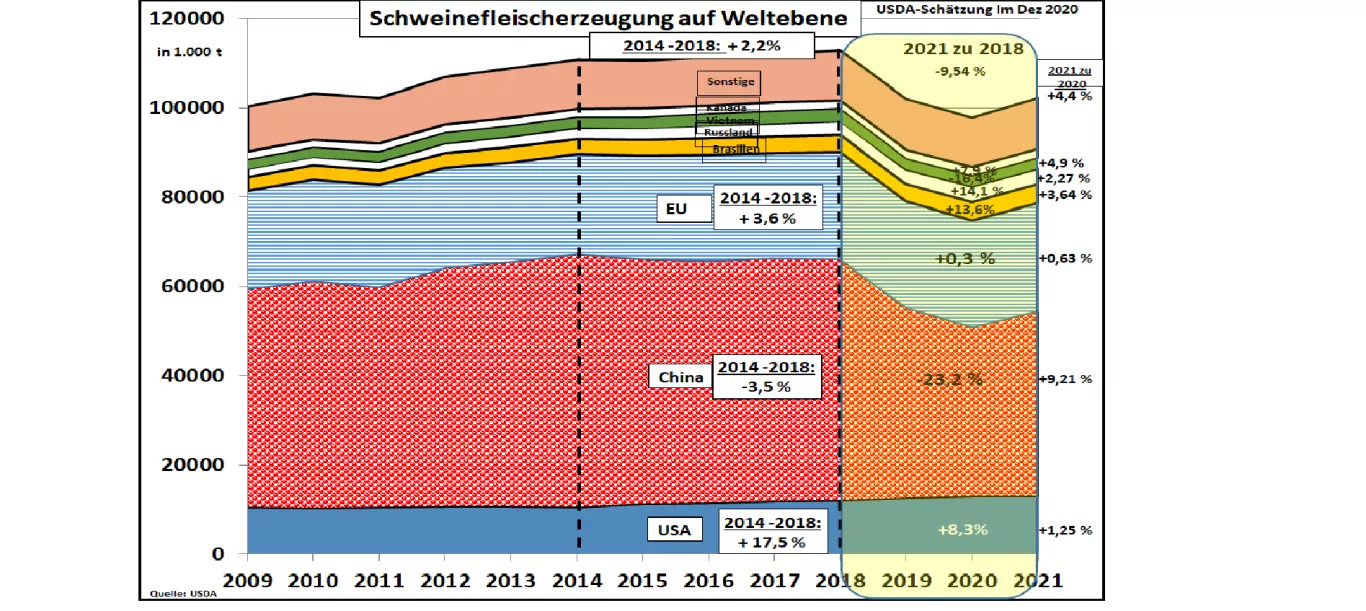

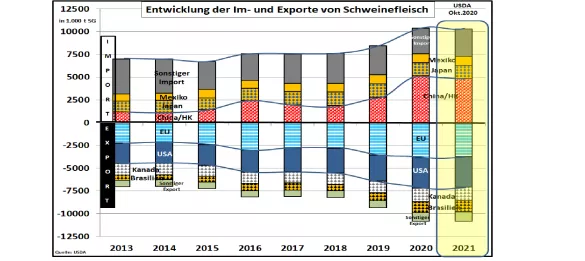

China's pork market remains the largest in the world, ahead of the EU and the US, despite the ASF-related cuts. Supplying the Chinese market is of crucial importance for the price of the affected surplus countries in the world. Chinese production of 41.5 million t is forecast for 2021. Consumption should be 45.9 million t . For comparison: in the years before the ASP outbreak, production was around. 54.5 million t and the consumption almost 56 million t. China's remaining shortfall is to be covered by 4.5 million tons of pork imports in 2021 (previous year: 4.8 million tons). In addition, there is an increasing 2.85 million t of beef - and an almost constant 0.9 million t of poultry imports . China thus dominates the global meat market with a trade share of 28%; in the case of pork it is approx. the half.Suppliers are the unblocked EU countries with a share of 50% with Spain at the top, the USA with 25% and other small exporters such as Brazil and Canada with just under 10%. The pork market in the EU-27 In the EU-27 , the seasonally higher slaughter figures were achieved in the 3rd and 4th quarters of 2020 compared to the previous months, but were slightly below the previous year's figures. For the first quarter of 2021, the previous forecasts remain just above the previous year's level. A clear downward trend is only predicted in the 2nd quarter of 2021 . However, the development is different in the individual EU member states. Significantly rising trends are expected for Spain, Italy, Denmark and Poland , while noticeable declines are expected for Germany, Holland and Romania .In France, Belgium and Austria only minor changes are expected. In addition to its size, Germany occupies a special position because of the cost-increasing requirements in the slaughter and processing area from Jan 2021 as well as the ASP-related export bans in Asian countries. The resulting price pressure will also be felt in the other EU member states. Falling German sow populations - tightened by more costly requirements for animal husbandry - increase the import demand for piglets. According to rough calculations, German piglet production is expected to decrease by 10 to 20% in the near future. In any case, Denmark and Holland continue to expect increasing sales opportunities for their surplus piglet production. From the “Brexit” rain to the “Coronavirus (2)” eaves? An agreement?The UK pork market is dependent on imports with a current level of self-sufficiency of 62%. So far, 90% of imports have been imported from EU countries duty-free and without complex border controls. Ireland has the largest share with 37%, Denmark provides 24%, Holland has a share of almost 17% and Germany holds a share of 16%. In return , Great Britain exports slaughter by-products and pig meat that are not salable on the island. Half of it goes to China ; Germany and Holland each received just under 10% so far. It is unclear what is in the preliminary agreement between UK and EU? In the event of a no-deal Brexit , the British would have had to introduce 10 to 25% tariff surcharges according to the rules of the WTO and have to bear the noticeably rising costs of border controls .The UK price level is 30% above the level on the continent. A lternative imports from the USA and Canada depend on British standards for hormone-free and GM-free production and chlorine-free disinfection. In addition, there is the longer overseas transport with lower quality of fresh meat. Problems that are not easy to solve! The British deliveries to the EU countries would be almost three times as high and thus much more restricted. The way out for the British would be increased exports to China. The preliminary results of the negotiations "in principle" provide for a continuation of " free" trade . However, the new corona virus shows how sensitive the movement of goods between the UK and the rest of the EU is. The traffic jam on the English Channel is exacerbated by hamster purchases. Forward-looking political action looks different.The price development in the EU depends to a large extent on the restrictions caused by the Covid pandemic and the ASP-related export bans in Asian countries. Danish market experts expect prices between 1.25 and 1.45 € / kg pork in the course of 2021. Piglet prices (north-west) should vary between 30 and 44 € / 25 kg animal over the course of the year. USA pork market Since the PEDv epidemic in 2014, pork production in the US has grown steadily. Only part of the increasing production has remained domestically . A larger part of the increase was exported. Deliveries are concentrated in China and Mexico as well as other Asian countries such as South Korea and Japan. The 2020 Covid pandemic has left its mark on US production.In 2020, US pork prices were mostly below the € 1 / kg mark, with a low of € 0.58 / kg. At the end of the year, producer prices are currently at € 0.93 / kg. At the turn of the year 2020/21 , the pork market is in an unstable and regionally very different situation. In China , despite great efforts to rebuild the pig population, the persistent shortage of demand is causing the highest pig prices of over € 5 / kg . This is offset by low prices of less than € 1 / kg in the USA , which were surprised by the Covid pandemic during an increase phase. In the EU , the restrictions caused by the corona are also tightened by Germany's ASP-related export ban . Nevertheless, pig farming is increasing in some EU countries such as Spain . In Germany , expensive animal husbandry requirements are increasing the decline in the number of sows.Hopes are based on vaccination-related relief of the Covid pandemic and recognition of regionalization at ASP.