 million tonnes or 4.5% in 2019. Domestic sales are becoming increasingly difficult after nearly 20% increase in consumption over the last 5 years. In any case, the US forward rates for the summer months, in anticipation of rising China exports have already made a big jump to an unusually high € 1.90 / kg . Brazil is full of hope that it will be able to offset the lost sales volume in Russia with rising Chinese exports. So far, the Brazilians were involved with 8% in China trade . The share is expected to increase in 2019. But with a total of 0.75 million tons of Brazilian export capacity, there is not much room for maneuver, if one does not want to spoil the existing clientele at home and abroad. Dodging Chinese poultry meat has little chance, according to past years' experience.The anthropomorphic variants of the poultry virus have reduced domestic production and consumption in recent years. But in an emergency, it is also resorted to. Chinese beef consumption has now risen to 5.5 kg per capita. The Chinese own production is predominantly as a by-product of dairy cattle husbandry with limited success. The additional consumption was covered by imports with an annual increase of 20%. In 2011, beef imports were still close to zero. In 2018, 1.35 million tonnes were already introduced. For 2019 is estimated 1.6 million t. South America can deliver value for money Leading supplier countries are the South American countries Brazil, Uruquay and Argentina as well as the oceanic countries Australia and New Zealand. The South Americans Brazil and Argentina currently bribe with low producer prices of the equivalent of 2 to 2.50 € / kg. By contrast, Australia is currently struggling with drought and lack of food. The livestock were reduced and the prices are slightly above the 3 € / kg line. However, low transport costs reduce the price competitive disadvantage.Illegal meat imports According to insiders, it is well known that beef is illegally imported to the country in the amount of 1 million t. The goods are mainly from India and smuggled to China via Vietnam. There are no trade agreements between China and India because India is not free from foot-and-mouth disease. The price level is equivalent to 2.60 € / kg. Indirect effects for the EU The EU hardly qualifies as a supplier of beef to China. There is a lack of sufficient quantities in the appropriate quality and the local higher cost prices are hardly competitive. Nevertheless, the worldwide shortage of beef through the import and export trade in correspondingly higher prices in this country will be noticeable. 2019 will be an exciting year. Last but not least, the sword of Damocles of ASP hovers in Europe.