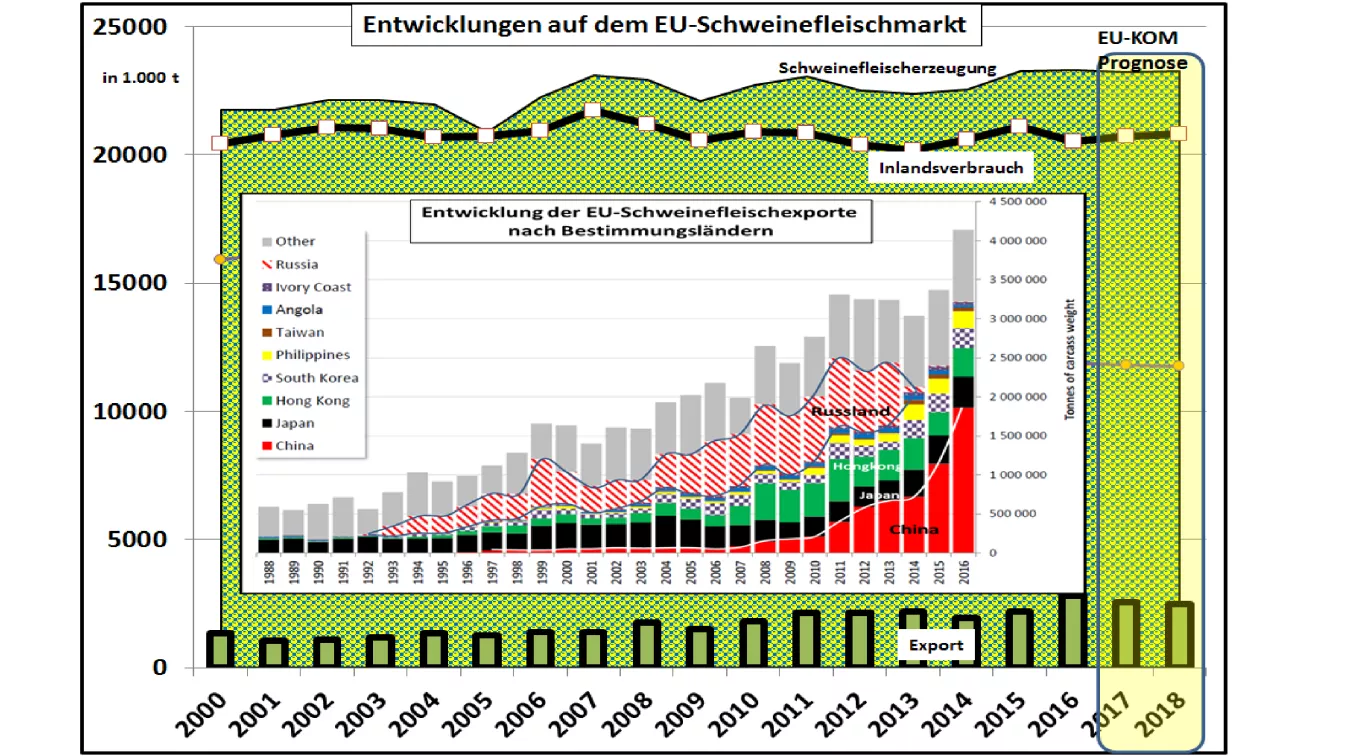

How to do it further on the EU pigmeat market? A short review of a decade of EU pigmeat market shows that encounters a weakly rising generation on a stagnant domestic demand with the consequence that the excess production or a stagnant domestic consumption in an rising third-country export land. The export dependency of the EU has as emerged clearly negative, its import ban as Russia imposed the year 2014. The local pork prices fell on hardly cost-covering prices below the €1.40 / kg brand. Over the years the Russia proved to be export as a reliable incline to guessing a sales opportunity right in front of the gates of the EU with significant competitive advantages over competitive offerings from North and South America. Slow onset rising imports of Asian countries with a focus on China gave additional support for the relief of the overhang of pork in the EU. The youngest of China's export boom exceeded expectations so far before. Within 2 years, exports have more than doubled and thus more than offsetting the offbeat Russia exports. Pork prices at the beginning of the year 2017 were about €1.50 / kg as high as no longer. However, a fully positive is To critically assess the China boom. First is to determine that the average export earnings of export volumes rather include brand of €1.50 / kg for processed, packaged and frozen goods to China the lowest range of the sections of the pigs. For the value-bearing parts, still the domestic sales is the mainstay. The development of production in the EU has been stagnant for several years. An additional third-country export was so in addition to the loss of Russia tends to with a reduction in domestic sales offset. This creates a tighter offer-demand ratio resulting in attractive prices. Should the EU pork production due to the price rise, the China effect is put into perspective are very quickly. The present forecasts of the EU Commission for the years 2017 and 2018 stagnant pork production continue to point to an order of the magnitude of 23 million tonnes. There is a crucial, if prices on the previously elevated level should remain. Multiple present investigations determine that China in the coming years will have a high and growing demand for meat imports due to structural reasons. The EU is one of the preferred areas of delivery because of the necessary high potential, the favourable exchange rate conditions, less problems with the production methods and health conditions compared to the competitors. Conclusion: the China import boom is still high prices alone. The EU offer development with their market opportunities in the internal market is just as crucial as the competitive advantage to the competing suppliers.