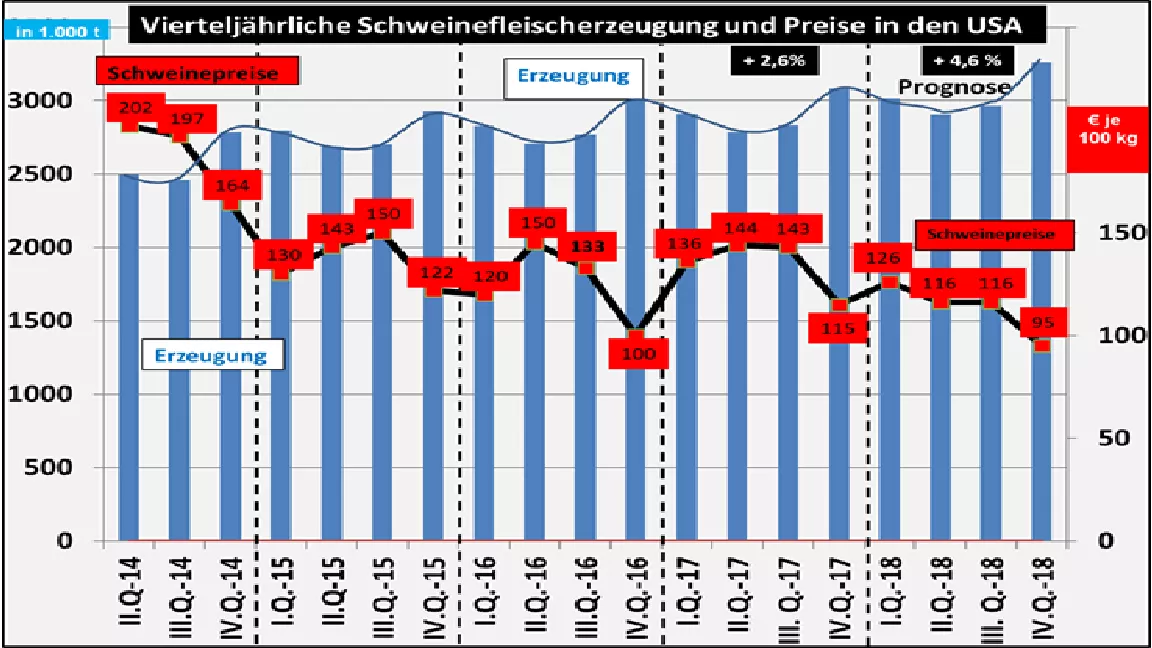

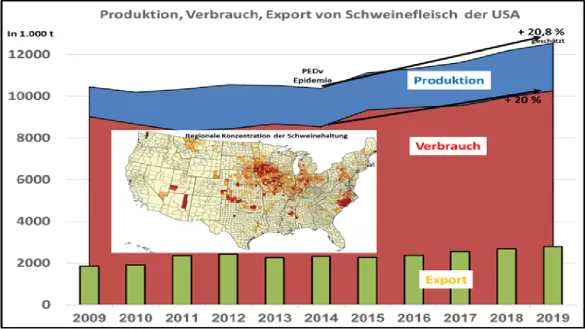

US Pig Market: Large Quantities - Small Prices Since 2014, the US pig market has grown by between 17% and 20% . The incentives came initially from pig prices up to the € 2 / kg mark as a result of failures of the deadly diarrheal epidemic in suckling piglets. In the follow-up period, falling feed prices partially offset the decline in pig prices. Domestic sales and exports were fully involved. The slaughter and processing industry has built 4 new large slaughterhouses. The US pig sector is very concentrated. In the 40 so-called " Pork Powerhouses " starting with 20,000 to 900,000 sows, more than 65% of US piglets are produced.The Smithfield / WH Group alone has 910,000 sows or 15% of the US sow herd. The second largest company comes to 325,000. Sows. In the subgroup of 100,000 to 325,000 sows there are 10 companies with 1.86 million sows or 30% of all US sows . Low unemployment and increasing average income are the driving forces on the demand side. The meanwhile more than 5 € / kg expensive beef prices slowed down the consumption of the competing product. In the case of poultry, the multiple poultry virus epidemics were of little value for production and consumption. Nevertheless, the per capita consumption on a slaughter weight basis decreases with approx. 25 kg of pork is still very modest compared to 36.8 kg of beef and 48 kg of chicken meat.Exports have risen comparatively moderately. Growing exports go to neighboring Mexico . China's limited export has been slowed down recently by Chinese import tariffs. The supply of the Japanese market has fallen behind. Imports and exports with Canada almost cancel each other out. The US pork prices are subject to extreme fluctuations. During the PEDv epidemic in the spring of 2014 , prices were approx. 2 € / kg . The opposite was true in March 2018, with prices of € 0.83 / kg on the occasion of the Chinese imposition of punitive tariffs on US pork deliveries.In parallel with fluctuating pig prices, profits / losses in pig fattening have been lost. In 2015 and 2016, the profit zone was rarely exceeded. In 2017, pig prices with an annual average of € 1.30 / kg were just enough to cover the costs. For the current year 2018 , an offer of 4.6% above the previous year's level is still expected. The consumption estimates are slightly lower. China's punitive tariffs reduce exports there. In other import areas such as South Korea, the Philippines, Japan and not least Mexico, there is still sales potential that is being used extensively at low prices to the detriment of the competition.This year's pork prices have recovered after the period of weakness in the spring months and are down by around € 1.10 / kg in May. For the barbecue season is calculated on the basis of recent estimates of the US Department of Agriculture with producer prices around 1.16 € / kg . On the Chicago Stock Exchange, the forward rates of the summer months are traded at the equivalent of € 1.30 / kg. Later in the year , however, prices should fall back towards 1 € / kg mark and below . For the current year is expected to increase feed costs.Results for the low-cost summer phase are still expected at the breakeven point, with significant losses for the autumn / winter period . The annual average is expected to be $ 15 loss per 100 kg live weight .