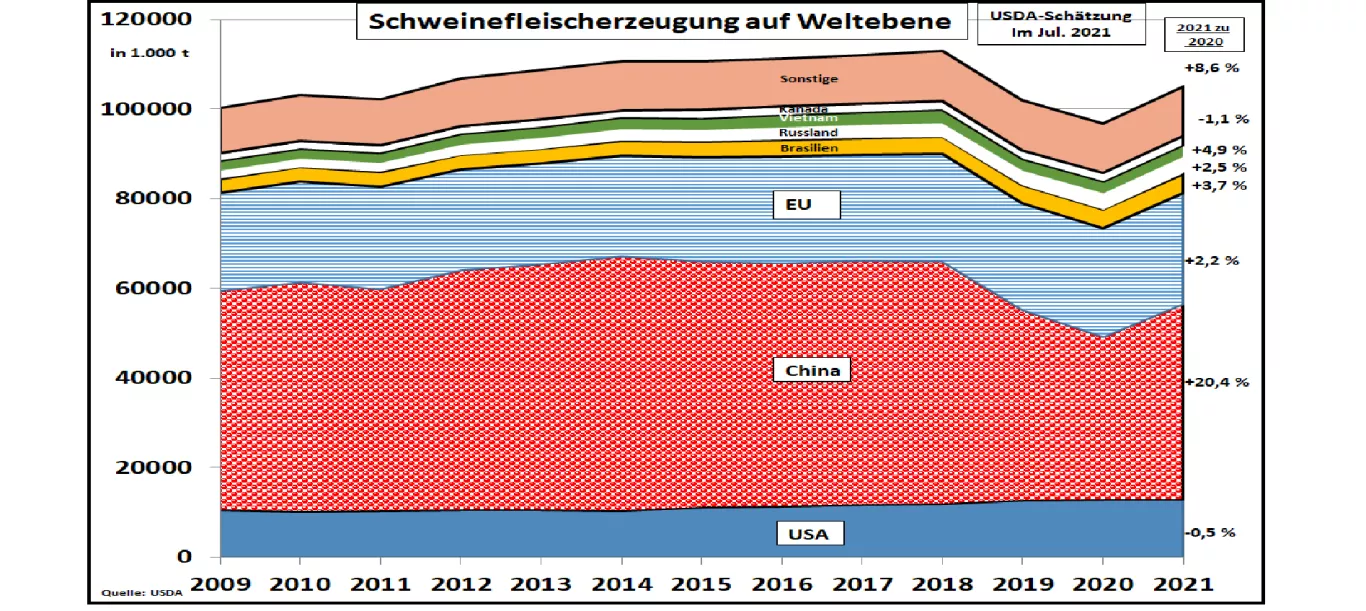

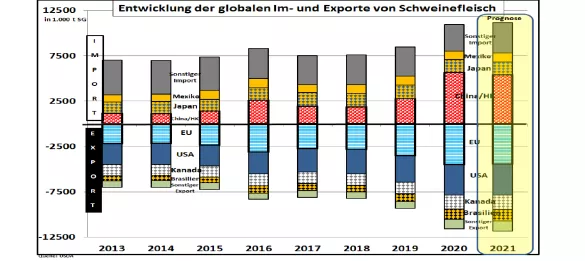

USDA July 21 estimate: Global pork production will rise 8.6% in 2021. In its quarterly July 2021 edition, the U.S. Department of Agriculture (USDA) estimated global pork production in 2021 to be + 8.6% higher than in the previous year. Production is still around -6.8% behind the ASP outbreak year 2018. Chinese pork production has the decisive influence on world level. After the massive ASP-related slump in 2018, production fell by around 30% by 2020. For the year 2021, the USDA estimates production of 43.75 million t , still below the base year of 54.5 million t . Chinese consumption in 2021 is currently estimated at 48.6 million t . Around 5 million tonnes of pork imports are still required to meet demand. Added to this are 3 million t of beef imports and 0.9 million tt poultry meat. For the protein requirement, fish imports are also added. The Chinese pork prices are currently in the seasonal high phase before the New Year celebrations in mid-February at a level of the converted € 5.60 / kg . According to the newly established futures contracts on the Dalian stock exchange , Chinese pig prices will fall to the equivalent of € 4.50 / kg in the further course of the year. The reason is seen in the increasing domestic production. The world's second largest pork production area is the EU with around 24.8 million t. However, there are opposing developments between the EU Member States. Increasing production can be observed in Spain, Denmark and Italy. Germany and some Eastern European countries show a clear downward trend. EU third country exports are largely determined by Spain, Denmark and Holland .The ASP-related blocking of Germany to China and other Asian importing countries has massively affected German exports. The current pig prices in the individual EU member states range from over € 1.25 to € 2 / kg . In the USA , the world's third largest production area, just under 12.8 million t of pork will be produced in 2021. However, the high rates of increase of earlier years are ebbing. US pork consumption is estimated at around 9.8 million tons . Around 3.4 million t are exported. The main destinations are Mexico, China, Japan and South Korea. The US pork prices are currently around € 2 / kg mark . At the beginning of the year, the prices were around 1 € / kg. Brazil's pork production is set to increase by 3% to 4.28 million in 2021.t grow. With domestic consumption rising moderately to around 3 million t , the greater part of the additional production is exported , which is expected to reach the order of 1.23 million t. That corresponds to a doubling in the last 5 years. Deliveries are mainly directed to China and Hong Kong. After a short-term soaring up to the magnitude of 1.90 € / kg before the Christmas holidays 2020 in July-21 , the Brazilian pig prices stabilized again at around 1.30 € / kg. The increased dependency on exports leads to a price adjustment in an international context. According to the USDA surveys, Canada's pork production is expected to rise to around 2.2 million t . With domestic consumption declining slightly, 1.56 million t are exported . The countries of destination are the USA, Mexico and several Asian import regions.After the temporary import ban, China is again one of the importing countries. Russia's pork production has exceeded the self-sufficiency mark of around 3.5 million t and is dependent on increasing exports. However, the ASF outbreaks are a powerful obstacle. After all, around 200,000 t are going to Hong Kong and Vietnam. The Russian pork prices fluctuate between 1.50 to 2 € / kg . The international pork market in 2021 will continue to depend on the still high Chinese imports. However, the recent price slump in China from over 5 to under 3 € / kg is causing instability. A lack of exports from EU exporting countries leads to price pressure on pork in the internal market. For Germany , the ASP is the biggest obstacle to a radical price recovery. Spain is gaining more and more weight in the EU-27, but is coming under pressure from declining exports from China.Brexit means costly controls that have led to cuts in the exchange of goods. The Covid pandemic continues to hinder demand for the time being. An expected price hike in the summer did not materialize.