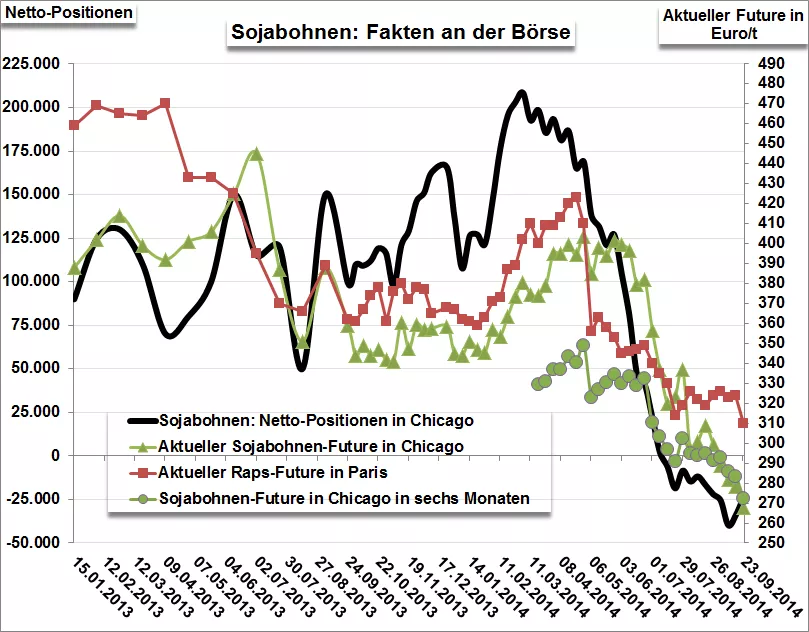

The speculators on the Chicago soya beans have reduced their contracts at the net short positions in the last week of the report to the 23.09.2014 to 10.038 on 23.691 NET short positions. But the prices fall, it's the strong bärischen course arguments on the world oilseed market. The high soy bean crop in the United States will put 2014/15 his stamp on the final stock rise in the fiscal year. The advantages of soy compared with the corn can then expect any destocking in the marketing year. How to price pressures subside so? While listen up the messages, that in this country the rapeseed is increasingly at risk, can be effect at best but only in the next financial year. Therefore even the rape is not recommended in the wake of falling rates, if the this year's U.S. soybean crop on the world market increased.