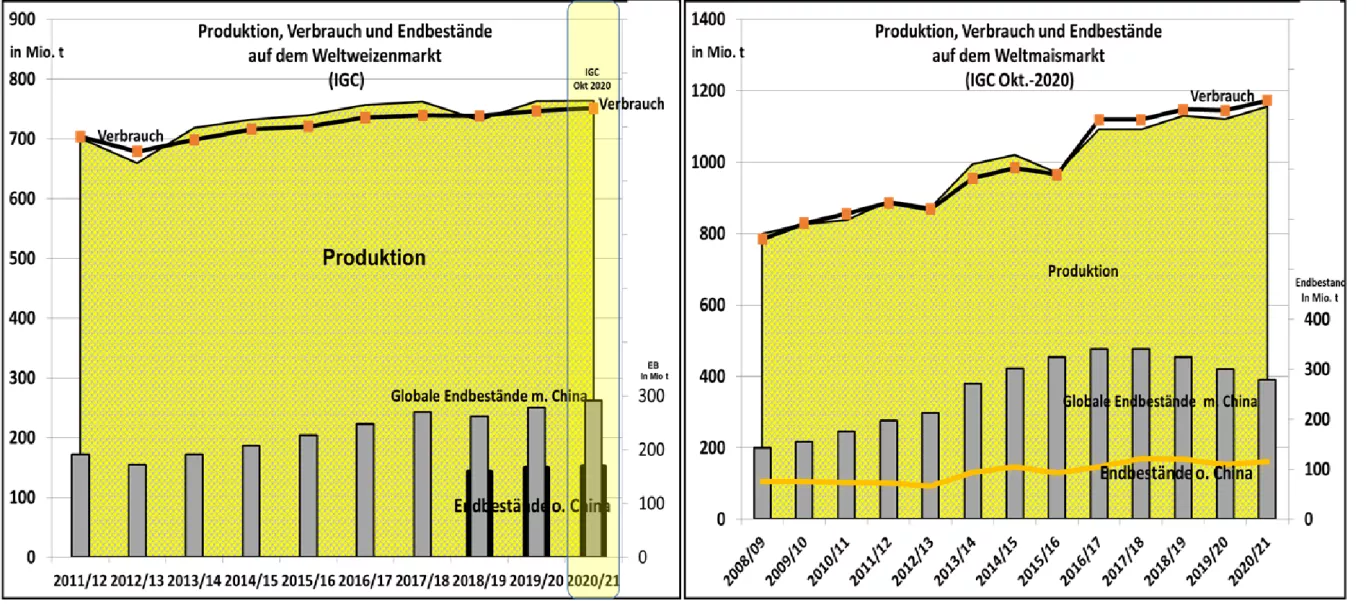

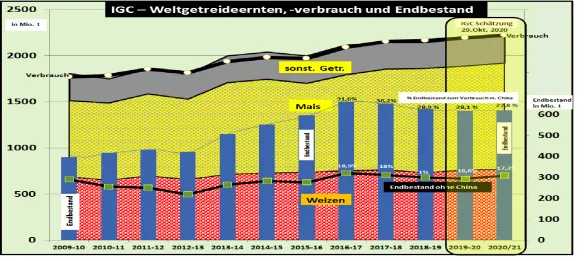

IGC cuts global grain harvest 2020/21 compared to the previous month - supply barely sufficient In its monthly October issue, the International Grain Council (IGC) revised the global grain harvest down slightly compared to earlier estimates. Global grain production is estimated at 2,225 million t . That is 1.3 million t less than in the previous month, but still 40 million t more than in the previous year. The expected consumption of 2,223 million t is estimated to be 3 million t higher than the previous month. Compared to the previous year, however, this is 29 million t more. The corrections were mainly triggered by weaker harvest results and expectations in the USA, EU, Ukraine and Argentina. In the global grain trade , the USA remains with approx. 92 million t of the world's leading export country. Russia achieves export figures of 49 million t, followed closely by Argentina with 48.5 million t .The EU is in fourth place with almost 40 million t . This is followed by Canada with 32 million t. The USA primarily supplies corn, while Russia , Canada and the EU are the primary exporters of wheat . On the import side , China (25 million t) and the EU with almost 30 million t are at the fore. The rest of the import trade is spread over a large number of small countries. Compared to the Sep 2020 estimate, the global end stocks will be reduced by 10 mln t to 619 mln t . In the previous year 616 million t were determined. The price-determining supply figure remains below the level of the previous year at 27.8% final inventory of consumption. The supply balance excluding China falls to 308 million t of the previous month (318 million t) of surplus stock or just under an average of 17.3% final stock for consumption.The global wheat harvest is estimated to be slightly higher than last year at 764 million tons . Wheat consumption increases to 751 million t . (Previous year 746 million t). The wheat stocks are estimated to be lower than the previous month at 2 91 million t . The supply situation is very high with 38.7% final inventory for consumption . However, if you exclude China due to its 50% share of stocks but insignificant exports, the result is a value of 24.4%. The final stocks of the major exporting countries - as potential suppliers in case of need - fall with approx. 61 million t even lower. For the coming months, the wheat harvests that have started in Argentina and Australia will play a decisive role in the price of the follow-up supply. Due to the drought in South America, the Argentinian result is estimated to be only 18 million t (previous year 19.8 million t) lower; the export is also canceled.In contrast, after years of drought, an above-average wheat harvest of 28.5 million t is expected in Australia (previous years around 16 million t). Exports are expected to double to 19.2 million t . Australian exports will primarily benefit the Asian import markets. The IGC has reduced global maize production to 1,155.5 million t compared to the previous month by approx. 5 million t. Compared to the previous year , 32 million t more should be produced. Corn consumption is estimated to be 20 million t higher (previous year 1,154 million t). The final stocks fall by 17 million t to approx. 279 million tons back. The global coverage figure falls from 28 to 23.8% , without China it is only enough for a below-average 12.5%. For the 1stIn the first half of 2021, the estimated record harvest in Brazil of 112.5 million t will play a decisive role in further market and price developments. The estimates are currently mainly based on the expected higher acreage. However, the La Niña weather phenomenon with drought could put a spanner in the works. For the EU-27 , the IGC estimates a total harvest of 273.5 million t , which is compared with a consumption of 260 million t . Falling exports to third countries (40 million t) lead to a slightly lower unchanged final inventory of 33.7 million t. After a brief surge, international wheat prices are stabilizing again at a lower level. The corn courses have not yet found their new basic orientation on a reduced basis.