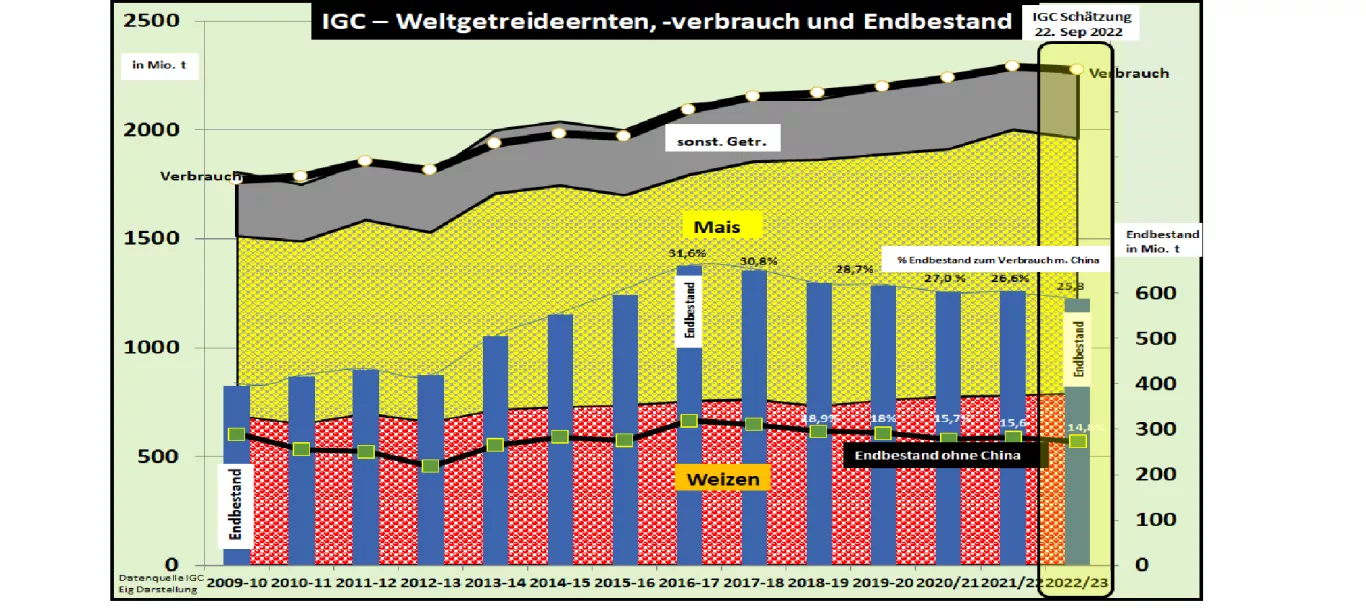

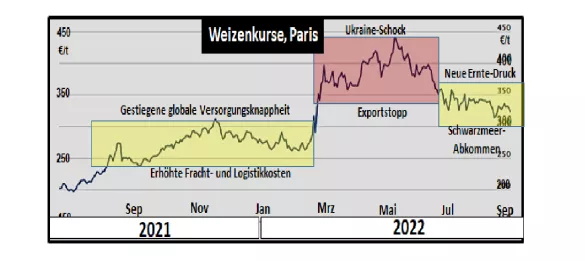

IGC slightly corrects world grain harvest 2022-23 In its latest Sep. 22 issue, the International Grains Council (IGC) corrects the estimate of the world grain supply slightly better than in the previous month. Month-on- month comparisons: The grain harvest is estimated at 2,256 million t (+11 million t). The decisive factors are the higher harvests in Russia (+7 million t), in the Ukraine (+5 million t), in Canada (+3 million t), in Australia (+3 million t) and smaller increases in others countries. However, this is offset by reductions in the EU (-2 million t) and the USA -10 million t. On the consumption side, 2,274 million t (+0.6 million t) are estimated. The individual corrections are rather small in a majority of countries. The calculated closing stocks including China rise to 587.5 million t (previous month 577 million t); without China 273 million t (previous month 263 million t.) and last for 55 days (previous year 57 days). The inventories of the major exporters available for trade will remain unchanged at approx.Estimated at 18% of world trade. The global wheat harvest was estimated to be 14 million t higher than in the previous month. Russia has a share of + 6 million t in the increase, Ukraine 2 million t, Australia and Canada each + 1 million t. The EU harvest was also estimated to be around + 1 million t higher . Global wheat consumption only increased by +3 million t to 644 million t. The ending stocks outside of China are calculated at 148 million t or unchanged at 23% of consumption. The global corn harvest was estimated at 1,168 million t by around 10 million t lower than in the previous month . Decisive are the cuts in the USA (-10 million t) and in the EU -3.5 million t. Global corn consumption including China falls by almost -7 million t to 1,190 million t.The ending stocks fall arithmetically by 2 million t. The supply figure o. China is only just under 10% final stock to consumption (previous year 10.5%). If one only looks at the fundamental figures on the supply situation, the current price level is too high compared to previous multi-year averages. But one must not lose sight of the insecurity of supply due to the Ukraine-Russia conflict, the increased transport and energy costs. A secure supply of the importing countries cannot be guaranteed at the moment. The risk has its price.