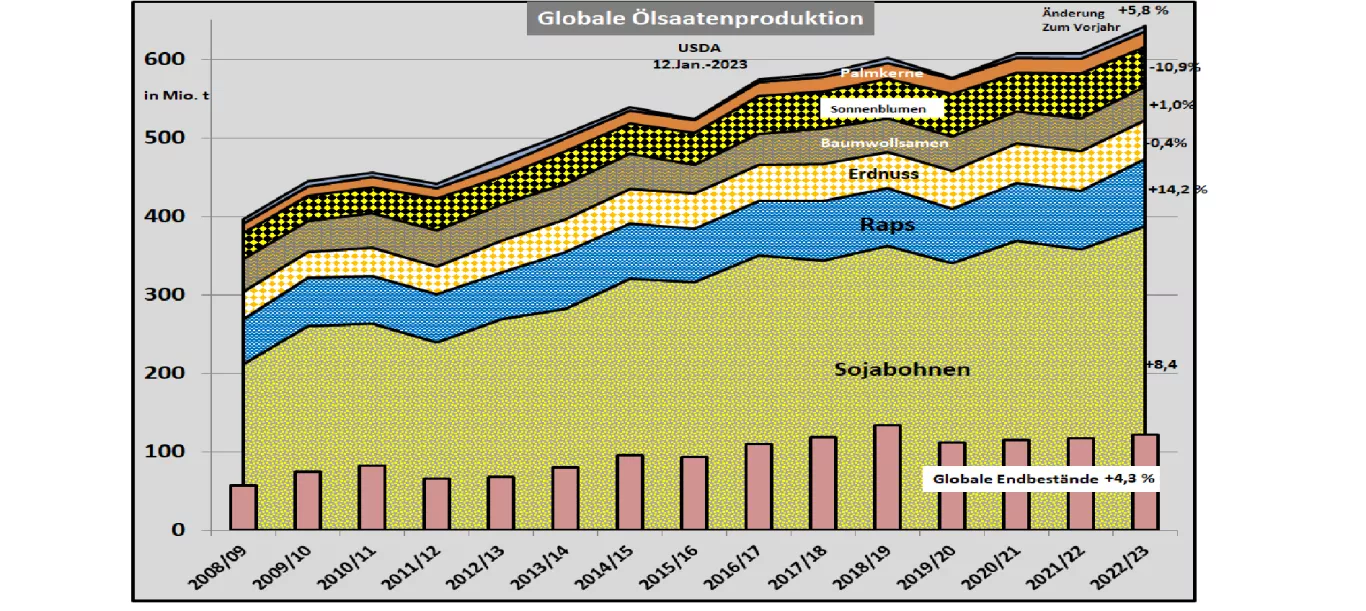

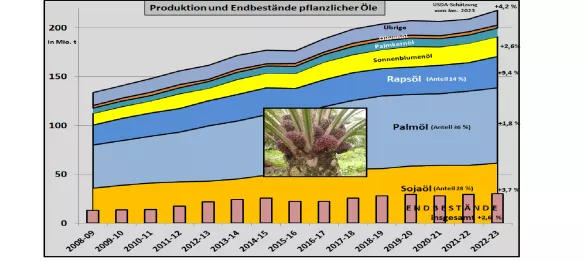

Oilseed market – cutbacks on the previous month 's estimate In its Jan. 2023 issue, the US Department of Agriculture (USDA) estimates the global oilseed harvest for 2022/23 to be somewhat lower than in the previous month. Compared to the previous year , however, earnings are still expected to be +5.6% higher. With a production share of 57%, soya plays the dominant role in the oilseed business. Compared to the Dec. 2022 estimate, the USDA has reduced the world harvest by around 2.5 million t. The decisive factor here was the reduction in the US harvest by 2 million tons due to the weaker than expected yields per hectare. Compared to the previous year, the US harvest lags behind by around 5 million tons. US exports are expected to be 4 million t smaller. The Argentine soybean harvest is also rated 4 million t lower than the previous month due to the drought. The South American country mainly exports soybean meal, with a downward trend in the current year. Brazil's soybean harvest now reaches approx.40% of world production and is expected to achieve a record harvest of 153 million t (previous year 129 million t) in the current marketing year. The harvest has just started and will peak in Feb-2023. The background to this is an increased area under cultivation and, as a result of the high rainfall caused by La Niña in the main growing areas, above-average yield expectations. Only in the southern regions are reductions made. Exports are estimated at 91 million tons from last year's 80 million tons. With the exception of Paraquay (crop failure in the previous year) , the USDA expects only minor changes in the harvest estimates for the other soybean producers . The Chinese soybean harvest of 20 million t (previous year 18 million t) deserves special mention due to the favorable weather conditions; the consequence is an expected reduction in soybean imports to 96 million t compared to previous years with 98 to almost 100 million t. For the EU-27 , the USDA estimates imports of soybeans at 14.4 million t and meal imports at 16.7 million t.The decline is mainly due to the reduction in livestock. The increasing EU self-generation plays a minor role for the time being. The global supply situation in the soybean sector is estimated to be somewhat more stable than in previous years with increasing ending stocks. In the case of the canola market , the USDA estimate essentially sticks to the results from the previous month. The current harvest is around 10 million t higher at 84.8 million t compared to the previous year. The decisive factors are the harvests in the two main growing areas, the EU with 19.5 million t and Canada with 19 million t, which together account for 45% of the world harvest. The export country Australia comes into play with a doubling of the rapeseed harvest to more than 7 million tons in the last few years. Since rapeseed is cultivated in the west of the Ukraine without severe war damage, the harvest and export quantities still play a significant role for the EU market, which requires imports. According to the latest information, a largely stable cultivation is expected.For price formation in the oilseed sector, the palm oil market, as the second market leader alongside soya, plays a significant price-influencing role. The USDA made no changes to the previous month's estimate. It remains at an increase over the previous year of +3.5 million t to 77.2 million t. A similarly high increase in consumption leads to an unchanged stock situation.