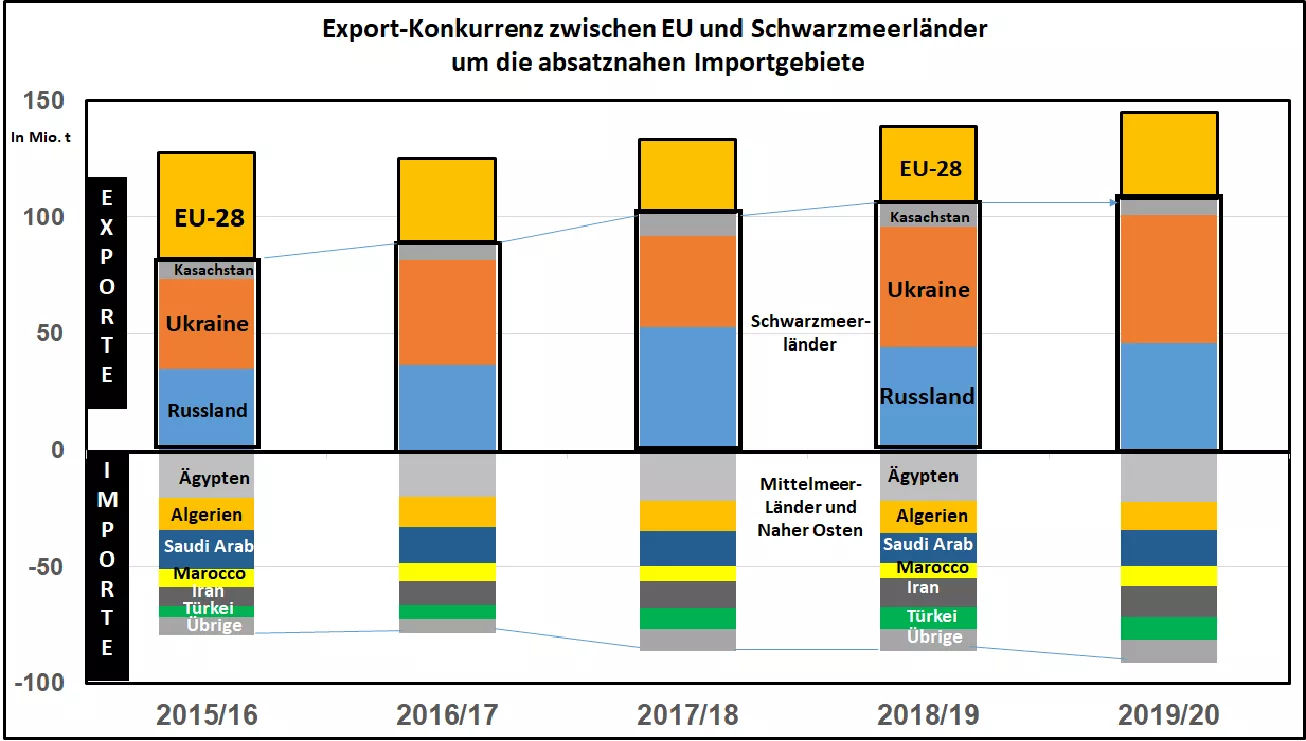

Price-determining export competition between the EU and the Black Sea countries Russia, Ukraine and Kazakhstan have in recent years expanded their grain production with growing land, but even more through higher land yields. The Russian harvests are from approx. 98 million t in 2015/16 has grown to the current 117 million t. As domestic consumption failed to keep up, exports rose from 34 million tonnes to 46 million tonnes in 2019/20. In the peak year of 2017/18 there were more than 50 million t. The export focus is on wheat. In addition to wheat, Ukraine has vigorously increased its corn production in the same period. The total harvest was from approx. 60 million t (2015/16) increased to 75 million t (2019/20) . Cereal exports increased from 39 million tonnes to 55 million tonnes . Thus, the country has moved without the peninsula of Crimea before Russia. Ukrainian corn reaches more than 60% market share. Kazakhstan reaches only 7 million this yeart cereal exports, in recent years, volumes have ranged from 10 to 12 million t. The total export volume from the 3 Black Sea countries today amounts to 108 million tonnes, an increase of more than 30% in 5 years. The Black Sea countries have the sales almost on their doorstep. The import areas are located along the North African Mediterranean coast as far as the countries of the Middle East with an import volume of approx. 85 million t . The ship's route goes through the Black Sea and then into the Mediterranean. These importing countries were traditional and are still the main sales area for EU exports . However, competition for tenders for importing countries is becoming increasingly severe. In the last 5 years, the Black Sea regions have achieved significant increases, while EU exports have had to lag behind. In the current year 2019/20 , Russia and Ukraine will be able to increase again, but the weak Kazakh harvest will offset more than half of the growth.As a result, the EU is seeing an increase in its export volume. In the near future winter in the Black Sea areas will limit the supply to the loading ports, so that the Russian and Ukrainian supply capacity is limited. For the EU, additional support for competitiveness comes from the low euro exchange rate. Higher EU export activity contributes to the consolidation or slight increase in grain prices. After the winter period, however, the export offer from the Black Sea region will increase again and the price war will continue. That should be a reason not to delay the marketing of this year's crop too long.