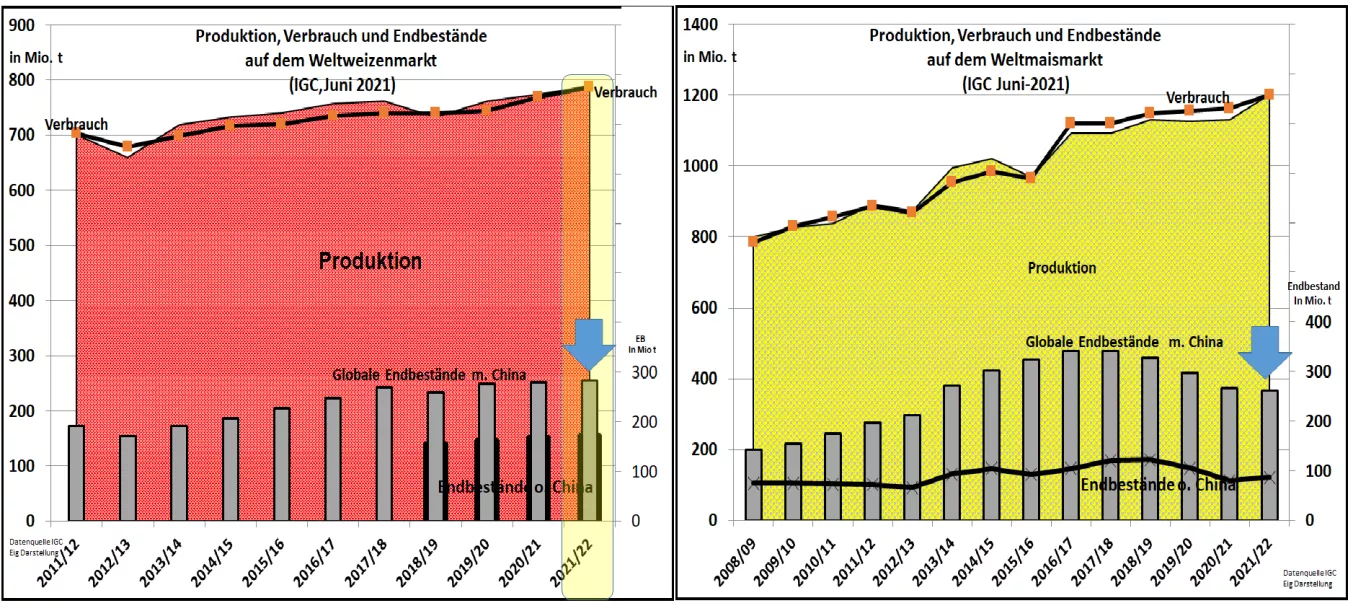

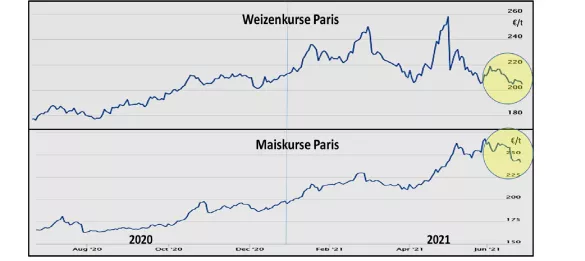

IGC June 2021: World grain harvest 2021/22 by 3.8% over the previous year - supply is not too plentiful In its June 2021 edition, the International Grain Council (IGC) estimates the global grain harvest to increase again to 2,301 million t or around 3.8% higher compared to the previous year. Consumption is estimated unchanged from the previous month by + 2.7% higher than the previous year to 2,298.6 million t . This means that the overhang stocks remain largely the same at 597.2 million t. The supply figure is 25.9% final inventory compared to consumption on average over the last few years. The stocks last for around 95 days (excluding China 56 days) In the wheat sector , a record harvest of 789 million t or +2.1% compared to the previous year is still forecast. Consumption remains unchanged at 787 million t (previous year 769 million t), but is estimated to be higher than in the previous month.This results in an increase in stocks from 281 to 283 million t. The supply figure, however, falls from 36.5% to 36.0% final inventory for consumption. This means that the wheat market in and of itself remains relatively well supplied. Higher wheat production than previously estimated is recorded in Russia, Ukraine and Australia. Despite outstanding risks in the grain formation and harvesting phase, the estimates are stabilizing. The IGC estimates the global corn harvest at 1,201.3 million t or +6.3 % higher than in the previous year. The US, the world's largest producer and exporter of corn, has made rapid progress this year after initial difficulties. On the other hand, significant cuts have been made in the Brazilian second corn harvest. Global consumption is expected to increase by 3.4% compared to the previous year at 1,201 million t. Chinese consumption in particular contributes to this. Global inventories are in the course of the maize marketing year 2021/22 marginally to 267 milliont rise. The supply figure remains at around 22.2% final inventory for consumption. 4 years ago, the excess stocks were up to 30% based on consumption. Global supplies last for 81 days (34 days without China; 44 days ago 2 years ago). Overall , it can be stated that despite the forecast increases in production, only a limited improvement in the supply situation is foreseen. The reason for this is the rising consumption. The relatively scarcer supply in the corn sector rubs off on the comparatively better supplied wheat market. The soaring price of wheat on the stock exchanges is over. The Paris prices drop significantly towards 200 € / t. The above-average corn prices also keep wheat prices at a high level, because inexpensive wheat replaces the missing corn in the feed sector.