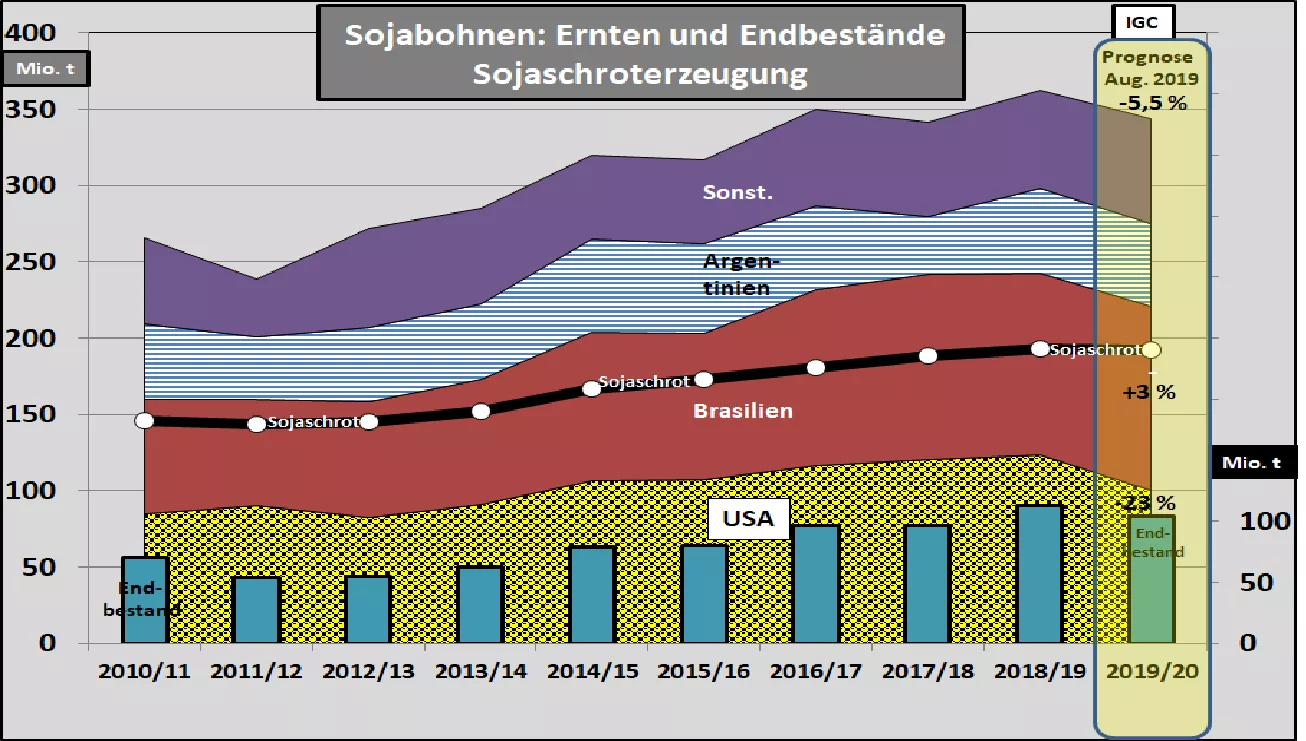

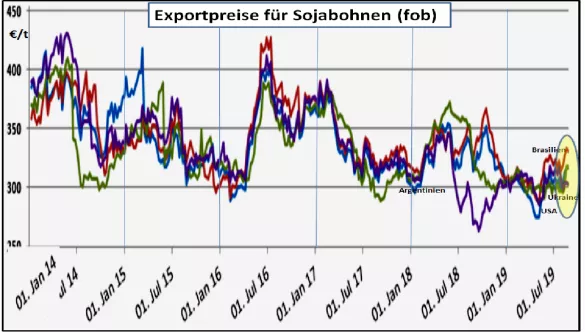

IGC expects lower world soybean production - 23% less in US In its Aug issue, the International Grains Council (IGC) has re-balanced the global soybean market. The total production predicts the IGC only to 344 million t , approx. 20 million t less than in the previous year. The decisive decline takes place in the US , where the harvest is estimated to be only 100 million tonnes, over 123 million tonnes, compared to the previous year. The reason for this is the heavy rainfall, which partly or partly prevented and delayed sowing. On the use side, the IGC expects consumption of 358 million t . The difference between current production and higher demand leads to a reduction in inventories from 55 to 41 million tonnes. For Brazil , the IGC estimates rising soybean production of 121 million tonnes compared to 116 million tonnes in the previous year. Paraquay increases its production from 9 to 10 million t .By contrast, Argentina is only expected to bring in a harvest of 54 million tonnes . On the demand side, China plays a decisive role with an import volume of almost 60% of world trade . The IGC estimates Chinese imports at only 85 million tonnes . Two years ago, volumes were still almost 100 million tonnes. The decrease in consumption is mainly due to the ASP-related reduction of pig stocks between 30 and 40%. China has imposed a complete import ban on US soy due to political tensions with the US. Of these, approx. affected half of all Chinese soybean imports and US exports. Replacement purchases China in large quantities in Brazil . But the Brazilian harvest from the spring / early summer of 2019 is almost sold out. The next South American harvest will not be available until March 2020. What measures is China taking in the meantime?The previous Chinese boycott of US soybean supplies has led to a doubling of stocks in the US . The upcoming low US soybean harvest may lead to a reduction, but remains uncertain because sales opportunities are narrow. The EU leads approx. 15 million t soybeans and 17.5 million soybean meal . The trend is largely unchanged. On the one hand, due to the drastically reduced rapeseed crop, a possible source of protein is missing, but this is partly offset by imports, on the other hand, livestock numbers in the EU are declining. The exception is Spain. The future development in the soybean market is characterized on the one hand by large South American harvests, but reduced US crop, a sharp slump in soya imports in China and the uncertain trade relations between China and the USA. The courses in the soy complex show a clear upward trend, however, even at a very reduced level.