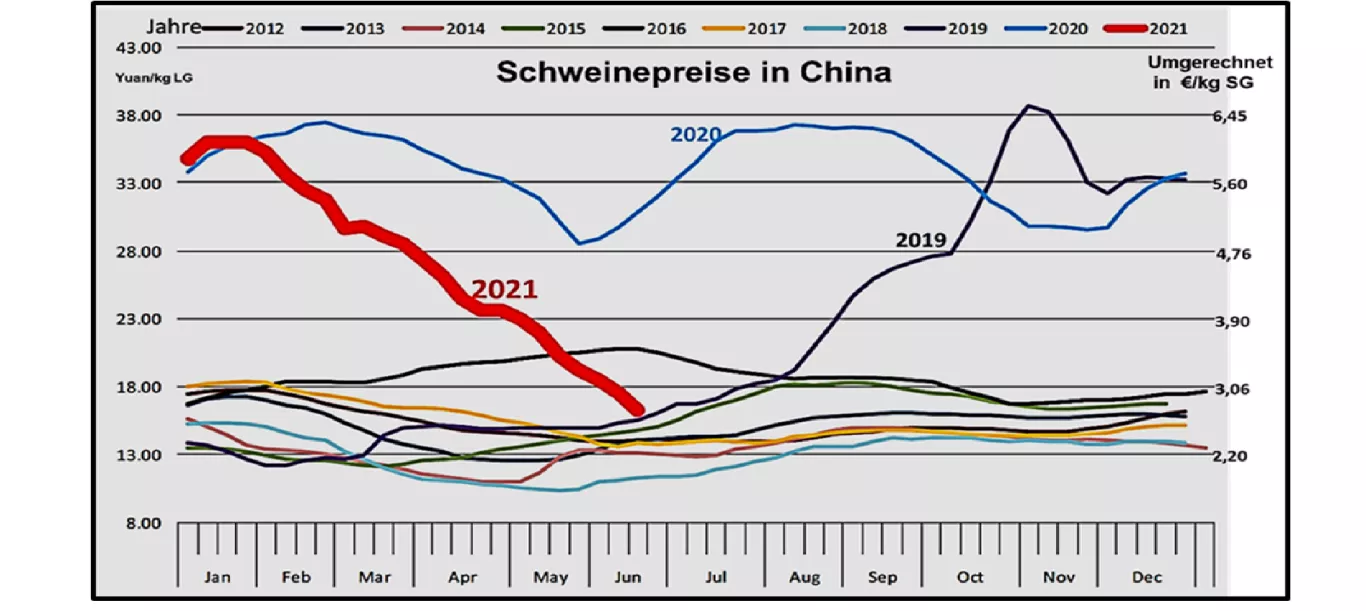

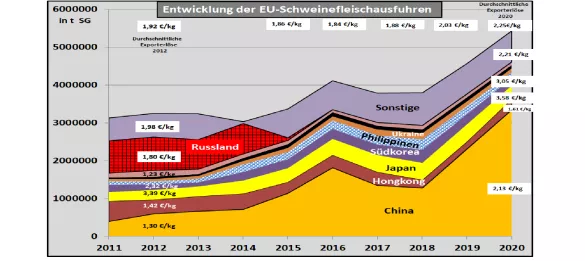

What do our pig prices have to do with China? Low battle figures in the middle of the barbecue season and the ongoing European Football Championship as well as reopened restaurants have not been able to prevent the VEZG listing from falling from -9 ct / kg to 1.48 € / kg. Even the house prices in the previous week with 1.54 € / kg were undercut. The main reason: Meat prices are under massive pressure due to the increasing supply in the EU internal market. In Denmark and Belgium the prices for the coming week were reduced by -8 ct / kg. In Spain, the price was lowered by -1 ct / kg last week. Further downward trend. Low slaughter figures lead to a smaller amount of meat, but in a surplus area like the EU the export possibilities play a decisive role in price. The EU-27 exports around 20% or 5.5 million t of pork to third countries every year.With a share of 60% , packaged and frozen cuts at an average price of 2.15 € / kg flowed into the world's largest import region, China. Serious changes have occurred in China in the past few weeks. The average pig price has fallen from over 5 to under 3 € / kg in a short period of time. Lower demand in connection with increasing in-house generation and the still high import figures have made a decisive contribution to this. However, the Chinese price drop is so loss-making for a successful rebuilding of the pig population that the government felt compelled to take over pork to state warehouses at a minimum price of around € 2.90 / kg. On the Dalian stock exchange, pigs are traded for the equivalent of 3 € / kg for the delivery month Sep.-21. The more relaxed Chinese supply situation is leading to falling import volumes and the lower price level to a lower willingness to pay.The supplier countries feel this strongly. In the EU it hits Spain as the largest EU export country in the first place. But Denmark, Holland and Belgium are also affected. Since autumn of last year Germany has not been allowed to deliver due to ASP and has laboriously found some other sales channels. A lack of third country exports and reduced export revenues lead to an increased supply of meat with falling prices in the EU internal market . The EU surplus countries Spain, Denmark, Germany, Holland and Belgium are competing with falling prices for the few EU importing countries with Italy in the lead. In the CEE countries, sales opportunities are limited due to low incomes. Denmark, Holland and Belgium are also trying their luck in German food retailing. Further prospects: On the Dalian stock exchange, pig prices for the month of Jan. 22 are traded around 3.10 € / kg. It is the month before the Chinese New Year with the highest meat demand. Are the days of extremely high Chinese pork prices and delivery options for exporters over?