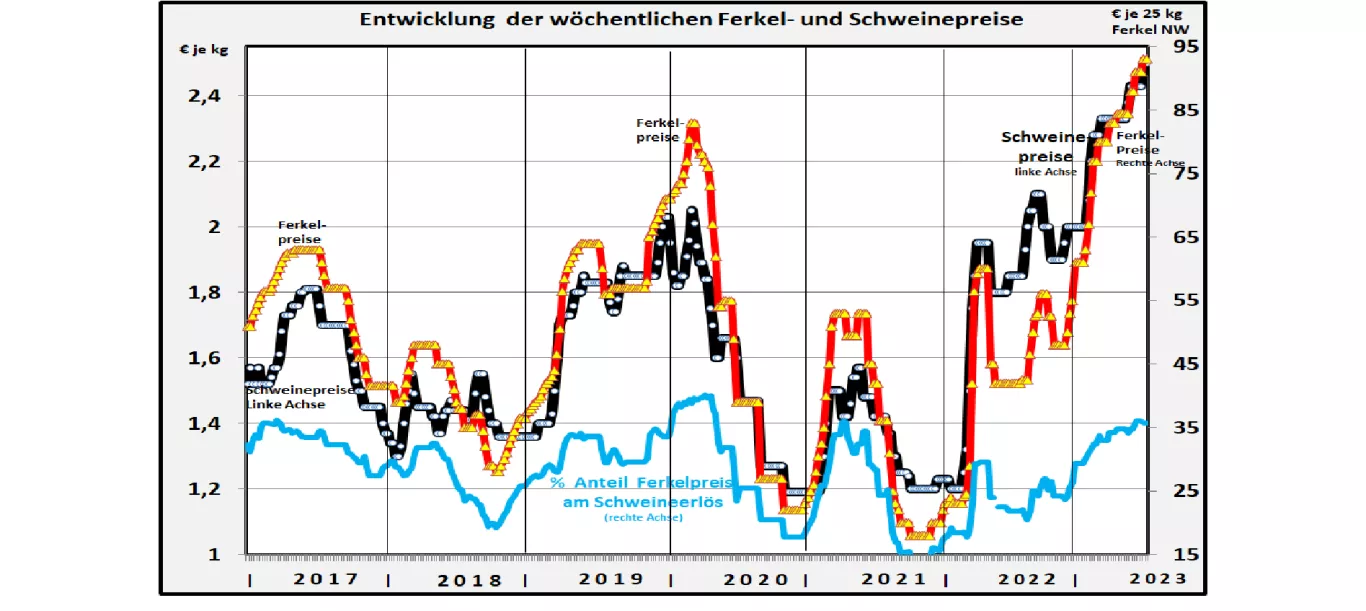

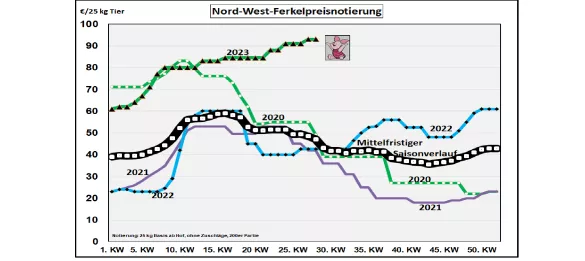

Piglet and pig prices: end of the road in the foreseeable future? Pork prices are currently stagnating at €2.50/kg. Based on the 25 kg north-west listing, the piglet base price is around the average of €93. With the usual surcharges, the piglet delivered to the fattening pen also costs well over €100. The piglet prices are usually based on the pig prices at the same time. There are the two exceptions to this: the cyclically caused excess in high price phases and undercutting in phases of depression, as well as the typical seasonal effects in spring and autumn. In times of low pig prices, piglet prices tend to be disproportionately low; This situation was particularly pronounced in autumn 2021 with €18 per 25 kg piglet. The situation is reversed in high-price phases, e.g. B. in 2017, early 2020 and currently in mid-2023. The background for this price behavior is the fact that piglets play a time-acute function in the production process of pork production. In the short term, the piglet market is inflexible.after-effects of the high feed and energy costs caused by the war, but the decisive part is the insufficient prospects for future animal husbandry conditions with insufficient financing and economic prospects. The restrained demand in domestic and foreign business is also not very encouraging. Under these conditions, the usual cyclical supply-reaction pattern works only to a very limited extent. The high price level causes only very few producers to increase their production volumes. The focus of action is more on slowing down the destocking of animals. As a result, a longer phase of stability at a higher price level can be expected in the medium term. The specific seasonal effect on the piglet prices is also overlaid by the most recent framework conditions.Usually the piglet prices give way after the spring high until autumn. Increases in sow admissions in the spring, which used to be usual in the past, resulted in increased piglet offers after the gestation, suckling and rearing period. That's hardly noticeable this year. On the contrary: the livestock census in May 2023 showed 2% fewer sows compared to the November census of 2022. Germany has been dependent on piglet imports of 15 to 20% for years. The main suppliers are Denmark and the Netherlands. In both countries, however, the number of sows has been reduced, so that the export potential is reduced. The market situation is aggravated by growing import competition from Spain and Poland . The enormous spread of ASF in Poland has led to a 50% drop in sow husbandry in the typical small herds. Denmark diverts increasing deliveries of piglets from Germany to Poland. The Spanish pig farmers are increasingly making up for their piglet deficit with Dutch piglet purchases. This reduces the export share for Germany.There are increasing signs that the recent upward momentum in pig and piglet prices is leading to a phase of stability at an above-average level.